A quick peek into the report

Table of Contents

1.1 Industry Outlook

1.1.1 Hypersonic Technology: Overview

1.1.2 Hypersonic Technology Roadmap

1.1.2.1 Scramjet Evolution

1.1.3 Advanced Hypersonic Materials

1.1.4 Ecosystem Participants

1.1.5 Top Countries Pioneering Hypersonic Technology

1.1.6 Development of Counter-Hypersonic Technology

1.1.6.1 Major Ongoing Programs

1.1.7 Patent Analysis

1.1.7.1 Introduction

1.1.7.2 Patent Landscape

1.1.8 Supply Chain Analysis

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Increasing demand for Hypersonic Weapons

1.2.1.2 Increasing Territorial Conflicts

1.2.1.3 Growing Global Defense Spending

1.2.2 Business Challenges

1.2.2.1 Issues associated with Maneuverability of Hypersonic Systems

1.2.2.2 Technical Challenges with Hypersonic Systems

1.2.3 Business Opportunities

1.2.3.1 Increasing Focus on Super Fast Intercontinental Travel

1.2.3.1.1 Jet-Powered Hypersonic spaceplane

1.2.3.1.2 Stratofly MR3

1.2.3.1.3 LAPCAT A2

1.2.3.1.4 I Plane

1.2.3.1.5 HyperStar

1.2.3.1.6 Hexafly

1.2.3.2 Development of Counter-Hypersonic Systems

1.2.3.3 Advancements in Scramjet Technology for Hypersonic Missiles

1.2.4 Business Strategies

1.2.4.1 Product Developments and Innovations

1.2.5 Corporate Strategies

1.2.5.1 Partnerships, Collaborations, and Contracts

2.1 Overview

2.2 Global Hypersonic Technology Market (by End User)

2.3 Demand Analysis of Hypersonic Technology (by End User)

2.3.1 Military

2.3.1.1 Army

2.3.1.2 Air Force

2.3.1.3 Navy

2.3.2 Space

2.4 Global Hypersonic Technology Market (by Launch Mode)

2.5 Demand Analysis of Hypersonic Technology (by Launch Mode)

2.5.1 Air Launched

2.5.2 Surface Launched

2.5.3 Subsea Launched

3.1 Overview

3.2 Global Hypersonic Technology Market (by Type)

3.3 Demand Analysis of Hypersonic Technology (by Type)

3.3.1 Hypersonic Glide Vehicle

3.3.1.1 Guidance System

3.3.1.1.1 Standard Trajectory Guidance

3.3.1.1.2 Predictor-Corrector Guidance

3.3.1.2 Airframe

3.3.1.3 Payload

3.3.2 Hypersonic Cruise Missile

3.3.2.1 Guidance System

3.3.2.2 Propulsion System

3.3.2.3 Payload

3.3.2.4 Airframe

3.3.3 Hypersonic Spaceplanes

4.1 Global Hypersonic Technology (by Country)

4.2 U.S.

4.2.1 Programs

4.2.1.1 U.S. Navy

4.2.1.2 U.S. Army

4.2.1.3 U.S. Air Force

4.2.1.4 DARPA

4.2.1.5 Hypersonic Missile Defense

4.2.2 Infrastructure

4.2.3 Markets

4.2.3.1 Key Manufacturers and Suppliers in the U.S.

4.3 Russia

4.3.1 Programs

4.3.1.1 Avangard

4.3.1.2 3M22 Tsirkon

4.3.2 Infrastructure

4.3.3 Markets

4.3.3.1 Key Manufacturers and Suppliers in Russia

4.4 China

4.4.1 Programs

4.4.1.1 DF-17

4.4.1.2 DF-ZF

4.4.1.3 Starry Sky-2

4.4.2 Infrastructure

4.4.3 Markets

4.4.3.1 Key Manufacturers and Suppliers in China

4.5 India

4.5.1 Programs

4.5.1.1 Brahmos II

4.5.1.2 Hypersonic Technology Demonstrator Vehicle (HSTDV)

4.5.2 Markets

4.5.2.1 Key Manufacturers and Suppliers in India

4.6 Australia

4.6.1 Programs

4.6.1.1 Hypersonic International Flight Research Experimentation (HIFiRE)

4.6.1.1.1 HyShot V (HIFiRE 4)

4.6.1.1.2 HyShot VI (HIFiRE 7)

4.6.1.1.3 HyShot VII (HIFiRE 8)

4.6.1.2 Southern Cross Integrated Flight Research Experiment (SCIFiRE)

4.6.1.3 Project Javelin

4.6.2 Markets

4.6.2.1 Key Manufacturers and Suppliers in Australia

4.7 Japan

4.7.1 Markets

4.7.1.1 Key Manufacturers and Suppliers in Japan

4.8 France

4.8.1 Programs

4.8.1.1 V-Max

4.8.2 Markets

4.8.2.1 Key Manufacturers and Suppliers in France

4.9 Germany

4.9.1 Programs

4.9.1.1 TWISTER

4.9.1.2 Sharp Edge Flight Experiment (SHEFEX) II

4.9.2 Markets

4.9.2.1 Key Manufacturers and Suppliers in Germany

4.10 Rest-of-the-World

4.10.1 Markets

4.10.1.1 Key Manufacturers and Suppliers in Rest-of-the-World

5.1 Competitive Benchmarking

5.2 Aerojet Rocketdyne Holdings Inc.

5.2.1 Company Overview

5.2.2 Role of Aerojet Rocketdyne Holdings Inc. in Hypersonic Technology Market

5.2.3 Product Portfolio

5.2.4 Geographical Presence and R&D Analysis

5.2.5 Business Strategies

5.2.6 Strength and Weakness of Aerojet Rocketdyne Holdings Inc.

5.3 BAE Systems

5.3.1 Company Overview

5.3.1.1 Role of BAE Systems in Hypersonic Technology Market

5.3.1.2 Product Portfolio

5.3.2 Corporate Strategies

5.3.2.1 Mergers and Acquisitions

5.3.3 Business Strategies

5.3.3.1 Product Development

5.3.4 R&D Analysis

5.3.5 Strength and Weakness of BAE Systems

5.4 Brahmos Aerospace

5.4.1 Company Overview

5.4.2 Role of Brahmos Aerospace in Hypersonic Technology Market

5.4.3 Product Portfolio

5.4.4 Business Strategies

5.4.5 Strength and Weakness of Brahmos Aerospace

5.5 Dynetics, Inc.

5.5.1 Company Overview

5.5.2 Role of Dynetics, Inc. in Hypersonic Technology Market

5.5.3 Product Portfolio

5.5.4 Geographical Presence

5.5.5 Business Strategies

5.5.6 Strength and Weakness of Dynetics, Inc.

5.6 General Dynamics Corporation

5.6.1 Company Overview

5.6.2 Role of General Dynamics Corporation in Hypersonic Technology Market

5.6.3 Geographical Presence and R&D Analysis

5.6.4 Strength and Weakness of General Dynamics Corporation

5.7 Lockheed Martin Corporation

5.7.1 Company Overview

5.7.2 Role of Lockheed Martin Corporation in Hypersonic Technology Market

5.7.3 Product Portfolio

5.7.4 Business Strategies

5.7.5 Strength and Weakness of Lockheed Martin Corporation

5.8 L3 Harris Technologies Inc.

5.8.1 Company Overview

5.8.2 Role of L3 Harris Technologies Inc. in Hypersonic Technology Market

5.8.3 Product Portfolio

5.8.4 Business Strategies

5.8.5 Strength and Weakness of L3 Harris Technologies Inc.

5.9 Northrop Grumman Corporation

5.9.1 Company Overview

5.9.2 Role of Northrop Grumman Corporation in Hypersonic Technology Market

5.9.3 Product Portfolio

5.9.4 Geographical Presence and R&D Analysis

5.9.5 Business Strategies

5.9.6 Strength and Weakness of Northrop Grumman Corporation

5.10 Raytheon Technologies Corporation

5.10.1 Company Overview

5.10.2 Role of Raytheon Technologies Corporation in Hypersonic Technology Market

5.10.3 Product Portfolio

5.10.4 Geographical Presence and R&D Analysis

5.10.5 Business Strategies

5.10.6 Strength and Weakness of Raytheon Technologies Corporation

5.11 Saab AB

5.11.1 Company Overview

5.11.2 Role of Saab AB in Hypersonic Technology Market

5.11.3 Product Portfolio

5.11.4 Geographical Presence and R&D Analysis

5.11.5 Business Strategies

5.11.6 Strength and Weakness of Saab AB

5.12 SPACEX

5.12.1 Company Overview

5.12.2 Role of SPACEX in Hypersonic Technology Market

5.12.3 Product Portfolio

5.12.4 Geographical Presence

5.12.5 Business Strategies

5.12.6 Strength and Weakness of SPACEX

5.13 The Boeing Company

5.13.1 Company Overview

5.13.2 Role of The Boeing Company in Hypersonic Technology Market

5.13.3 Product Portfolio

5.13.4 Geographical Presence and R&D Analysis

5.13.5 Business Strategies

5.13.6 Strength and Weakness of The Boeing Company

5.14 Thales Group

5.14.1 Company Overview

5.14.2 Role of Thales Group in Hypersonic Technology Market

5.14.3 Product Portfolio

5.14.4 Strength and Weakness of Thales Group

6.1 Data Sources

6.1.1 Primary Data Sources

6.1.2 Secondary Data Sources

6.2 Data Triangulation

6.3 Market Estimation and Forecast

Table 1: Hypersonic Technology Programs, 2021

Table 2: Global Hypersonic Technology Market, Value ($Million), 2020 and 2026

Table 3: Hypersonic Vehicles, 2021

Table 4: Major Hypersonic Technology Programs, 2011 - 2020

Table 5: Global Hypersonic Technology Market (by End User), $Million, 2021-2031 and Missile Propulsion Systems Market (by Application)

Table 6: Global Hypersonic Technology Market (by Launch Mode), $Million, 2021-2031

Table 7: Global Hypersonic Technology Market (by Type), $Million, 2020-2031

Table 8: Global Hypersonic Technology Market (by Country), $Million, 2020-2031

Table 9: U.S. Hypersonic Programs,2021

Table 10: U.S. Department of Defense Hypersonic Ground Test Facilities

Table 11: China Hypersonic Wind Tunnels

Table 12: Mergers and Acquisitions

Table 13: Product Development

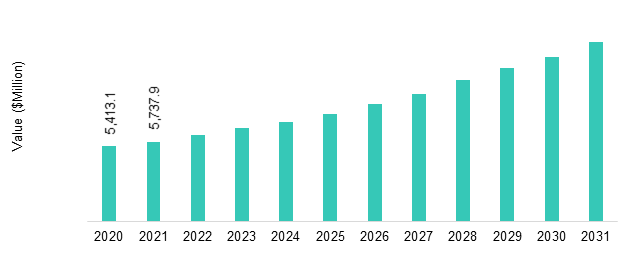

Figure 1: Global Hypersonic Technology Market, $Million, 2020-2031

Figure 2: Global Hypersonic Technology Market (by Type), $Million, 2020 and 2031

Figure 3: Global Hypersonic Technology Market (by End User), $Million, 2020

Figure 4: Global Hypersonic Technology Market (by Launch Mode), $Million, 2020

Figure 5: Global Hypersonic Technology Market (by Region), $Billion, 2021

Figure 6: Global Hypersonic Technology Market Coverage

Figure 7: Hypersonic Glide Vehicle Trajectory

Figure 8: Compression, Combustion, and Expansion Regions of Turbojet, Ramjet, and Scramjet Engines

Figure 9: Ecosystem: Hypersonic Technology

Figure 10: Number of Hypersonic Vehicles (by Country)

Figure 11: Patent Landscape: Hypersonic Technology

Figure 12: Hypersonic Technology Patents, January 2017-March 2021

Figure 13: Supply Chain Analysis of Hypersonic Technology Market

Figure 14: Global Hypersonic Technology Market, Business Dynamics

Figure 15: Defense Spending (by Country), 2017, 2018, and 2019

Figure 16: Share of Key Market Strategies and Developments, 2017-2020

Figure 17: Product Development and Innovations (by Company), 2017-2020

Figure 18: Partnerships, Collaborations and Contracts (by Company), 2017-2020

Figure 19: Global Hypersonic Technology Market (by End User)

Figure 20: Global Hypersonic Technology Market (by Army), $Million, 2020-2031

Figure 21: Global Hypersonic Technology Market (by Air Force), $Million, 2020-2031

Figure 22: Global Hypersonic Technology Market (by Navy), $Million, 2020-2031

Figure 23: Global Hypersonic Technology Market (by Space), $Million, 2020-2031

Figure 24: Global Hypersonic Technology Market

Figure 25: Global Hypersonic Technology Market, Air Launched, $Million, 2020-2031

Figure 26: Global Hypersonic Technology Market, Surface Launched, $Million, 2020-2031

Figure 27: Global Hypersonic Technology Market, Subsea Launched, $Million, 2020-2031

Figure 28: Global Hypersonic Technology Market

Figure 29: Flight Trajectory of Hypersonic Glide Vehicles and Ballistic Missiles

Figure 30: 14-X Specifications

Figure 31: DF-ZF Specifications

Figure 32: HGV-202F Specifications

Figure 33: Hypersonic Technology Demonstrator Vehicle Specifications

Figure 34: Hypersonic Technology Vehicle 2 Specifications

Figure 35: X-43 Specifications

Figure 36: Avangard Specifications

Figure 37: Global Hypersonic Technology Market, (by Hypersonic Glide Vehicles), $Million, 2020-2031

Figure 38: 3M22 Zircon Specification

Figure 39: Advanced Hypersonic Weapon Specification

Figure 40: AGM-183 ARRW Specification

Figure 41: BrahMos II Specification

Figure 42: HAWC Specification

Figure 43: High-Speed Strike Weapon Specification

Figure 44: Kh-90 Specification

Figure 45: Mayhem Specifications

Figure 46: Global Hypersonic Technology Market, (by Hypersonic Cruise Missiles), $Million, 2020-2031

Figure 47: Avatar Specifications

Figure 48: Intermediate eXperimental Vehicle Specifications

Figure 49: Kholod Specifications

Figure 50: RLV-TD Specifications

Figure 51: Shenlong Specifications

Figure 52: Skylon Specifications

Figure 53: SpaceLiner Specifications

Figure 54: X-37 Specifications

Figure 55: XS-1 Specifications

Figure 56: Global Hypersonic Technology Market, (by Hypersonic Spaceplanes), $Million, 2020-2031

Figure 57: U.S. Hypersonic Technology Market, $Million, 2020-2031

Figure 58: Russia Hypersonic Technology Market, $Million, 2020-2031

Figure 59: China Hypersonic Technology Market, $Million, 2020-2031

Figure 60: India Hypersonic Technology Market, $Million, 2020-2031

Figure 61: Australia Hypersonic Technology Market, $Million, 2020-2031

Figure 62: Japan Hypersonic Technology Market, $Million, 2020-2031

Figure 63: France Hypersonic Technology Market, $Million, 2020-2031

Figure 64: Germany Hypersonic Technology Market, $Million, 2020-2031

Figure 65: Rest-of-the-World Hypersonic Technology Market, $Million, 2020-2031

Figure 66: Competitive Benchmarking, 2020

Figure 67: Aerojet Rocketdyne Holdings Inc.: Product Portfolio

Figure 68: Aerojet Rocketdyne Holdings Inc.: Research and Development Expenditure, 2017-2020

Figure 69: BAE Systems: Product Portfolio

Figure 70: BAE Systems – Research and Development Expenditure, 2017-2019

Figure 71: Brahmos Aerospace: Product Portfolio

Figure 72: Dynetics, Inc.: Product Portfolio

Figure 73: General Dynamics Corporation – Research and Development Expenditure, 2017-2019

Figure 74: Lockheed Martin Corporation Market: Product Portfolio

Figure 75: Lockheed Martin Corporation - Research and Development Expenditure, 2017-2019

Figure 76: L3 Harris Technologies Inc.: Product Portfolio

Figure 77: Northrop Grumman Corporation: Product Portfolio

Figure 78: Northrop Grumman Corporation – Research and Development Expenditure, 2017-2019

Figure 79: Raytheon Technologies Corporation: Product Portfolio

Figure 80: Raytheon Technologies Corporation – Research and Development Expenditure, 2017-2019

Figure 81: Saab AB: Product Portfolio

Figure 82: Saab AB – Research and Development Expenditure, 2018-2020

Figure 83: SPACEX: Product Portfolio

Figure 84: The Boeing Company: Product Portfolio

Figure 85: The Boeing Company – Research and Development Expenditure, 2018-2020

Figure 86: Thales Group: Product Portfolio

Figure 87: Thales Group – Research and Development Expenditure, 2017-2019

Figure 88: Research Methodology

Figure 89: Data Triangulation

Figure 90: Top-Down and Bottom-Up Approach

Figure 91: Assumptions and Limitations

Report Description

Scope of the Global Hypersonic Technology Market

The purpose of the market analysis is to examine the global hypersonic technology market in terms of factors driving the market, trends, technological developments, and competitive benchmarking, among others.

The report further takes into consideration the market dynamics and the competitive landscape of the key players operating in the market.

Global Hypersonic Technology Market Segmentation

The report constitutes an extensive study of the global hypersonic technology industry. The report primarily focuses on providing market information on hypersonic technology covering various segments and countries. The global hypersonic technology market is segmented on the basis of end-user, type, launch-mode, and countries. While highlighting the key driving and restraining forces for this market, the report also provides a detailed study of the industry. The report analyzes different end-user that include military and space. The type segment is further segmented into hypersonic glide vehicles, hypersonic cruise missiles and space launch vehicles. The launch mode has been segmented into surface to surface, surface to air, air to air, and subsea to surface.

The global hypersonic technology market is segregated into major countries, namely U.S., Russia, China, India, Australia, Japan, France, Germany, and Rest-of-the-World. Data for each of these countries is provided in the market study.

Key Companies in the Global Hypersonic Technology Industry

The key market players in the global hypersonic technology market include Aerojet Rocketdyne Holdings Inc., The Boeing Company, Brahmos Aerospace Pvt. Ltd., Lockheed Martin Corporation, Thales Group, General Dynamics Corporation, Northrop Grumman Corporation, Raytheon Company, SAAB SA, Dynetics Inc., SpaceX, and L3 Harris Technologies Inc.

Key Questions Answered in this Report:

• What are the major drivers, challenges, and opportunities for the global hypersonic technology market during the forecast period 2021-2031?

• What are the recent trends in the hypersonic cruise missiles segment?

• Who are the key players in the global hypersonic technology market, and what is their competitive benchmarking?

• What is the expected revenue generated by the global hypersonic technology market during the forecast period 2021-2031?

• What are the strategies adopted by the key players in the market to increase their market presence in the industry?

• Which end-user (military and space) in the hypersonic technology market is expected to dominate the market in 2031?

• What revenue are expected to be generated by the global hypersonic technology market (by launch mode) – surface to surface, surface to air, air to air and subsea to surface – in 2021, and what are the estimates till 2031?

• What are the competitive strengths of the key players in the global hypersonic technology market?

• What would be the aggravated revenue generated by the hypersonic technology market segmented by U.S., Russia, China, India, Australia, Japan, France, Germany and Rest-of-the-World.

• What are the major restraints inhibiting the growth of the global hypersonic technology market?

Market Overview

Global Hypersonic Technology Market Forecast, 2021-2031

Figure :Global Hypersonic Technology Market, $Million, 2020-2031

The global hypersonic technology industry analysis by BIS Research projects the market to have significant growth of CAGR 8.45% during the forecast period 2021-2031. United States is expected to dominate the global hypersonic technology market with an estimated share of 54.1% in 2031. China and Germany are the two most prominent countries having significant share in the hypersonic technology market.

The global hypersonic technology market is gaining widespread importance owing to the increasing demand of hypersonic weapons, growing global defense spending and rising territorial conflicts. Moreover, the increasing focus on super fast intercontinental travel, development of counter-hypersonic systems, and advancements in Scramjet technology for hypersonic missiles are other important factors that may propel the market growth in the coming years.

Hypersonic Technology Market - A Global and Country Analysis

Focus on Type, End User, Launch Mode, and Country - Analysis and Forecast, 2021-2031

Frequently Asked Questions

The global market for hypersonic technology generated $5.413 Billion in 2020 and is projected to register a CAGR of 8.45% during the forecast period 2021-2031.

The prime business drivers that influence the growth rate of hypersonic technology market include the increasing demand for hypersonic weapons, increasing territorial conflicts, and growing global defense spending.

The issues associated with maneuverability of hypersonic systems and technical challenges with hypersonic systems, are some of the business challenges that impact the growth rate of the global hypersonic technology market in the coming decade.

Based on region, United States is expected to dominate the global hypersonic technology market with an overall share of 54.1% by the end of 2031.

The key market players in the global hypersonic technology market include Northrop Grumman Corporation, The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation, SpaceX, Thales Group, and Brahmos Aerospace Pvt. Ltd., among others.