A quick peek into the report

Table of Contents

1.1 Drivers

1.1.1 Rising Demand for Artificial Intelligence for Developing Military Equipment

1.1.2 Increasing Need for Situational Awareness in Military

1.1.3 Growing Demand for Cloud Services in Military

1.2 Restraint

1.2.1 Lack of Standard Professional for Operating AI-Integrated Equipment

1.2.2 Rising Cyber Threat for Military Data

1.3 Opportunity

1.3.1 Increasing Adoption of AI for Military Operation

1.3.2 Rising Demand for Next-Generation Battlefield Technologies

2.1 Key Strategies and Developments

2.1.1 Partnerships, Collaborations, Contracts, and Agreements

2.1.2 Mergers and Acquisitions

2.1.3 Product Launches

2.1.4 Other Developments

2.2 Competitive Benchmarking

3.1 Industry Overview

3.2 Ongoing Programs of Artificial Intelligence for Defense

3.3 Patent Analysis

3.4 Emerging Technological Trends

3.4.1 Advance Analytics and Big Data

3.4.2 Neural Network

3.5 Artificial Intelligence and Military Integration Challenges

3.5.1 Technology

3.5.2 Process

3.5.3 Personnel

3.5.4 Culture

3.6 Future Trends: Internet of Battlefield Things (IOBT)

4.1 Introduction

4.2 Applications of Cybernetics

4.2.1 Human-Machine Interface

4.2.2 Bionic Power (Cyborgs)

4.3 Evolution of Cybernetics

4.4 AI in Cybernetics

4.5 Future of Warfare: Robots, Cyborgs and Soldiers

5.1 Assumptions and Limitations

5.2 Market Overview

6.1 Market Overview

6.2 Land

6.2.1 Armoured Fighting Vehicle

6.2.2 Command & Control System

6.2.3 Unmanned Ground Vehicle

6.2.4 Others

6.3 Naval

6.3.1 Submarine

6.3.2 Unmanned Marine Vehicle

6.3.3 Ships

6.4 Air

6.4.1 Unmanned Aerial Vehicle

6.4.2 Fighter Jets & Aircrafts

6.5 Space

6.5.1 Satellite

6.5.2 Space Launch Vehicle

7.1 Market Overview

7.1.1 Learning & Intelligence

7.1.1.1 Natural Language Processing

7.1.1.2 Machine Learning

7.1.1.3 Data Mining

7.1.1.4 Deep Learning

7.1.2 Artificial Intelligence System

7.1.2.1 Computer Vision

7.1.2.2 Virtual Agents

7.1.2.3 Virtual Reality

7.1.3 Advanced Computing

7.1.3.1 Super Computing

7.1.3.2 Quantum Computing

7.1.3.3 Neuromorphic Engineering

8.1 Market Overview

8.1.1 Surveillance

8.1.2 Warfare Platform

8.1.3 Logistics & Transportation

8.1.4 Autonomous Weapons & Targeting System

8.1.5 Battlefield Health Care

8.1.6 Combat Simulation

8.1.7 Others

9.1 Market Overview

9.2 Hardware

9.2.1 Processor

9.2.2 Memory

9.2.3 Network

9.3 Software

9.3.1 AI Services

9.3.2 AI Platform

9.4 Services

9.4.1 Integration & Deployment

9.4.2 Maintenance

10.1 Market Overview

10.2 North America

10.2.1 North America Military Artificial Intelligence Market (by Platform)

10.2.1.1 U.S.

10.2.1.2 Canada

10.3 Europe

10.3.1 Europe Military Artificial Intelligence Market (by Platform)

10.3.1.1 U.K.

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Russia

10.3.1.5 Italy

10.3.1.6 Rest-of-Europe

10.4 Asia-Pacific

10.4.1 Asia-Pacific Military Artificial Intelligence Market (by Platform)

10.4.1.1 China

10.4.1.2 India

10.4.1.3 South Korea

10.4.1.4 Japan

10.4.1.5 Australia

10.4.1.6 Rest-of-Asia-Pacific

10.5 Rest-of-the-World

10.5.1 Rest-of-the-World Military Artificial Intelligence Market (by Platform)

10.5.1.1 Middle East & Africa

10.5.1.2 Latin America

11.1 BAE Systems

11.1.1 Company Overview

11.1.2 Role of BAE Systems in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.1.3 Financials

11.1.4 SWOT Analysis

11.2 Boeing

11.2.1 Company Overview

11.2.2 Role of Boeing Company in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.2.3 Financials

11.2.4 SWOT Analysis

11.3 Blue Bear

11.3.1 Company Overview

11.3.2 Role of Blue Bear in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.3.3 SWOT Analysis

11.4 Charles River Analytics Inc.

11.4.1 Company Overview

11.4.2 Role of Charles River Analytics Inc. in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.4.3 SWOT Analysis

11.5 General Dynamics

11.5.1 Company Overview

11.5.2 Role of General Dynamics in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.5.3 Financials

11.5.4 SWOT Analysis

11.6 Harris Corporation

11.6.1 Company Overview

11.6.2 Role of Harris Corporation in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.6.3 Financials

11.6.4 SWOT Analysis

11.7 IBM

11.7.1 Company Overview

11.7.2 Role of IBM in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.7.3 Financials

11.7.4 SWOT Analysis

11.8 Lockheed Martin Corporation

11.8.1 Company Overview

11.8.2 Role of Lockheed Martin Corporation in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.8.3 Financials

11.8.4 SWOT Analysis

11.9 Leidos

11.9.1 Company Overview

11.9.2 Role of Leidos in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.9.3 Financials

11.9.4 SWOT Analysis

11.10 Northrop Grumman Corporation

11.10.1 Company Overview

11.10.2 Role of Northrop Grumman Corporation in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.10.3 Financials

11.10.4 SWOT Analysis

11.11 Raytheon Company

11.11.1 Company Overview

11.11.2 Role of Raytheon Company in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.11.3 Financials

11.11.4 SWOT Analysis

11.12 SparkCognition

11.12.1 Company Overview

11.12.2 Role of SparkCognition in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.12.3 SWOT Analysis

11.13 SAIC

11.13.1 Company Overview

11.13.2 Role of SAIC in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.13.3 Financial

11.13.4 SWOT Analysis

11.14 SOARTECH

11.14.1 Company Overview

11.14.2 Role of SoarTech in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.14.3 SWOT Analysis

11.15 Thales Group

11.15.1 Company Overview

11.15.2 Role of Thales Group in Global Military Artificial Intelligence (AI) and Cybernetics Market

11.15.3 Financials

11.15.4 SWOT Analysis

11.16 Other Key Players

11.16.1 Centaurus Technology

11.16.2 Gov Brain

11.16.3 High Tech Robotic System

11.16.4 Machine Halo

11.16.5 Reconrobotics

12.1 Scope of the Report

12.2 Global Military Artificial Intelligence Market Research Methodology

13.1 Related Reports

Table 1: Market Snapshot: Global Military Artificial Intelligence Market, Value ($Million), 2018 and 2024

Table 2.1: Partnerships, Collaborations, Contracts, and Agreements in Military Artificial Intelligence Market

Table 2.2: Mergers and Acquisitions

Table 2.3: Product Launches

Table 2.4: Other Developments

Table 3.1: Ongoing Program of Artificial Intelligence

Table 3.2: Significant Patents Granted for Military AI and Cybernetics, 2016-2019

Table 10.1: Global Military Artificial Intelligence Market (by Region), $Million, 2018-2024

Table 10.2: Global Military Artificial Intelligence Market (by Region), Units, 2018-2024

Table 10.3: North America Military Artificial Intelligence Market (by Platform), Value ($Million), 2018-2024

Table 10.4: Europe Military Artificial Intelligence Market (by Platform), Value ($Million), 2018-2024

Table 10.5: Asia-Pacific Military Artificial Intelligence Market (by Platform), Value ($Million), 2018-2024

Table 10.6: Rest-of-the-World Military Artificial Intelligence Market (by Platform), Value ($Million) 2018-2024

Figure 1: Global Defense Expenditure (2017, 2018)

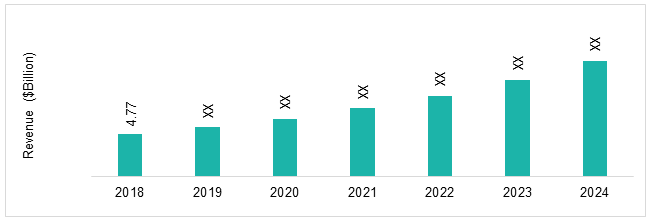

Figure 2: Global Military Artificial Intelligence Market, Value ($Billion), 2018-2024

Figure 3: Global Military Artificial Intelligence Market, Volume (Units), 2018-2024

Figure 4: Global Military Artificial Intelligence Market (by Application), Revenue ($Million), 2018 and 2024

Figure 5: Global Military Artificial Intelligence Market (by Platform), Revenue ($Million), 2018 and 2024

Figure 6: Global Military Artificial Intelligence Market (by Service), Revenue ($Million), 2018 and 2024

Figure 7: Global Military Artificial Intelligence Market (by Technology), Revenue ($Million), 2018 and 2024

Figure 8: Global Military Artificial Intelligence Market (by Region), Value ($Million), 2018

Figure 1.1: Market Dynamics Snapshot

Figure 1.2: Functioning of Artificial Intelligence

Figure 1.3: Application of Cloud Services in Military

Figure 1.4: Role of Cyber Security

Figure 2.1: Key Strategies Adopted by Market Players

Figure 2.2: Percentage Share of Strategies Adopted by Market Players, January 2017-September 2019

Figure 2.3: Competitive Benchmarking, 2018

Figure 3.1: Industry Insights

Figure 3.2: Global Military AI and Cybernetics Market, Number of Patents Granted, 2016-2019

Figure 3.3: Global Military AI & Cybernetics Market, Patent Analysis by Major Companies, 2016-2019

Figure 3.4: Global Military AI & Cybernetics Market, Key Patent Analysis by Country, 2016-2019

Figure 3.5: Meta Models of Combat Situation

Figure 3.6: Internet of battlefield things in Warfare

Figure 4.1: Technological Insights

Figure 4.2: Functioning of Cyborgs

Figure 5.1: Global Military Artificial Intelligence Market, Revenue ($Billion), 2018-2024

Figure 5.2: Global Military Artificial Intelligence Market, Volume (Units), 2018-2024

Figure 6.1: Classification of the Global Military Artificial Intelligence Market (by Platform)

Figure 6.2: Global Military Artificial Intelligence Market (by Platform), Value ($Million), 2018-2024

Figure 6.3: Global Military Artificial Intelligence Market (by Land), $Million, 2018-2024

Figure 6.4: Global Military Artificial Intelligence (Armoured Fighting Vehicle), $Million, 2018-2024

Figure 6.5: Global Military Artificial Intelligence Market (Command & Control System), $Million, 2018-2024

Figure 6.6: Global Military Artificial Intelligence Market (Unmanned Ground Vehicle), $Million, 2018-2024

Figure 6.7: Global Military Artificial Intelligence Market (Others), $Million, 2018-2024

Figure 6.8: Global Military Artificial Intelligence Market (by Naval), $Million, 2018-2024

Figure 6.9: Global Military Artificial Intelligence Market (Submarine), $Million, 2018-2024

Figure 6.10: Global Military Artificial Intelligence Market (Unmanned Marine Vehicle), $Million, 2018-2024

Figure 6.11: Global Military Artificial Intelligence Market (Ships), $Million, 2018-2024

Figure 6.12: Global Military Artificial Intelligence Market (by Air), $Million, 2018-2024

Figure 6.13: Global Military Artificial Intelligence Market (Unmanned Aerial Vehicle), $Million, 2018-2024

Figure 6.14: Global Military Artificial Intelligence Market (Fighter Jets & Aircrafts), $Million, 2018-2024

Figure 6.15: Global Military Artificial Intelligence Market (Space), $Million, 2018-2024

Figure 6.16: Global Military Artificial Intelligence Market (Satellite), $Million, 2018-2024

Figure 6.17: Global Military Artificial Intelligence Market (Space Launch Vehicle), $Million, 2018-2024

Figure 7.1: Global Military Artificial Intelligence Market (By Technology)

Figure 7.2: Global Military Artificial Intelligence Market (by Technology), $Million, 2018-2024

Figure 7.3: Global Military Artificial Intelligence Market (Learning & Intelligence), $Million, 2018-2024

Figure 7.4: Global Military Artificial Intelligence Market (Natural Language Processing Technology) $Million, 2018-2024

Figure 7.5: Global Military Artificial Intelligence Market (Machine Learning), $Million, 2018-2024

Figure 7.6: Global Military Artificial Intelligence Market (Data Mining), $Million, 2018-2024

Figure 7.7: Global Military Artificial Intelligence Market (Deep Learning), $Million, 2018-2024

Figure 7.8: Global Military Artificial Intelligence Market (by Artificial Intelligence System), $Million, 2018-2024

Figure 7.9: Global Military Artificial Intelligence Market (Computer Vision), $Million, 2018-2024

Figure 7.10: Global Military Artificial Intelligence Market (Virtual Agents), $Million, 2018-2024

Figure 7.11: Global Military Artificial Intelligence Market (Virtual Reality), $Million, 2018-2024

Figure 7.12: Global Military Artificial Intelligence Market (Advance Computing), $Million, 2018-2024

Figure 7.13: Global Military Artificial Intelligence Market (Super Computing), $Million, 2018-2024

Figure 7.14: Global Military Artificial Intelligence Market (Quantum Computing), $Million, 2018-2024

Figure 7.15: Global Military Artificial Intelligence Market (Neuromorphic Engineering), $Million, 2018-2024

Figure 8.1: Global Military Artificial Intelligence Market (by Application)

Figure 8.2: Global Military AI Market (by Application), $Million, 2018-2024

Figure 8.3: Global Military Artificial Intelligence Market (Cybersecurity), $Million, 2018-2024

Figure 8.4: Global Military Artificial Intelligence Market (Surveillance), $Million, 2018-2024

Figure 8.5: Global Military Artificial Intelligence Market (by Warfare Platform), $Million, 2018-2024

Figure 8.6: Global Military Artificial Intelligence Market (Logistics & Transportation Market), $Million, 2018-2024

Figure 8.7: Global Military Artificial Intelligence Market (Autonomous Weapons & Targeting System Market), $Million, 2018-2024

Figure 8.8: Global Military Artificial Intelligence Market (Battlefield Healthcare), $Million, 2018-2024

Figure 8.9: Global Military Artificial Intelligence Market (Combat Simulation), $Million, 2018-2024

Figure 8.10: Global Military Artificial Intelligence Market (Threat Monitoring & Situational Awareness, Information Processing, Target Recognition), $Million, 2018-2024

Figure 9.1: Classification of the Global Military Artificial Intelligence Market (by Service)

Figure 9.2: Global Military Artificial Intelligence Market (by Service), Value ($Million), 2018-2024

Figure 9.3: Global Military Artificial Intelligence Market (by Hardware), $Million, 2018-2024

Figure 9.4: Global Military Artificial Intelligence Market (Processor), $Million, 2018-2024

Figure 9.5: Global Military Artificial Intelligence Market (Memory), $Million, 2018-2024

Figure 9.6: Global Military Artificial Intelligence Market (Network), $Million, 2018-2024

Figure 9.7: Global Military Artificial Intelligence Market (by Software), $Million, 2018-2024

Figure 9.8: Global Military Artificial Intelligence Market (AI Services), $Million, 2018-2024

Figure 9.9: Global Military Artificial Intelligence Market (AI Platform), $Million, 2018-2024

Figure 9.10: Global Military Artificial Intelligence Market (by Services), $Million, 2018-2024

Figure 9.11: Global Military Artificial Intelligence Market (Integration & Deployment), $Million, 2018-2024

Figure 9.12: Global Military Artificial Intelligence Market (Maintenance), $Million, 2018-2024

Figure 10.1: Classification of Global Military Artificial Intelligence Market (by Region)

Figure 10.2: North America Military AI Market Value (by Country), $Million, 2018 and 2024

Figure 10.3: U.S. Defense Budget, 2017-2019

Figure 10.4: U.S. Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.5: Canada Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.6: Europe Military AI Market Value (by Country), $Million, 2018 and 2024

Figure 10.7: U.K. Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.8: Germany Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.9: France Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.10: Russia Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.11: Italy Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.12: Rest-of-Europe Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.13: Asia-Pacific Military Artificial Intelligence Market (by Country), 2018 and 2024

Figure 10.14: China Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.15: India Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.16: South Korea Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.17: Japan Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.18: Australia Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.19: Rest-of-Asia-Pacific Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.20: Rest-of-the-World Military Artificial Intelligence Market (by Country), (2018,2024)

Figure 10.21: Middle East & Africa Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 10.22: Latin America Military Artificial Intelligence Market Size, $Million, 2018-2024

Figure 11.1: BAE Systems – Product Offerings

Figure 11.2: BAE Systems - Financials, 2016-2018

Figure 11.3: BAE Systems - Business Revenue Mix, 2017-2018

Figure 11.4: BAE Systems - Region Revenue Mix, 2016-2018

Figure 11.5: BAE Systems – Research and Development Expenditure, 2016-2018

Figure 11.6: SWOT Analysis – BAE Systems

Figure 11.7: The Boeing Company – Product Offerings

Figure 11.8: The Boeing Company - Financials, 2016-2018

Figure 11.9: Boeing Company - Business Revenue Mix, 2016-2018

Figure 11.10: Boeing Company - Region Revenue Mix, 2016-2018

Figure 11.11: Boeing Company – Research and Development Expenditure, 2016-2018

Figure 11.12: SWOT Analysis – The Boeing Company

Figure 11.13: Blue Bear – Product Offerings

Figure 11.14: SWOT Analysis – Blue Bear

Figure 11.15: Charles River Analytics Inc. – Solution Offerings

Figure 11.16: SWOT Analysis – Charles River Analytics Inc.

Figure 11.17: General Dynamics – Product Offerings

Figure 11.18: General Dynamics - Financials, 2016-2018

Figure 11.19: General Dynamics - Business Revenue Mix, 2016-2018

Figure 11.20: General Dynamics - Region Revenue Mix, 2016-2018

Figure 11.21: General Dynamics - Research and Development Expenditure, 2016-2018

Figure 11.22: SWOT Analysis – General Dynamics

Figure 11.23: Harris Corporation – Product Offerings

Figure 11.24: Harris Corporation - Financials, 2016-2018

Figure 11.25: Harris Corporation - Business Revenue Mix, 2016-2018

Figure 11.26: Harris Corporation - Region Revenue Mix, 2016-2018

Figure 11.27: Harris Corporation - Research and Development Expenditure, 2016-2018

Figure 11.28: SWOT Analysis – Harris Corporation

Figure 11.29: IBM – Product Offerings

Figure 11.30: IBM - Financials, 2016-2018

Figure 11.31: IBM - Business Revenue Mix, 2016-2018

Figure 11.32: IBM - Region Revenue Mix, 2016-2018

Figure 11.33: IBM - Research and Development Expenditure, 2016-2018

Figure 11.34: SWOT Analysis – IBM

Figure 11.35: Lockheed Martin Corporation – Product Offerings

Figure 11.36: Lockheed Martin Corporation - Financials, 2016-2018

Figure 11.37: Lockheed Martin Corporation - Business Revenue Mix, 2016-2018

Figure 11.38: Lockheed Martin Corporation - Region Revenue Mix, 2016-2018

Figure 11.39: Lockheed Martin Corporation - Research and Development Expenditure, 2016-2018

Figure 11.40: SWOT Analysis– Lockheed Martin Corporation

Figure 11.41: Leidos – Product Offerings

Figure 11.42: Leidos - Financials, 2016-2018

Figure 11.43: Leidos - Business Revenue Mix, 2016-2018

Figure 11.44: Leidos - Region Revenue Mix, 2016-2018

Figure 11.45: Leidos - Research and Development Expenditure, 2016-2018

Figure 11.46: SWOT Analysis – Leidos

Figure 11.47: Northrop Grumman Corporation: Product Offerings

Figure 11.48: Northrop Grumman Corporation - Financials, 2016-2018

Figure 11.49: Northrop Grumman Corporation - Business Revenue Mix, 2016-2018

Figure 11.50 Northrop Grumman Corporation - Region Revenue Mix, 2016-2018

Figure 11.51: Northrop Grumman Corporation – Research and Development Expenditure, 2016-2018

Figure 11.52: SWOT Analysis – Northrop Grumman Corporation

Figure 11.53: Raytheon Company – Product Offerings

Figure 11.54: Raytheon Company - Financials, 2016-2018

Figure 11.55: Raytheon Company - Business Revenue Mix, 2016-2018

Figure 11.56: Raytheon Company - Region Revenue Mix, 2016-2018

Figure 11.57: Raytheon Company – Research and Development Expenditure, 2016-2018

Figure 11.58: SWOT Analysis – Raytheon Company

Figure 11.59: SparkCognition – Product Offerings

Figure 11.60: SWOT Analysis – SparkCognition

Figure 11.61: SAIC – Product Offerings

Figure 11.62: SAIC - Financials, 2016-2018

Figure 11.63: SAIC - Research and Development Expenditure, 2017-2019

Figure 11.64: SWOT Analysis – SAIC

Figure 11.65: SoarTech – Product Offerings

Figure 11.66: SWOT Analysis – SoarTech

Figure 11.67: Thales Group – Product Offerings

Figure 11.68: Thales Group - Financials, 2016-2018

Figure 11.69: Thales Group - Business Revenue Mix, 2016-2018

Figure 11.70: Thales Group - Region Revenue Mix, 2016-2018

Figure 11.71: Thales Group – Research and Development Expenditure, 2016-2018

Figure 11.72: SWOT Analysis – Thales Group

Figure 12.1: Global Military AI and Cyberneitcs Market Segmentation

Figure 12.2: Military Artificial Intelligence Market Research Methodology

Figure 12.3: Data Triangulation

Figure 12.4: Top-Down and Bottom-up Approach

Figure 12.5: Global Military Artificial Intelligence Market Influencing Factors

Figure 12.6: Assumptions and Limitations

Key Questions Answered in this Report:

Key Questions Answered in this Report:

• What are the trends in the global military artificial intelligence and cybernetics across different regions?

• What are the major driving factors in global military artificial intelligence and cybernetics market during the forecast period 2019-2024?

• What are the major challenges inhibiting the growth of the global military artificial intelligence and cybernetics?

• Which application type (cyber security, warfare platform, surveillance, autonomous weapons and targeting system, battlefield healthcare, simulation, and others (threat monitoring and situational awareness, information processing, target recognition) of the global military artificial intelligence market dominated in 2018, and what would be the expected scenario by 2024?

• What was the revenue generated by the global military artificial intelligence market by platform, technologies, and services in 2018, and what would be the anticipated estimates by 2024?

• What was the aggregate revenue generated by the global military artificial intelligence market segmented by region (North America, Europe, Asia-Pacific, and Rest-of-the-World) in 2018, and what would be the anticipated estimates by 2024?

• Who are the key players in the global military artificial intelligence and cybernetics market, and what are the new strategies adopted by the market players to make a mark in the industry?

• What major opportunities do the military artificial intelligence and cybernetics companies foresee in the next five years?

• What is the competitive strength of the key leading players in the military artificial intelligence and cybernetics market?

Market Overview

Global Military Artificial Intelligence Market Forecast, 2019-2024

Figure: Global Military Artificial Intelligence Market, Value ($Billion), 2018-2024

The Global Military Artificial Intelligence Market report by BIS Research projects the market to grow at a significant CAGR of 18.66% on the basis of value during the forecast period from 2019 to 2024. North America dominated the global military artificial intelligence market with a share of 48.23% in 2019. North America, including the major countries such as the U.S., is the most prominent region for the military artificial intelligence market. In North America, the U.S. acquired a major market share in 2019 due to the major deployment of counter measures in defense sector in the country.

The global military artificial intelligence market has gained widespread importance owing to rising adoption of artificial intelligence for military operation. However, lack of standard professional for the use of AI-integrated equipment and rising cyber threat for military data are some of the factors that are restraining the market growth.

Expert Quote

“The rising demand for artificial intelligence for various military equipment across different platform is forcing the artificial intelligence solution provider to develop the products with more advanced technologies. Moreover, the increasing need for situational awareness, and growing demand for cloud services in military around the world are expected to drive the market.”

Report Description

Scope of the Global Military Artificial Intelligence and Cybernetics Market

The market research provides detailed market information for segmentation on the basis of application, platform, technology, service, and region. The purpose of this market analysis is to examine the artificial intelligence and cybernetics market outlook in terms of factors driving the market, trends, technological developments, and competitive benchmarking, among others.

The report further takes into consideration the market dynamics and the competitive landscape along with the detailed financial and product contribution of the key players operating in the market.

Market Segmentation

The military artificial intelligence market is further segmented into application, platform, technology, service, and region. The naval platform dominated the global military artificial intelligence market in 2018 and is anticipated to maintain its dominance throughout the forecast period (2019-2024).

While highlighting the key driving and restraining forces for this market, the report also provides a detailed study of the industry that has been analyzed. The report also analyzes different application that includes cybersecurity, warfare platform, surveillance, logistics and transportation, autonomous weapons and targeting system, battlefield healthcare, and simulation. In the platform segment, the market is segmented into land, air, naval, and space. In technology segment, the market is segmented into learning and intelligence, advance computing, and AI system. In the service segment, the market is segmented into hardware, software and services.

The military artificial intelligence and cybernetics market is segregated by region under four major regions, namely, North America, Europe, APAC, and Rest-of-the-World. Data for each of these regions (by country) is provided.

Key Companies in the Global Military AI and Cybernetics Market

The key market players in the global military artificial intelligence and cybernetics market include General Dynamics, Lockheed Martin Corporation, Northrop Grumman Corporation, BAE system, Boeing, Blue Bear, Charles River Analytics, IBM, Leidos, Raytheon, SparkCognition, SAIC, Soar Tech and Thales Group.

Global Military Artificial Intelligence (AI) and Cybernetics Market - Analysis and Forecast, 2019-2024

Focus on Platform, Technology, Application and Services