A quick peek into the report

Table of Contents

1.1 Market Drivers

1.1.1 Transition of Mid-Tier Building Sector Toward Energy Efficiency

1.1.2 A Plain-Sailing Supply Chain for HVAC in Both Countries

1.2 Market Restraints

1.2.1 Energy Consumption and GHG Emissions

1.3 Market Opportunities

1.3.1 Building a Roadmap Toward Net-Zero Buildings

2.1 Key Market Developments and Strategies

2.1.1 Product Launches and Developments

2.1.2 Mergers and Acquisitions

2.1.3 Business Expansion and Contracts

2.1.4 Partnerships, Collaborations, and Joint Ventures

2.1.5 Others (Awards and Recognitions)

2.2 Industry Attractiveness

2.2.1 Threat of New Entrants

2.2.2 Bargaining Power of Buyers

2.2.3 Bargaining Power of Suppliers

2.2.4 Threat from Substitutes

2.2.5 Intensity of Competitive Rivalry

2.3 Australia and New Zealand HVAC Market: Distribution Channel Analysis

3.1 Assumptions and Limitations for Analysis and Forecast

3.2 Market Overview

3.3 Windows and Portable Air Conditioners

3.4 Mini Split Air Conditioners

3.5 Single Packaged Air Conditioners

3.6 Chillers

3.7 Air Handling Units (AHU)

3.8 Fan Coil Units (FCU)

4.1 Market Overview

4.2 Windows and Portable Air Conditioners

4.3 Mini Split Air Conditioners

4.4 Single Packaged Air Conditioners

4.5 Chillers

4.6 Air Handling Unit (AHU)

4.7 Fan Coil Unit

Overview

5.1 Actron Engineering Pty Ltd.

5.1.1 Company Overview

5.1.2 Role of Actron Engineering Pty Ltd. in the ANZ HVAC Market

5.1.3 Product Portfolio

5.1.4 SWOT Analysis

5.2 Daikin Industries, Ltd.

5.2.1 Company Overview

5.2.2 Role of Daikin Industries Ltd. in the ANZ HVAC Market

5.2.3 Financials

5.2.4 SWOT Analysis

5.3 FUJITSU

5.3.1 Company Overview

5.3.2 Role of FUJITSU in the ANZ HVAC Market

5.3.3 Financials

5.3.4 SWOT Analysis

5.4 Ingersoll Rand

5.4.1 Company Overview

5.4.2 Role of Ingersoll Rand in the ANZ HVAC Market

5.4.3 Financials

5.4.4 SWOT Analysis

5.5 Johnson Controls

5.5.1 Company Overview

5.5.2 Role of Johnson Controls in the ANZ HVAC Market

5.5.3 Financials

5.5.4 SWOT Analysis

5.6 LG Electronics

5.6.1 Company Overview

5.6.2 Role of LG Electronics in the ANZ HVAC Market

5.6.3 Financials

5.6.4 SWOT Analysis

5.7 Mitsubishi Electric Corporation

5.7.1 Company Overview

5.7.2 Role of Mitsubishi Electric Corporation in the ANZ HVAC Market

5.7.3 Financials

5.7.4 SWOT Analysis

5.8 Panasonic Corporation

5.8.1 Company Overview

5.8.2 Role of Panasonic Corporation in the ANZ HVAC Market

5.8.3 Financials

5.8.4 SWOT Analysis

5.9 SAMSUNG

5.9.1 Company Overview

5.9.2 Role of SAMSUNG in the ANZ HVAC Market

5.9.3 Financials

5.9.4 SWOT Analysis

5.10 Temperzone Ltd.

5.10.1 Company Overview

5.10.2 Role of Temperzone Ltd. in the ANZ HVAC Market

5.10.3 SWOT Analysis

5.11 Toshiba Carrier Corporation

5.11.1 Company Overview

5.11.2 Role of Toshiba Carrier Corporation in the ANZ HVAC Market

5.11.3 SWOT Analysis

5.12 United Technologies Corporation

5.12.1 Company Overview

5.12.2 Role of United Technologies Corporation in the ANZ HVAC Market

5.12.3 Financials

5.12.4 SWOT Analysis

5.13 List of Other Key Players in Australia and New Zealand HVAC Market

6.1 Report Scope

6.2 Research Methodology

6.2.1 Assumptions

6.2.2 Limitations

6.2.3 Primary Data Sources

6.2.4 Secondary Data Sources

6.2.5 Data Triangulation

6.2.6 Market Estimation and Forecast

Table 1: Significant Construction Projects across Australia and New Zealand

Table 2: Market Snapshot: ANZ HVAC Market, by Volume

Table 1.1: Impact Analysis of Drivers

Table 1.2: Improvements Implemented Under EEOB Program, Australia

Table 1.3: Supply Chain Structure, HVAC Systems, Australia & New Zealand

Table 1.4: Impact Analysis of Restraints

Table 1.5: Green Infrastructure Pipeline, 2020, Australia

Table 1.6: Technologies with Opportunities in HVAC

Table 2.1: Analyzing Threat of New Entrants

Table 2.2: Analyzing Bargaining Power of Buyers

Table 2.3: Analyzing Bargaining Power of Suppliers

Table 2.4: Analyzing the Threat from Substitutes

Table 2.5: Analyzing the Intensity of Competitive Rivalry

Table 3.1: Australia Window & Portable AC Market, $Million, 2016-2024

Table 3.2: Australia Window & Portable AC Market, Thousand Units, 2016-2024

Table 3.3: Australia Mini Split Air Conditioners Market, by Type, $Million, 2016-2024

Table 3.4: Australia Mini Split Air Conditioners Market, by Type, Thousand Units, 2016-2024

Table 3.5: Australia Ductless Systems Market, by Capacity, $Million, 2016-2024

Table 3.6: Australia Ductless Systems Market, by Capacity, Thousand Units, 2016-2024

Table 3.7: Australia Ductless Systems Market, by Ductless Type, $Million, 2016-2024

Table 3.8: Australia Ductless Systems Market, by Ductless Type, Thousand Units, 2016-2024

Table 3.9: Australia Ducted Systems Market, by Capacity, $Million, 2016-2024

Table 3.10: Australia Ducted Systems Market, by Capacity, Thousand Units, 2016-2024

Table 3.11: Australia Ducted Systems Market, by Type, $Million, 2016-2024

Table 3.12: Australia Ducted Systems Market, by Type, Thousand Units, 2016-2024

Table 3.13: Advantages and Disadvantages of Packaged Air Conditioners

Table 3.14: Australia Chillers Market, by Type, $Million, 2016-2024

Table 3.15: Australia Chillers Market, by Type, Thousand Units, 2016-2024

Table 3.16: Australia Chillers Market, by Cooling Type, $Million, 2016-2024

Table 3.17: Australia Chillers Market, by Cooling Type, Thousand Units, 2016-2024

Table 3.18: Australia Chillers Market, by Capacity, $Million, 2016-2024

Table 3.19: Australia Chillers Market, by Capacity, Thousand Units, 2016-2024

Table 3.20: Benefits of Fan Coil Units

Table 3.21: Australia FCU Market, by Type, $Million, 2016-2024

Table 3.22: Australia FCU Market, by Type, Thousand Units, 2016-2024

Table 3.23: Australia FCU Market, by Application, $Million, 2016-2024

Table 3.24: Australia FCU Market, by Application, Thousand Units, 2016-2024

Table 4.1: Difference between Windows AC and Portable AC

Table 4.2: New Zealand Window & Portable AC Market, $Million, 2016-2024

Table 4.3: New Zealand Window & Portable AC Market, Thousand Units, 2016-2024

Table 4.4: New Zealand Mini Split Air Conditioners Market, by Type, $Million, 2016-2024

Table 4.5: New Zealand Mini Split Air Conditioners Market, by Type, Thousand Units, 2016-2024

Table 4.6: New Zealand Ductless Systems Market, by Capacity, $Million, 2016-2024

Table 4.7: New Zealand Ductless Systems Market, by Capacity, Thousand Units, 2016-2024

Table 4.8: New Zealand Ductless Systems Market, by Ductless Type, $Million, 2016-2024

Table 4.9: New Zealand Ductless Systems Market, by Ductless Type, Thousand Units, 2016-2024

Table 4.10: New Zealand Ducted Systems Market, by Capacity, $Million, 2016-2024

Table 4.11: New Zealand Ductless Systems Market, by Capacity, Thousand Units, 2016-2024

Table 4.12: New Zealand Ducted Systems Market, by Ducted Type, $Million, 2016-2024

Table 4.13: New Zealand Ducted Systems Market, by Type, Thousand Units, 2016-2024

Table 4.14: Key Companies in New Zealand Providing Single Packaged Air Conditioners

Table 4.15: Key Companies in New Zealand Providing Chillers

Table 4.16: New Zealand Chillers Market, by Type, $Million, 2016-2024

Table 4.17: New Zealand Chillers Market, by Type, Thousand Units, 2016-2024

Table 4.18: New Zealand Chillers Market, by Cooling Type, $Million, 2016-2024

Table 4.19: New Zealand Chillers Market, by Cooling Type, Thousand Units, 2016-2024

Table 4.20: New Zealand Chillers Market, by Capacity, $Million, 2016-2024

Table 4.21: New Zealand Chillers Market, by Capacity, Thousand Units, 2016-2024

Table 4.22: Key Companies in New Zealand Providing AHU

Table 4.23: Key Companies in New Zealand Providing FCU

Table 4.24: New Zealand FCU Market, by Type, $Million, 2016-2024

Table 4.25: New Zealand FCU Market, by Type, Thousand Units, 2016-2024

Table 4.26: New Zealand FCU Market, by Application, $Million, 2016-2024

Table 4.27: New Zealand FCU Market, by Application, Thousand Units, 2016-2024

Table 5.1: Recent Developments (2017-2019)

Table 5.2: Daikin Industries Ltd.: Product Portfolio

Table 5.3: FUJITSU: Product Portfolio

Table 5.4: Ingersoll Rand: Product Portfolio

Table 5.5: Johnson Controls: Product Portfolio

Table 5.6: LG Electronics: Product Portfolio

Table 5.7: Mitsubishi Electric Corporation: Product Portfolio

Table 5.8: Panasonic Corporation: Product Portfolio

Table 5.9: SAMSUNG: Product Portfolio

Table 5.10: Temperzone Group: Product Portfolio

Table 5.11: Toshiba Carrier Corporation: Product Portfolio

Table 5.12: Toshiba Carrier Corporation: Recent Developments

Table 5.13: United Technologies Corporation: Product Portfolio

Figure 1: Increasing Population across Australia and New Zealand 2016-2018

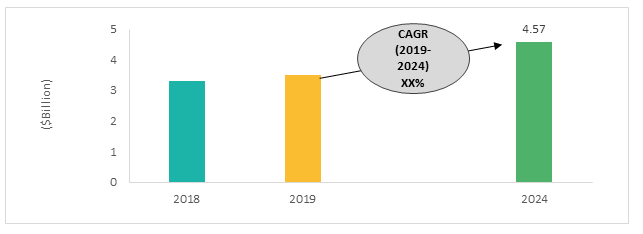

Figure 2: ANZ HVAC Market Snapshot, by Value, $Million, 2018, 2019 and 2024

Figure 3: Australia HVAC Market Share (%, by Type), 2019 and 2024

Figure 4: New Zealand HVAC Market Share (%, by Type), 2019 and 2024

Figure 1.1: Market Dynamics

Figure 1.2: Mid-tier Building Profile, Australia

Figure 1.3: Energy Consumption of an Office Building in Australia

Figure 1.4: Energy Consumption, by HVAC System Component

Figure 1.5: Indirect GHG Emissions, by Major Class

Figure 1.6: Number of Projects, Green Infrastructure, by Category, Australia, 2020

Figure 2.1: Strategies Adopted by the Key Players (January 2017-February 2020)

Figure 2.2: Share of Key Market Strategies and Developments (January 2017-February 2020)

Figure 2.3: Product Launches and Developments Share (by Company)

Figure 2.4: Mergers and Acquisitions Share (by Company)

Figure 2.5: Business Expansion and Contracts Share (by Company)

Figure 2.6: Partnerships, Collaborations, and Joint Ventures Share (by Company)

Figure 2.7: Porter’s Five Forces Analysis for the ANZ HVAC Market

Figure 2.8: Australia & New Zealand HVAC Market, Distribution Channel Analysis

Figure 3.1: Australia HVAC Market, by Product Type

Figure 3.2: Australia HVAC Market, by Product Type, $Million, 2019 and 2024

Figure 3.3: Australia HVAC Market, by Product Type, Thousand Units, 2019 and 2024

Figure 3.4: Australia Window & Portable AC Market, by Value, 2019

Figure 3.5: Australia Mini Split Systems, by Value, 2019

Figure 3.6: Australia Mini Split Systems, by Volume, 2019

Figure 3.7: Australia Single Packaged Air Conditioners Market, $Million, 2016-2024

Figure 3.8: Australia Single Packaged Air Conditioners Market, Thousand Units, 2016-2024

Figure 3.9: Australia AHU Market, by Value, 2016-2024

Figure 3.10: Australia AHU Market, by Volume, 2016-2024

Figure 3.11: Australia FCU Market, by Value, 2016-2024

Figure 3.12: Australia FCU Market, by Volume, 2016-2024

Figure 4.1: New Zealand HVAC Market (by Product Type)

Figure 4.2: New Zealand HVAC Market, by Product Type, $Million, 2019 and 2024

Figure 4.3: New Zealand HVAC Market, by Product Type, Thousand Units, 2019 and 2024

Figure 4.4: New Zealand Windows and Portable AC Market, by Value, 2019

Figure 4.5: Advantages and Disadvantages of Multi Split Air Conditioners

Figure 4.6: Type of Multi Split Air Conditioners

Figure 4.7: New Zealand Mini Split Systems (by Type) by Value, 2019

Figure 4.8: New Zealand Mini Split Systems (by Type), by Volume, 2019

Figure 4.9: New Zealand Single Packaged Air Conditioners Market, by Value, 2016-2024

Figure 4.10: New Zealand Single Packaged Air Conditioners Market, by Value, 2016-2024

Figure 4.11: New Zealand AHU Market, by Value, 2016-2024

Figure 4.12: New Zealand AHU Market, by Volume, 2016-2024

Figure 4.13: New Zealand FCU Market, by Value, 2016-2024

Figure 4.14: New Zealand FCU Market, by Volume, 2016-2024

Figure 5.1: Actron Engineering Pty Ltd.: Product Category

Figure 5.2: Actron Engineering Pty Ltd.: SWOT Analysis

Figure 5.3: Daikin Industries Ltd.: Overall Financials, 2017-2019

Figure 5.4: Daikin Industries Ltd.: Net Revenue by Regional Segment, 2017-2019

Figure 5.5: Daikin Industries Ltd.: Net Revenue by Business Segment, 2016-2018

Figure 5.6: Daikin Industries: SWOT Analysis

Figure 5.7: FUJITSU: Overall Financials, 2016-2018

Figure 5.8: FUJITSU: Net Revenue by Operating Segment 2016-2018

Figure 5.9: FUJITSU: Net Revenue by Regional Segment 2016-2018

Figure 5.10: FUJITSU: SWOT Analysis

Figure 5.11: Ingersoll Rand: Overall Financials, 2016-2018

Figure 5.12: Ingersoll Rand: Net Revenue by Business Segment, 2016-2018

Figure 5.13: Ingersoll Rand: Net Revenue by Regional Segment, 2016-2017

Figure 5.14: Ingersoll Rand: Net Revenue by Regional Segment, 2018

Figure 5.15: Ingersoll Rand: SWOT Analysis

Figure 5.16: Johnson Controls: Overall Financials, 2017-2019

Figure 5.17: Johnson Control: Net Revenue by Business Segment, 2017-2019

Figure 5.18: Johnson Controls: Net Revenue by Regional Segment, 2017-2019

Figure 5.19: Johnson Controls: SWOT Analysis

Figure 5.20: LG Electronics: Overall Financials, 2017-2019

Figure 5.21: LG Electronics: Net Revenue by Business Segment, 2017-2019

Figure 5.22: LG Electronics: SWOT Analysis

Figure 5.23: Mitsubishi Electric Corporation: Overall Financials, 2017-2019

Figure 5.24: Mitsubishi Electric Corporation: Net Revenue (by Region), 2017-2019

Figure 5.25: Mitsubishi Electric Corporation: Net Revenue (by Business Segment), 2017-2019

Figure 5.26: Mitsubishi Electric Corporation: SWOT Analysis

Figure 5.27: Panasonic Corporation: Overall Financials, 2017-2019

Figure 5.28: Panasonic Corporation: Net Revenue (by Region), 2017-2019

Figure 5.29: Panasonic Corporation: Net Revenue (by Business Segment), 2017-2019

Figure 5.30: Panasonic Corporation: SWOT Analysis

Figure 5.31: SAMSUNG: Product Portfolio

Figure 5.32: SAMSUNG: Overall Financials, 2017-2019

Figure 5.33: SAMSUNG: Net Revenue by Business Segment, 2017-2019

Figure 5.34: SAMSUNG: Net Revenue by Regional Segment, 2017-2019

Figure 5.35: SAMSUNG: SWOT Analysis

Figure 5.36: Temperzone Group: SWOT Analysis

Figure 5.37: Toshiba Carrier Corporation: SWOT Analysis

Figure 5.38: United Technologies Corporation: Overall Financials, 2016-2018

Figure 5.39: United Technologies Corporation: Net Revenue by Business Segment, 2016-2018

Figure 5.40: United Technologies Corporation: Net Revenue by Regional Segment, 2016-2018

Figure 5.41: United Technologies Corporation: SWOT Analysis

Figure 6.1: ANZ HVAC Market Scope

Figure 6.2: Report Methodology

Figure 6.3: Primary Interviews Breakdown (by Company, Designation, and Country)

Figure 6.4: Sources of Secondary Research

Figure 6.5: Data Triangulation

Figure 6.6: Top Down-Bottom-Up Approach for Market Estimation

Key Questions Answered in the Report

Key Questions Answered in the Report:

• What is the Australia and New Zealand HVAC market size in terms of value and volume, and what is the expected growth rate during the forecast period 2019-2024?

• What is the expected growth and market size for Australia and New Zealand HVAC market based on different types of HVAC systems?

• What are the major driving forces that are expected to increase the demand for the Australia and New Zealand HVAC market during the forecast period?

• What is the market size (value and volume) of windows and portable air conditioners across Australia and New Zealand?

• What is the market size (value and volume) of mini split air conditioners across Australia and New Zealand?

• What is the market size (value and volume) of single packaged air conditioners across Australia and New Zealand?

• What is the market size (value and volume) of chillers across Australia and New Zealand?

• What is the market size (value and volume) of air-handling units across Australia and New Zealand?

• What is the market size (value and volume) of fan coil unit across Australia and New Zealand?

• What is the market size (value) of different types of fan coil unit across Australia and New Zealand?

• What is the market size (value) of fan coil unit, by end-user segments across Australia and New Zealand?

• What are the key trends and opportunities in the market pertaining to Australia and New Zealand HVAC industry?

• What are the major challenges inhibiting the growth of the Australia and New Zealand HVAC market?

• What is the competitive strength of the key players in the Australia and New Zealand HVAC market on the basis of analysis of their recent developments, product offerings, and regional presence?

Report Description

Scope of the Australia and New Zealand HVAC Market

The Australia and New Zealand HVAC market research provides a detailed perspective regarding the type of HVAC systems installed and used across Australia and New Zealand, and its estimation, among others. The purpose of this market analysis is to examine the Australia and New Zealand HVAC industry outlook in terms of factors driving the market, trends, developments, and distribution channel analysis, among others.

The report further takes into consideration the market dynamics and the competitive landscape along with the detailed financial and product contributions of the key players operating in the market. The Australia and New Zealand HVAC study is a compilation of the analysis of different type of HVAC systems used across Australia and New Zealand.

Australia and New Zealand HVAC Market Segmentation

The Australia and New Zealand HVAC market (on the basis of type) has been segmented into windows and portable air conditioners, mini split air conditioners, chillers, single packaged air conditioners, air handling unit and fan coil units. Mini split air conditioners dominated the Australia and New Zealand HVAC market in 2018 and is anticipated to maintain its dominance throughout the forecast period (2019-2024).

Key Companies in the Australia and New Zealand HVAC Industry

The key market players in the Australia and New Zealand HVAC market include Daikin Industries, LG Australia, Fujitsu General Australia Carrier Transicold Australia, Temperzone Ltd., ActronAir, Panasonic, Samsung, Toshiba and Hitachi.

Market Overview

Australia and New Zealand HVAC Market Forecast, 2019-2024

Figure: Australia and New Zealand HVAC Market Snapshot

Source: Secondary Research, Expert Interviews, and BIS Research Analysis

The Australia and New Zealand HVAC Market − Analysis and Forecast by BIS Research projects the market size is expected to reach $4.57 billion by 2024. Government regulations and standards are supporting the overall growth and development of the Australia and New Zealand HVAC market. The consumers are directly benefited from these regulations as these devices save electrical energy and cut down cost considerably. At present, government initiatives are focused toward launching new construction projects, supporting new installments, and promoting HVAC equipment using renewable energy.

Expert Quote

"The HVAC industry is one of the major contributors to the economy of both Australia and New Zealand. Industries such as agriculture, telecommunications and health sectors are the largest end users of HVAC systems. The air conditioning solutions have also penetrated the residential sector across the country owing to a rising demand for products such as window and portable air conditioners.”

Australia and New Zealand HVAC Market – Analysis and Forecast, 2019-2024

Focus on Product Type (Windows & Portable, Mini Split, Single Packaged, Chillers, AHU, FCU, Others), and Country Analysis