A quick peek into the report

Table of Contents

1.1 Inclusion and Exclusion

2.1 Scope of the Study

3.1 Global Nucleic Acid Isolation and Purification Market: Research Methodology

3.2 Primary Data Sources

3.3 Secondary Data Sources

3.4 Market Estimation Model

4.1 Definitions

4.1.1 Product Definition

4.1.2 Definition by Products

4.1.2.1 Instruments

4.1.2.2 Column-Based Instruments

4.1.2.3 Bead-Based Instruments

4.1.2.4 Low-Throughput Instruments

4.1.2.5 Medium-Throughput Instruments

4.1.2.6 High-Throughput Instruments

4.1.2.7 Kits

4.1.2.8 Reagents

4.2 Nucleic Acid Isolation and Purification Automation Applications

4.2.1 Genomic/Plasmid DNA Extraction

4.2.2 Cell-Free DNA (cfDNA) Extraction

4.2.3 Viral RNA Extraction

4.2.4 Cell-Free RNA Extraction

4.3 Market Size and Growth Potential, $Million, 2020-2031

4.3.1 North America

4.3.2 Europe, Middle East & Africa (EMEA)

4.3.3 Asia-Pacific (APAC)

4.3.4 Latin America

4.4 Market Attractiveness: Macro and Micro Factor Analysis

4.5 Impact of COVID-19 Pandemic on Nucleic Acid Isolation and Purification Market

4.6 Market Dynamics

4.7 Impact Analysis

4.8 Market Drivers

4.8.1 Growing Number of Genetic Tests

4.8.2 Increasing Demand for Reliable Next-Generation Sequencing (NGS) Results

4.8.3 Rise in the Prevalence of Infectious Disease

4.8.4 Rise in the Field of Microbial Sequencing

4.8.5 Increasing Research Funding in the Field of Molecular Biology

4.8.6 Increase in Awareness and Acceptance of Personalized Medicines on a Global Level

4.8.7 Decreasing Cost of Sequencing

4.9 Market Restraints

4.9.1 Genomic Data Protection

4.9.2 High Cost of Automated Instruments

4.9.3 Rigid Regulatory Standards

4.10 Market Opportunities

4.10.1 Evolution of Biobanking in Healthcare

4.10.2 Capitalizing on the High Prevalence of Genetic Disorders

4.10.3 Growth in Emerging Nations

4.10.4 Massive Scope for Adoption of NGS-based Genetic Tests in Emerging Markets

5.1 Key Developments

5.1.1 Product Launches and Enhancements

5.1.2 Collaborations and Agreements

5.1.3 Acquisitions

5.1.4 Business Expansions

5.2 Industry Trends

5.2.1 Emergence of Advanced Stabilization Products

5.2.2 Regulated vs. Multimodal Analysis

5.2.3 Novel Targets for Isolation and Purification

5.2.4 Exploring New Applications

5.2.5 Other Key Trends

6.1 Satisfaction Level of Different Instruments (by Brand)

6.2 Pricing Analysis of Preferred Instruments

6.3 Pricing Analysis - Accessories and Components

6.4 Pricing Analysis – Consumables

7.1 Introduction

7.2 Consumables

7.2.1 Kits

7.2.2 Reagents

7.3 Instruments

8.1 By Workflow

8.1.1 Sample Isolation/Extraction/Purification

8.1.2 DNA/RNA Clean-Up and Concentration

8.1.3 DNA and RNA Quantification

8.2 By Analyte

8.2.1 DNA

8.2.2 RNA

9.1 Cell-Free

9.1.1 By Sample

9.1.1.1 Blood

9.1.1.2 Serum/Plasma

9.1.1.3 Other Sources

9.1.2 By Application

9.1.2.1 Parental and Hereditary Testing

9.1.2.2 Tumor Testing

9.1.2.3 Transplantation

9.2 Genomic

9.2.1 Blood

9.2.2 Body Fluids

9.2.3 Buccal

9.2.4 Cell/Cultured Cell

9.2.5 FFPE

9.2.6 Forensic

9.2.7 Plant

9.2.8 Saliva/Swab

9.2.9 Serum/Plasma

9.2.10 Tissue

9.2.11 Stool, Urine, and Other Samples

9.3 Microbe

9.3.1 Bacterial

9.3.2 Fungus

9.3.3 Yeast

9.3.4 Other Sources

9.4 Plasmid

9.4.1 GigaPrep

9.4.2 MaxiPrep

9.4.3 MegaPrep

9.4.4 MidiPrep

9.4.5 MiniPrep

9.5 Viral

10.1 Genomic RNA

10.1.1 Blood

10.1.2 Body Fluids

10.1.3 Cell/Cultured Cell

10.1.4 FFPE

10.1.5 Plant

10.1.6 Saliva/Swab

10.1.7 Serum/Plasma

10.1.8 Tissue

10.1.9 Urine

10.1.10 Others

10.2 Microbial RNA

10.2.1 Bacteria

10.2.2 Yeast

10.2.3 Fungus

10.2.4 Others

10.3 Viral RNA

10.4 Cell-Free RNA

10.4.1 Serum/Plasma

10.4.2 Others

11.1 Silica-Based

11.2 Magnetic Particle Technology

11.3 Other Technologies

12.1 PCR

12.2 qPCR

12.3 NGS

12.4 Cloning

12.5 Microarray

12.6 Blotting Techniques

12.7 Other Applications

13.1 Introduction

13.2 Academic Research Institutes and Laboratories

13.3 Pharmaceutical and Biotechnology Companies

13.4 Contract Research Organizations

13.5 Applied Testing

13.6 Clinical Diagnostic Centers

14.1 North America

14.1.1 U.S.

14.1.2 Canada

14.2 Europe, Middle East & Africa (EMEA)

14.3 Latin America (LATAM)

14.4 Asia-Pacific

14.4.1 China

14.4.2 Japan

14.4.3 Rest-of-APAC

15.1 Introduction

15.2 Nucleic Acid Isolation and Purification Instrument Market (by Workflow)

15.2.1 Isolation/Extraction/Purification

15.2.2 Quality Control/Quantification

15.3 Nucleic Acid Isolation and Purification Instrument Market (by Technology)

15.3.1 Automated Spin Column-Based Instruments

15.3.2 Magnetic Bead-based Instruments

15.3.3 Automated Liquid Handling Instruments

15.4 Nucleic Acid Isolation and Purification Instrument Market (by Throughput)

15.4.1 Low Throughput Instruments

15.4.2 Medium Throughput Instruments

15.4.3 High Throughput Instruments

15.5 Quality Control/Quantification Instruments (by Technology)

15.5.1 Spectrophotometer

15.5.2 Fluorometers

15.5.3 Others

15.6 Nucleic Acid Isolation and Purification Instrument Market (by End User)

15.6.1 Academic Research Institutes

15.6.2 Pharmaceutical and Biotechnology Companies

15.6.3 Clinical Diagnostic Centers

15.6.4 Applied Testing (Biobanks, Forensic and Veterinary Laboratories)

15.6.5 Contract Research Organizations

15.7 Nucleic Acid Isolation and Purification Instrument Market (by Region)

15.7.1 North America

15.7.1.1 U.S.

15.7.1.2 Canada

15.7.2 Europe, Middle East and Africa

15.7.3 Asia-Pacific

15.7.3.1 China

15.7.3.2 Japan

15.7.3.3 Rest-of-APAC

15.7.4 Latin America

16.1 Market Share Analysis (Regional and Global)

16.1.1 Global

16.1.2 North America

16.1.3 EMEA

16.2 Growth Share Matrix by End User

16.3 Growth Share Matrix by Region

16.4 Growth Share Matrix by Products

17.1 Key Takeaways

17.2 Gap Analysis

17.3 Business Expansion Opportunity Mapping

17.3.1 By Product

17.3.2 By Region

17.4 Investment Opportunities

17.5 SWOT Analysis

17.6 Propitious Strategies to Succeed in Nucleic Acid Isolation and Purification Market

18.1 Overview

18.2 Agilent Technologies, Inc.

18.2.1 Company Overview

18.2.2 Role of Agilent Technologies, Inc. in the Global Nucleic Acid Isolation and Purification Market

18.2.3 Financials

18.2.4 Key Insights About Financial of the Company

18.2.5 SWOT Analysis

18.3 Analytik Jena AG

18.3.1 Company Overview

18.3.2 Role of Analytik Jena AG in the Global Nucleic Acid Isolation and Purification Market

18.3.3 SWOT Analysis

18.4 AutoGen, Inc.

18.4.1 Company Overview

18.4.2 Role of Autogen, Inc. in the Global Nucleic Acid Isolation and Purification Market

18.4.3 SWOT Analysis

18.5 Bio-Rad Laboratories, Inc.

18.5.1 Company Overview

18.5.2 Role of Bio-Rad Laboratories, Inc. in the Global Nucleic Acid Isolation and Purification Market

18.5.3 Financials

18.5.4 Key Insights About Financial Health of the Company

18.5.5 SWOT Analysis

18.6 F. Hoffmann-La Roche AG

18.6.1 Company Overview

18.6.2 Role of F. Hoffmann-La Roche AG in the Global Nucleic Acid Isolation and Purification Market

18.6.3 Financials

18.6.4 Key Insights About Financial Health of the Company

18.6.5 SWOT Analysis

18.7 Illumina, Inc.

18.7.1 Company Overview

18.7.2 Role of Illumina, Inc. in the Global Nucleic Acid Isolation and Purification Market

18.7.3 Financials

18.7.4 Key Insights About Financial Health of the Company

18.7.5 SWOT Analysis

18.8 Merck KGaA

18.8.1 Company Overview

18.8.2 Role of Merck KGaA in the Global Nucleic Acid Isolation and Purification Market

18.8.3 Financials

18.8.4 Key Insights About Financial Health of the Company

18.8.5 SWOT Analysis

18.9 Meridian Bioscience, Inc.

18.9.1 Company Overview

18.9.2 Role of Meridian Bioscience in the Global Nucleic Acid Isolation and Purification Market

18.9.3 Financials

18.9.4 Key Insights about Financial Health of the Company

18.9.5 SWOT Analysis

18.10 Macherey-Nagel GmbH & Co KG

18.10.1 Company Overview

18.10.2 Role of Macherey-Nagel GmbH & Co KG in the Global Nucleic Acid Isolation and Purification Market

18.10.3 SWOT Analysis

18.11 New England Biolabs, Inc

18.11.1 Company Overview

18.11.2 Role of New England Biolabs, Inc. in the Global Nucleic Acid Isolation and Purification Market

18.11.3 SWOT Analysis

18.12 Norgen Biotek Corp.

18.12.1 Company Overview

18.12.2 Role of Norgen Biotek Corp. in the Global Nucleic Acid Isolation and Purification Market

18.12.3 SWOT Analysis

18.13 Omega Bio-tek, Inc.

18.13.1 Company Overview

18.13.2 Role of Omega Bio-tek, Inc., in the Global Nucleic Acid Isolation and Purification Market

18.13.3 SWOT Analysis

18.14 Orasure Technologies, Inc.

18.14.1 Company Overview

18.14.2 Role of Orasure Technologies in the Global Nucleic Acid Isolation and Purification Market

18.14.3 Financials

18.14.4 Key Insights about Financial Health of the Company

18.14.5 SWOT Analysis

18.15 PerkinElmer, Inc.

18.15.1 Company Overview

18.15.2 Role of PerkinElmer, Inc. in the Nucleic Acid Isolation and Purification Market

18.15.3 Financials

18.15.4 SWOT Analysis

18.16 Promega Corporation

18.16.1 Company Overview

18.16.2 Role of Promega Corporation in the Global Nucleic Acid Isolation and Purification Market

18.16.3 SWOT Analysis

18.17 QIAGEN N.V.

18.17.1 Company Overview

18.17.2 Role of QIAGEN N.V. plc in the Global Nucleic Acid Isolation and Purification Market

18.17.3 Financials

18.17.4 Key Insights About Financial Health of the Company

18.17.5 SWOT Analysis

18.18 Sage Science, Inc.

18.18.1 Company Overview

18.18.2 Role of Sage Science, Inc. in the Global Nucleic Acid Isolation and Purification Market

18.18.3 SWOT Analysis

18.19 Tecan Group

18.19.1 Company Overview

18.19.2 Role of Tecan Group in the Global Nucleic Acid Isolation and Purification Market

18.19.3 Financials

18.19.4 Key Insights about Financial Health of the Company

18.19.5 SWOT Analysis

18.20 ThermoFisher Scientific Inc.

18.20.1 Company Overview

18.20.2 Role of Thermo Fisher Scientific in the Global Nucleic Acid Isolation and Purification Market

18.20.3 Financials

18.20.4 Key Insights About Financial Health of the Company

18.20.5 SWOT Analysis

18.21 Zymo Research

18.21.1 Company Overview

18.21.2 Role of Zymo Research in the Global Nucleic Acid Isolation and Purification Market

18.21.3 SWOT Analysis

18.22 Emerging Companies

Table 4.1: Likert Scale

Table 4.2: Impact Analysis of Market Drivers

Table 4.3: Impact Analysis of Market Restraints

Table 4.4: Other Key Research Funding for Nucleic Acid Extraction

Table 5.1: Commercially Available CTC Isolation Technologies

Table 5.2: Key Market Players Offering Ultra Pure Extraction Kits

Table 6.1: Key Automated DNA Extraction/Isolation/Purification and Quantification/Quality Control Systems Price and Material Cost per Sample

Table 6.2: Pricing of Market Available Consumables

Table 11.1: Other Technologies Consumables Market, $Million, 2020-2031

Table 13.1: Academic Research Institutes and Laboratories Consumables Market (by Analyte), $Million, 2020-2031

Table 13.2: Pharmaceutical and Biotechnology Companies Consumables Market (by Analyte), $Million, 2020-2031

Table 13.3: Contract Research Organizations Consumables Market (by Analyte), $Million, 2020-2031

Table 13.4: Applied Testing Consumables Market, (by Analyte) $Million, 2020-2031

Table 13.5: Clinical Diagnostic Center Consumables Market (by Analyte), $Million, 2020-2031

Table 14.1: Global Nucleic Acid Isolation and Purification Consumables Market (by Region), $Million, 2020-2031

Table 14.2: Global DNA Isolation and Purification Kits Market (by Region), $Million, 2020-2031

Table 14.3: Global RNA Isolation and Purification Kits Market (by Region), $Million, 2020-2031

Table 14.4: Global Nucleic Acid Isolation and Purification Reagents Market (by Region), $Million, 2020-2031

Table 14.5: North America Nucleic Acid Isolation and Purification Consumables Market (by Analyte), $Million, 2020-2031

Table 14.6: North America DNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.7: North America RNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.8: EMEA Nucleic Acid Isolation and Purification Consumables Market (by Country), $Million, 2020-2031

Table 14.9: EMEA Nucleic Acid Isolation and Purification Consumables Market (by Analyte), $Million, 2020-2031

Table 14.10: EMEA DNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.11: EMEA RNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.12: LATAM Nucleic Acid Isolation and Purification Consumables Market (by Country), $Million, 2020-2031

Table 14.13: LATAM Nucleic Acid Isolation and Purification Consumables Market (by Analyte), $Million, 2020-2031

Table 14.14: LATAM DNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.15: LATAM RNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.16: APAC Nucleic Acid Isolation and Purification Consumables Market (by Country), $Million, 2020-2031

Table 14.17: APAC Nucleic Acid Isolation and Purification Consumables Market (by Analyte), $Million, 2020-2031

Table 14.18: APAC DNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 14.19: APAC RNA Isolation and Purification Kits Market (by Source), $Million, 2020-2031

Table 15.1: Key Isolation/Extraction/Purification Systems for Nucleic Acids

Table 15.2: Key Quality Control/Quantification Systems for Nucleic Acids

Table 15.3: Key Column-Based Systems for Nucleic Acid Extraction

Table 15.4: Key Magnetic Bead-Based Systems for Nucleic Acid Extraction

Table 15.5: Key Automated Liquid Handling Instruments for Nucleic Acid Extraction

Table 15.6: Key Low Throughput Systems for Nucleic Acid Extraction

Table 15.7: Key Medium Throughput Systems for Nucleic Acid Extraction

Table 15.8: Key High Throughput Systems for Nucleic Acid Extraction

Table 15.9: Key Spectrophotometer Systems for Quality Control/Quantification

Table 15.10: Key Fluorometers Systems for Quality Control/Quantification

Table 15.11: Key Other Systems for Quality Control/Quantification

Table 15.12: Collaborations in Genetics and Genomics Research in Africa, by Funder

Table 17.1: Major Issues in Research Laboratories in the Asia-Pacific Region

Table 17.2: Funding Scenario in the Competitive Genomic Landscape

Figure 1: Cumulative Number of Tested Conditions and Associated Genes for Genetic Testing, 2012-2019

Figure 2: Impact Analysis on the Global Nucleic Acid Isolation and Purification Market

Figure 3: Nucleic Acid Isolation and Purification Market, (by Product), $Million, 2020 vs. 2031

Figure 4: Nucleic Acid Isolation and Purification Consumables Market, (by Type), $Million, 2020 vs. 2031

Figure 5: Nucleic Acid Isolation and Purification Consumables Market, (by Technology), $Million, 2020 vs. 2031

Figure 6: Nucleic Acid Isolation and Purification Consumables Market, (by End User), $Million, 2020 vs. 2031

Figure 7: Global Nucleic Acid Isolation and Purification Consumables Market Snapshot, (by Region) 2020 and 2031

Figure 8: Nucleic Acid Isolation and Purification Instrument Market, (by Technology), $Million, 2020 vs. 2031

Figure 9: Nucleic Acid Isolation and Purification Instrument Market, (by Throughput), $Million, 2020 vs. 2031

Figure 10: Global Nucleic Acid Isolation and Purification Instrument Market Snapshot, (by Region)

Figure 2.1: Global Nucleic Acid Isolation and Purification Market Segmentation

Figure 3.1: Global Nucleic Acid Isolation and Purification Market Methodology

Figure 3.2: Primary Research Methodology

Figure 3.3: Bottom-Up Approach (Segment-Wise Analysis)

Figure 3.4: Forecast Methodology

Figure 4.1: North America Nucleic Acid Isolation and Purification Addressable Market, 2020-2031

Figure 4.2: EMEA Nucleic Acid Isolation and Purification Addressable Market, 2020-2031

Figure 4.3: Asia-Pacific Nucleic Acid Isolation and Purification Addressable Market, 2020-2031

Figure 4.4: Latin America Nucleic Acid Isolation and Purification Addressable Market, 2020-2031

Figure 4.5: Market Attractiveness Based on Key Characteristics

Figure 4.6: Impact of COVID-19 on the Global Nucleic Acid Isolation and Purification Market

Figure 4.5: Decreasing Cost and Increasing Output (TB) of Genome Sequencing (2009-2025)

Figure 4.6: Key Genetic Disorder Prevalence in the U.S., 2012-2017

Figure 5.1: Share of Key Developments and Strategies

Figure 6.1: Nucleic Acid Isolation and Purification Customer Preference (by Major Brand), N=27

Figure 6.2: Nucleic Acid Isolation and Purification Customer Satisfaction Level (5 Being the Highest) (by Brand) (N=27)

Figure 7.1: Nucleic Acid Isolation and Purification Market (by Product), $Million, 2020 and 2031

Figure 7.2: Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 7.3: Nucleic Acid Isolation and Purification Kits Market, $Million, 2020-2031

Figure 7.4: Nucleic Acid Isolation and Purification Reagents Market, $Million, 2020-2031

Figure 7.5: Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 8.1: Nucleic Acid Isolation and Purification Kits Market (by Workflow), $Million, 2020 and 2031

Figure 8.2: Sample Isolation/Extraction/Purification Kits Market, $Million, 2020-2031

Figure 8.3: DNA/RNA Clean-Up and concentration Kits Market, $Million, 2020-2031

Figure 8.4: DNA and RNA Quantification Kits Market, $Million, 2020-2031

Figure 8.5: Nucleic Acid Isolation and Purification Kits Market (by Analyte), $Million, 2020 and 2031

Figure 8.6: DNA Kits Market, $Million, 2020-2031

Figure 8.7: Market Share for DNA Kits Market, $Million, 2020

Figure 8.8: RNA Kits Market, $Million, 2020-2031

Figure 8.9: Market Share for RNA Kits Market, $Million, 2020

Figure 9.1: DNA Isolation and Purification Kits Market (by Source Type), $Million, 2020 and 2031

Figure 9.2: Cell-Free DNA Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.3: Market Share for Cell-Free DNA Isolation and Purification Kits Market, $Million, 2020

Figure 9.4: Cell-Free DNA Isolation and Purification Kits Market for Blood, $Million, 2020-2031

Figure 9.5: Cell-Free DNA Isolation and Purification Kits Market for Serum/Plasma, $Million, 2020-2031

Figure 9.6: Cell-Free DNA Isolation and Purification Kits Market for Other Sources, $Million, 2020-2031

Figure 9.7: Cell-Free DNA Isolation and Purification Kits Market for Prenatal and Hereditary Testing, $Million, 2020-2031

Figure 9.8: Cell-Free DNA Isolation and Purification Kits Market for Tumor Testing, $Million, 2020-2031

Figure 9.9: Cell-Free DNA Isolation and Purification Kits Market for Transplantation, $Million, 2020-2031

Figure 9.10: Genomic DNA Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.11: Market Share for Genomic DNA Isolation and Purification Kits Market, $Million, 2020

Figure 9.12: Genomic DNA Isolation and Purification Kits Market for Blood, $Million, 2020-2031

Figure 9.13: Market Share for Genomic DNA Isolation and Purification Market for Blood, $Million, 2020

Figure 9.14: Genomic DNA Isolation and Purification Kits Market for Body Fluids, $Million, 2020-2031

Figure 9.15: Market Share for Genomic DNA Isolation and Purification Kits Market for Body Fluids, $Million, (2020)

Figure 9.16: Genomic DNA Isolation and Purification Kits Market for Buccal, $Million, 2020-2031

Figure 9.17: Market Share for Genomic DNA Isolation and Purification Kits Market for Buccal, $Million, 2020

Figure 9.18: Genomic DNA Isolation and Purification Kits Market for Cell/Cultured Cell, $Million, 2020-2031

Figure 9.19: Market Share for Genomic DNA Isolation and Purification Kits Market for Cell/Cultured Cell, $Million, 2020

Figure 9.20: Genomic DNA Isolation and Purification Kits Market for FFPE, $Million, 2020-2031

Figure 9.21: Market Share for Genomic DNA Isolation and Purification Kits Market for FFPE, $Million, 2020

Figure 9.22: Genomic DNA Isolation and Purification Kits Market for Forensic, $Million, 2020-2031

Figure 9.23: Market Share for Genomic DNA Isolation and Purification Kits Market for Forensic, $Million, 2020

Figure 9.24: Genomic DNA Isolation and Purification Kits Market for Plant, $Million, 2020-2031

Figure 9.25: Market Share for Genomic DNA Isolation and Purification Kits Market for Plant, $Million, 2020

Figure 9.26: Genomic DNA Isolation and Purification Kits Market for Saliva/Swab, $Million, 2020-2031

Figure 9.27: Market Share for Genomic DNA Isolation and Purification Kits Market for Saliva/Swab, $Million, 2020

Figure 9.28: Genomic DNA Isolation and Purification Kits Market for Serum/Plasma, $Million, 2020-2031

Figure 9.29: Market Share for Genomic DNA Isolation and Purification Kits Market for Serum/Plasma, $Million, 2020

Figure 9.30: Genomic DNA Isolation and Purification Kits Market for Tissue, $Million, 2020-2031

Figure 9.31: Market Share for Genomic DNA Isolation and Purification Kits Market for Tissue, $Million, 2020

Figure 9.32: Genomic DNA Isolation and Purification Kits Market for Combined Segment, $Million, 2020-2031

Figure 9.33: Market Share for Genomic DNA Isolation and Purification Kits Market for Stool, Urine, and Other Samples, $Million, 2020

Figure 9.34: Microbe DNA Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.35: Market Share for Microbe DNA Isolation and Purification Kits Market, $Million, 2020

Figure 9.36: Microbial DNA Isolation and Purification Kits Market for Bacterial, $Million, 2020-2031

Figure 9.37: Market Share for Microbial DNA Isolation and Purification Kits Market for Bacterial, $Million, 2020

Figure 9.38: Microbial DNA Isolation and Purification Kits Market for Fungus, $Million, 2020-2031

Figure 9.39: Market Share for Microbial DNA Isolation and Purification Kits Market for Fungus, $Million, 2020

Figure 9.40: Microbial DNA Isolation and Purification Kits Market for Yeast, $Million, 2020-2031

Figure 9.41: Market Share for Microbial DNA Isolation and Purification Kits Market for Yeast, $Million, 2020

Figure 9.42: Microbial DNA Isolation and Purification Kits Market for Other Sources, $Million, 2020-2031

Figure 9.43: Plasmid DNA Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.44: Market Share for Plasmid DNA Isolation and Purification Kits Market, $Million, 2020

Figure 9.45: Plasmid GigaPrep Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.46: Market Share for Plasmid GigaPrep Isolation and Purification Kits Market, $Million, 2020

Figure 9.47: Plasmid MaxiPrep Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.48: Market Share for Plasmid MaxiPrep Isolation and Purification Kits Market, $Million, 2020

Figure 9.49: Plasmid MegaPrep Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.50: Market Share for Plasmid MegaPrep Isolation and Purification Kits Market, $Million, 2020

Figure 9.51: Plasmid MidiPrep Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.52: Market Share for Plasmid MidiPrep Isolation and Purification Kits Market, $Million, 2020

Figure 9.53: Plasmid MiniPrep Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.54: Market Share for Plasmid MiniPrep Isolation and Purification Kits Market, $Million, 2020

Figure 9.55: Viral DNA Isolation and Purification Kits Market, $Million, 2020-2031

Figure 9.56: Market Share for Viral DNA Isolation and Purification Kits Market, $Million, 2020

Figure 10.1: RNA Isolation and Purification Kits Market, $Million, 2020 and 2031

Figure 10.2: Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.3: Genomic RNA Kits Market Share, 2020

Figure 10.4: Genomic RNA Kits for Blood Market, $Million, 2020-2031

Figure 10.5: Genomic RNA Extraction Kits from Blood, Market Share, 2020

Figure 10.6: Body Fluids Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.7: Cell/Cultured Cell Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.8: Cell/Cultured Cell Genomic RNA Extraction Kits, Market Share, 2020

Figure 10.9: FFPE Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.10: FFPE Genomic RNA Extraction Kits, Market Share, 2020

Figure 10.11: Plant Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.12: Plant Genomic RNA Extraction Kits, Market Share, 2020

Figure 10.13: Saliva/Swab Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.14: Serum/Plasma Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.15: Serum/Plasma Genomic RNA Extraction Kits, Market Share, 2020

Figure 10.16: Tissue Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.17: Tissue Genomic RNA Extraction Kits, Market Share, 2020

Figure 10.18: Urine Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.19: Other Genomic RNA Kits Market, $Million, 2020-2031

Figure 10.20: Microbial RNA Kits Market, $Million, 2020-2031

Figure 10.21: Microbial RNA Kits Market Share, 2020

Figure 10.22: Bacterial RNA Kits Market, $Million, 2020-2031

Figure 10.23: Bacterial RNA Kits Market Share, 2020

Figure 10.24: Yeast RNA Kits Market, $Million, 2020-2031

Figure 10.25: Yeast RNA Kits Market Share, 2020

Figure 10.26: Fungus RNA Kits Market, $Million, 2020-2031

Figure 10.27: Fungal RNA Kits Market Share, 2020

Figure 10.28: Other Microbial RNA Kits Market, $Million, 2020-2031

Figure 10.29: Viral RNA Kits Market, $Million, 2020-2031

Figure 10.30: Viral RNA Kits Market Share, 2020

Figure 10.31: Cell-Free RNA Kits Market, $Million, 2020-2031

Figure 10.32: cell-free RNA Kits Market Share, 2020

Figure 10.33: Serum/Plasma Cell-Free RNA Kits Market, $Million, 2020-2031

Figure 10.34: Other Cell-Free RNA Kits Market, $Million, 2020-2031

Figure 11.1: Nucleic Acid Isolation and Purification Consumables Market (by Technology), $Million, 2020 and 2031

Figure 11.2: Silica-Based Consumables Market, $Million, 2020-2031

Figure 11.3: Magnetic Particle-based Consumables Market, $Million, 2020-2031

Figure 12.1: Nucleic Acid Isolation and Purification Consumables Market (by Technological Downstream Applications), $Million, 2020 and 2031

Figure 12.2: PCR Market, $Million, 2020-2031

Figure 12.3: qPCR Market, $Million, 2020-2031

Figure 12.4: NGS Market, $Million, 2020-2031

Figure 12.5: Cloning Market, $Million, 2020-2031

Figure 12.6: Microarray Market, $Million, 2020-2031

Figure 12.7: Blotting Techniques Market, $Million, 2020-2031

Figure 12.8: Other Applications Market, $Million, 2020-2031

Figure 13.1: Nucleic Acid Isolation and Purification Consumables Market (by End User), $Million, 2020 and 2031

Figure 13.2: Academic Research Institutes and Laboratories Market, $Million, 2020-2031

Figure 13.3: Pharmaceutical and Biotechnology Companies Market, $Million, 2020-2031

Figure 13.4: Contract Research Organizations Market, $Million, 2020-2031

Figure 13.5: Applied Testing Market, $Million, 2020-2031

Figure 13.6: Clinical Diagnostic Center Market, $Million, 2020-2031

Figure 14.1: Nucleic Acid Isolation and Purification Consumables Market (by Region), $Million, 2020 and 2031

Figure 14.2: North America Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.3: U.S. Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.4: Canada Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.5: EMEA Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.6: LATAM Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.7: APAC Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.8: China Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.9: Japan Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 14.10: Rest-of-APAC Nucleic Acid Isolation and Purification Consumables Market, $Million, 2020-2031

Figure 15.1: Nucleic Acid Isolation and Purification Instrument Market (by Workflow), $Million, 2020 and 2031

Figure 15.2: Isolation/Extraction/Purification Instrument Market, $Million, 2020-2031

Figure 15.3: Quality Control/Quantification Instrument Market, $Million, 2020-2031

Figure 15.4: Nucleic Acid Extraction/Isolation/Purification Instrument Market (by Technology), $Million, 2020 and 2031

Figure 15.5: Automated Spin Column-Based Instrument Market, $Million, 2020-2031

Figure 15.6: Magnetic Bead-based Instrument Market, $Million, 2020-2031

Figure 15.7: Automated Liquid Handling Instruments Market, $Million, 2020-2031

Figure 15.8: Nucleic Acid Extraction/Isolation/Purification Instrument Market (by Throughput), $Million, 2020 and 2031

Figure 15.9: Low Throughput Instrument Market, $Million, 2020-2031

Figure 15.10: Medium Throughput Instrument Market, $Million, 2020-2031

Figure 15.11: High Throughput Instrument Market, $Million, 2020-2031

Figure 15.12: Quality Control/Quantification Instruments, (by Technology), $Million, 2020 and 2031

Figure 15.13: Spectrophotometers Market, $Million, 2020-2031

Figure 15.14: Fluorometers Market, $Million, 2020-2031

Figure 15.15: Others Market, $Million, 2020-2031

Figure 15.16: Nucleic Acid Isolation and Purification Instrument Market (by End User), $Million, 2020 and 2031

Figure 15.17: Nucleic Acid Isolation and Purification Instrument Market for Academic Research Institutes, $Million, 2020-2031

Figure 15.18: Nucleic Acid Isolation and Purification Instrument Market for Pharmaceutical and Biotechnology Companies, $Million, 2020-2031

Figure 15.19: Nucleic Acid Isolation and Purification Instrument Market for Clinical Diagnostic Centers, $Million, 2020-2031

Figure 15.20: Nucleic Acid Isolation and Purification Instrument Market for Applied Testing, $Million, 2020-2031

Figure 15.21: Nucleic Acid Isolation and Purification Instrument Market for Contract Research Organizations, $Million, 2020-2031

Figure 15.22: Nucleic Acid Isolation and Purification Instrument Market (by Region), $Million, 2020 and 2031

Figure 15.23: North America Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.24: North America Nucleic Acid Isolation and Purification Instrument Market (by Country), $Million, 2020-2031

Figure 15.25: U.S. Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.26: Canada Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.27: EMEA Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.28: APAC Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.29: APAC Nucleic Acid Isolation and Purification Instrument Market (by Country) $Million, 2020-2031

Figure 15.30: China Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.31: Japan Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.32: Rest-of-APAC Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 15.33: LATAM Nucleic Acid Isolation and Purification Instrument Market, $Million, 2020-2031

Figure 16.1: Market Share Analysis for the Global Nucleic Acid Isolation and Purification (Instrument and Kits) Market, 2020

Figure 16.2: Market Share Analysis for the Global Nucleic Acid Isolation and Purification Instrument Market, 2020

Figure 16.3: Global Nucleic Acid Isolation and Purification Kits Market Share, 2020

Figure 16.4: Market Share Analysis for the North America Nucleic Acid Isolation and Purification (Instrument and Kits) Market, 2020

Figure 16.5: Market Share Analysis for the North America Nucleic Acid Isolation and Purification Instrument Market, 2018

Figure 16.6: Market Share Analysis for the North America Nucleic Acid Isolation and Purification Kits Market, 2020

Figure 16.7: Market Share Analysis for the EMEA Nucleic Acid Isolation and Purification (Instrument and Kits) Market, 2020

Figure 16.8: Market Share Analysis for the EMEA Nucleic Acid Isolation and Purification Instrument Market, 2020

Figure 16.9: Market Share Analysis for the EMEA Nucleic Acid Isolation and Purification Kits Market, 2020

Figure 16.10: Growth Share Matrix for Global Nucleic Acid Isolation and Purification Market (by End User)

Figure 16.11: Growth Share Matrix for Global Nucleic Acid Isolation and Purification Market (by Region)

Figure 16.12: Growth Share Matrix for Global Nucleic Acid Isolation and Purification Market (by Product)

Figure 17.1: Business Expansion Opportunity Mapping (by Product)

Figure 17.2: Business Expansion Opportunity Mapping (by Region)

Figure 17.3: Nucleic Acid Isolation and Purification Market: SWOT Analysis

Figure 18.1: Total Number of Companies Profiles

Figure 18.2: Agilent Technologies, Inc.: Key Product Portfolio

Figure 18.3: Agilent Technologies, Inc.: Overall Financials, 2018-2020

Figure 18.4: Agilent Technologies, Inc.: Revenue (by Segment), 2018-2020

Figure 18.5: Agilent Technologies, Inc.: Revenue (by Region), 2018-2020

Figure 18.6: Agilent Technologies, Inc.: R&D Expenditure, 2018-2020

Figure 18.7: Agilent Technologies, Inc.: SWOT Analysis

Figure 18.8: Analytik Jena AG: Key Product Portfolio

Figure 18.9: Analytik Jena AG: SWOT Analysis

Figure 18.10: AutoGen, Inc.: Key Product Portfolio

Figure 18.11: AutoGen, Inc.: SWOT Analysis

Figure 18.12: Bio-Rad Laboratories, Inc.: Key Product Portfolio

Figure 18.13: Bio-Rad Laboratories, Inc.: Overall Financials, 2018-2020

Figure 18.14: Bio-Rad Laboratories, Inc.: Sales (by Segment), $Million, 2018-2020

Figure 18.15: Bio-Rad Laboratories, Inc.: Sales (by Region), 2018-2020

Figure 18.16: Bio-Rad Laboratories, Inc.: R&D Expenditure, 2018-2020

Figure 18.17: Bio-Rad Laboratories, Inc.: SWOT Analysis

Figure 18.18: F. Hoffmann-La Roche AG: Key Product Portfolio

Figure 18.19: F. Hoffmann-La Roche AG: Overall Financials, 2018-2020

Figure 18.20: F. Hoffmann-La Roche AG: Revenue (by Segment), $Million, 2018-2020

Figure 18.21: F. Hoffmann-La Roche AG: Revenue (by Region), 2018-2020

Figure 18.22: F. Hoffmann-La Roche AG: R&D Expenditure, 2018-2020

Figure 18.23: F. Hoffmann-La Roche AG: SWOT Analysis

Figure 18.24: Illumina, Inc.: Key Product Portfolio

Figure 18.25: Illumina, Inc.: Overall Financials, 2018-2020

Figure 18.26: Illumina, Inc.: Revenue (by Segment), $Million, 2018-2020

Figure 18.27: Illumina, Inc.: Revenue (by Region), 2018-2020

Figure 18.28: Illumina, Inc.: R&D Expenditure, 2018-2020

Figure 18.29: Illumina, Inc.: SWOT Analysis

Figure 18.30: Merck KGaA: Key Product Offerings

Figure 18.31: Merck KGaA: Overall Financials, 2018-2020

Figure 18.32: Merck KGaA: Revenue (by Segment), $Million, 2018-2020

Figure 18.33: Merck KGaA: Revenue (by Region), 2018-2020

Figure 18.34: Merck KGaA: R&D Expenditure, 2018-2020

Figure 18.35: Merck KGaA: SWOT Analysis

Figure 18.36: Meridian Bioscience: Key Product Portfolio

Figure 18.37: Meridian Bioscience: Overall Financials, 2018-2020

Figure 18.38: Meridian Bioscience Revenue (by Segment), 2018-2020

Figure 18.39: Meridian Bioscience: Revenue (by Region), 2018-2020

Figure 18.40: Meridian Bioscience: R&D Expenditure, 2018-2020

Figure 18.41: Meridian Bioscience: SWOT Analysis

Figure 18.42: Macherey-Nagel GmbH & Co KG: Key Product Portfolio

Figure 18.43: Macherey-Nagel GmbH & Co KG: SWOT Analysis

Figure 18.44: New England Biolabs, Inc: Key Product Offerings

Figure 18.45: New England Biolabs, Inc.: SWOT Analysis

Figure 18.46: Norgen Biotek Corp.: Key Product Portfolio

Figure 18.47: Norgen Biotek Corp.: SWOT Analysis

Figure 18.48: Omega Bio-tek, Inc.: Key Product Portfolio

Figure 18.49: Omega Bio-Tek: SWOT Analysis

Figure 18.50: Orasure Technologies, Inc.: Key Product Portfolio

Figure 18.51: Orasure Technologies, Inc.: Overall Financials, 2018-2020

Figure 18.52: Orasure Technologies, Inc. Revenue (by Segment), 2018-2020

Figure 18.53: Orasure Technologies, Inc.: Revenue (by Region), 2018-2020

Figure 18.54: Orasure Technologies, Inc.: R&D Expenditure, 2018-2020

Figure 18.55: Orasure Technologies, Inc.: SWOT Analysis

Figure 18.56: PerkinElmer, Inc.: Key Product Portfolio

Figure 18.57: Perkin Elmer, Inc.: Overall Financials, (2018-2020)

Figure 18.58: Perkin Elmer, Inc.: Revenue (by Business Segment), 2018-2020

Figure 18.59: Perkin Elmer, Inc.: Revenue (by Region), 2018-2020

Figure 18.60: PerkinElmer, Inc.: R&D Expenditure, 2018-2020

Figure 18.61: PerkinElmer, Inc.: SWOT Analysis

Figure 18.62: Promega Corporation: Key Product Portfolio

Figure 18.63: Promega Corporation: SWOT Analysis

Figure 18.64: QIAGEN N.V.: Key Product Offerings

Figure 18.65: QIAGEN N.V.: Overall Financials, 2018-2020

Figure 18.66: QIAGEN N.V.: Revenue (by Segment), 2018-2020

Figure 18.67: QIAGEN N.V.: Revenue (by Region), 2016-2018

Figure 18.68: QIAGEN N.V.: R&D Expenditure, 2018-2020

Figure 18.69: QIAGEN N.V.: SWOT Analysis

Figure 18.70: Sage Science, Inc.: Key Product Portfolio

Figure 18.71: Sage Science, Inc.: SWOT Analysis

Figure 18.72: Tecan Group: Key Product Portfolio

Figure 18.73: Tecan Group: Overall Financials, 2018-2020

Figure 18.74: Tecan Group Revenue (by Segment), 2018-2020

Figure 18.75: Tecan Group: Revenue (by Region), 2018-2020

Figure 18.76: Tecan Group: R&D Expenditure, 2018-2020

Figure 18.77: Tecan Group: SWOT Analysis

Figure 18.78: Thermo Fisher Scientific Inc.: Key Product Offerings

Figure 18.79: Thermo Fisher Scientific Inc.: Overall Financials, 2018-2020

Figure 18.80: Thermo Fisher Scientific Inc: Sales (by Segment), $Million, 2018-2020

Figure 18.81: Thermo Fisher Scientific Inc.: Sales (by Region), 2018-2020

Figure 18.82: Thermo Fisher Scientific Inc.: R&D Expenditure, 2018-2020

Figure 18.83: Thermo Fisher Scientific Inc.: SWOT Analysis

Figure 18.84: Zymo Research: Key Product Portfolio

Figure 18.85: Zymo Research: SWOT Analysis

Market Report Coverage

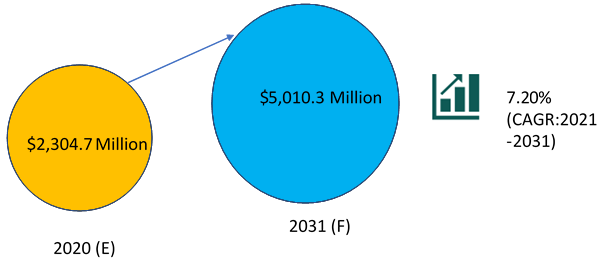

|

Nucleic Acid Isolation and Purification Market |

|||

|

Base Year |

2020 |

Market Size in 2020 |

$2,304.7 Million |

|

Forecast Period |

2021-2031 |

Value Projection and Estimation by 2031 |

$5,010.3 Million |

|

CAGR During Forecast Period |

7.20% |

Number of Tables |

47 |

|

Number of Pages |

395 |

Number of Figures |

290 |

|

Market Segmentation |

• Product Type- Instruments and Consumables (Kits and Reagents) • End User – Academic and Research Institutions, Biopharmaceutical and Biotechnological, Companies, Contract Research Organizations, Applied Testing, Clinical Diagnostic Centers, and Other End Users |

||

|

Regional Segmentation |

• North America – U.S., Canada • Europe, Middle East & Africa (EMEA) • Asia-Pacific – China, Japan, and Rest-of-Asia-Pacific (RoAPAC) • Latin America (LATAM) |

||

|

Growth Drivers |

• Growing Number of Genetic Tests • Increasing Demand for Reliable Next-Generation Sequencing (NGS) Results • Rise in the Prevalence of Infectious Disease • Rise in the Field of Microbial Sequencing • Increasing Research Funding in the Field of Molecular Biology • Increase in Awareness and Acceptance of Personalized Medicines on a Global Level • Decreasing Cost of Sequencing |

||

|

Market Challenges |

• Genomic Data Protection • High Cost of Automated Instruments • Rigid Regulatory Standards |

||

|

Market Opportunities |

• Evolution of Biobanking in Healthcare • Capitalizing on the High Prevalence of Genetic Disorders • Growth in Emerging Nations • Massive Scope for Adoption of NGS-based Genetic Tests in Emerging Markets |

||

|

Key Companies Profiled |

Agilent Technologies, Inc., Analytik Jena AG, AutoGen, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche AG, Illumina, Inc., Merck KGaA, Meridian Bioscience, Inc., Macherey-Nagel GmbH & Co KG, New England Biolabs, Inc, Norgen Biotek Corp., Omega Bio-tek, Inc., Orasure Technologies, Inc., PerkinElmer, Inc., Promega Corporation, QIAGEN N.V., Sage Science, Inc., Tecan Group, ThermoFisher Scientific Inc., Zymo Research |

||

Key Questions Answered in this Report:

• What are the major market drivers, challenges, and opportunities in the global nucleic acid isolation and purification market?

• What are the key development strategies which are being implemented by major players in order to sustain in the competitive market?

• How each segment of the market is expected to grow during the forecast period from 2020 to 2029 based on

o Product type: instrument and consumables (kits and reagents)

o End User: academic research institutes, pharmaceutical and biotechnology companies, applied testing, contract research organizations, and clinical diagnostic centers

o Region: North America, EMEA, Asia-Pacific, and Latin America

• Which are the leading players with significant offerings to the global nucleic acid isolation and purification market? What is the expected market dominance for each of these leading players?

• Which companies are anticipated to be highly disruptive in the future and why?

• What are the challenges in the nucleic acid isolation and purification market?

Report Summary

BIS Research healthcare experts have found the nucleic acid isolation and purification market to be one of the growing markets, which is predicted to grow at a CAGR of 7.20% during the forecast period, 2021-2031. The nucleic acid isolation and purification market growth has been primarily attributed to the major drivers in this market, such as growing number of genetic tests, increasing demand for reliable next-generation sequencing (NGS) results, rise in the prevalence of infectious diseases, increasing research funding in the field of molecular biology, and increase in awareness and acceptance of personalized medicine on a global level. However, genomic data protection, high cost of automated instruments, and rigid regulatory standards are some of the factors expected to retrain the market growth.

Figure: Global Nucleic Acid Isolation and Purification Market Snapshot

The market is favored by the increased research activities based on next-generation sequencing-based technologies. The consumable segment has been segmented to into DNA and RNA sample type, among which RNA sample type is expected to growth at a highest CAGR of 7.70% during the forecast period 2021-2031. This increase is mainly attributed to the large number of research and development being conducted due to the COVID-19 pandemic, specifically considering viral RNA sample.

Within the research report, the market is segmented on the basis of product type, end users, and region. The kits segment is further segment into DNA and RNA, to gain holistic view of the industry. Each of these segments covers the snapshot of the market over the projected years, the inclination of the market revenue, underlying patterns, and trends by using analytics on the primary and secondary data obtained.

Competitive Landscape

The exponential rise in the downstream application such as next-generation sequencing, polymerase chain reaction, and other techniques used for COVID-19 testing on the global level has created a buzz among companies to invest in the development of extraction RNA free severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) tests. Due to technologically advanced solutions and intense market penetration, companies such as Qiagen N.V., Promega Corporation, and Thermo Fisher Scientific, Inc. have been a pioneer and a significant competitor in this market.

Other key players in the market are Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., F.Hoffmann-La Roche AG, Illumina, Inc., General Electric Company (GE), and New England Biolabs, among others.

With the increasing demand for complex and custom sequencing techniques, rising genetic testing services, and growing research to treat and diagnose genetic and infectious diseases, companies have the opportunity to expand their product portfolios, increasing automation facilitation, and develop novel techniques for nucleic acid extraction by adopting different strategic approaches. Some of the strategies followed by the contributors are new product launches and enhancements, agreements, collaborations, partnerships, acquisitions, and expansions. For instance, in 2020, Promega Corporation has launched Wizard HMW DNA Extraction Kit for researchers working with large fragments of genomic DNA, which enables researchers to obtain DNA that will provide strong performance in long-read sequencing applications in a 90-minute manual protocol.

The nucleic acid isolation and purification market has immensely propelled by nationwide sequencing activities, focusing on generating large genomic libraries for research and development purpose. For instance, Illumina, Inc. has invested $60.0 million in sequencing capabilities to a global pathogen genomics initiative, in partnership with the Bill & Melinda Gates Foundation and other public and private entities. Under the contract, Illumina, Inc. will donate next-generation sequencing (NGS) platforms, reagents, and training support worth approximately US $60 million over five years.

Global Nucleic Acid Isolation and Purification Market

Focus on Product, End User, Region/Country Data and Competitive Landscape - Analysis and Forecast, 2021-2031