A quick peek into the report

Table of Contents

1.1 Market Drivers

1.1.1 Increasing Space Budgets by Various Countries

1.1.2 Rising Demand for Small Satellites

1.1.3 Emergence of New Space Agencies

1.2 Market Challenges

1.2.1 High Cost Associated With Deep Space Exploration Systems

1.3 Market Opportunities

1.3.1 Huge Investments by Private Space Companies

1.3.2 Space Drones for Deep Space Exploration Missions

2.1 Key Strategies and Developments

2.1.1 Partnerships, Agreements, Collaborations, and Contracts

2.1.2 New Product Launch and Development

2.1.3 Acquisitions

2.1.4 Other Developments

2.2 Competitive Benchmarking

3.1 Overview

3.2 Global Deep Space Exploration Roadmap

3.3 Space Exploration Programs

3.4 Profiles of Leading Space Agencies

3.4.1 NASA

3.4.2 European Space Agency

3.4.3 China National Space Administration (CNSA)

3.4.4 Indian Space Research Organization (ISRO)

3.4.5 Japan Aerospace Exploration Agency (JAXA)

3.4.6 ROSCOSMOS (Russia State Space Corporation)

3.5 Government Funding Scenario

3.6 Value Chain Analysis

3.7 Technology Trends

3.7.1 Artificial Intelligence

3.7.2 Solar Electric Propulsion (SEP)

3.7.3 Station Explorer for X-Ray Timing and Navigation Technology (SEXTANT)

3.7.4 Global Exploration Roadmap: Critical Technologies

3.8 Patent Analysis

4.1 Assumptions and Limitations

4.2 Market Overview

5.1 Market Overview

5.2 Rockets

5.3 Landers

5.4 Robots

5.5 Satellites

5.6 Orbiters

6.1 Market Overview

6.2 Moon Exploration

6.3 Transportation

6.4 Orbital Infrastructure

6.5 Mars Exploration

6.6 Others

7.1 Market Overview

7.2 Propulsion system

7.2.1 Propulsion System (by Type)

7.2.1.1 Solid

7.2.1.2 Liquid

7.2.1.3 Electric

7.2.1.4 Hybrid

7.3 Navigation and Guidance System

7.4 Command and Control System

7.5 Others

8.1 Market Overview

8.2 Crewed Missions

8.3 Uncrewed Missions

8.4 Combination Missions

9.1 Market Overview

9.2 Government Space Agencies

9.3 Commercial

10.1 Market Overview

10.2 North America

10.2.1 North America Deep Space Exploration and Technology Market (By Subsystem)

10.2.1.1 North America Deep Space Exploration and Technology Market for Propulsion System (by Type)

10.2.2 North America Deep Space Exploration and Technology Market (by Technology Mode)

10.2.3 North America Deep Space Exploration and Technology Market (by Mission Type)

10.2.4 North America Deep Space Exploration and Technology Market (by Application)

10.2.5 North America Deep Space Exploration and Technology Market (by End user)

10.2.6 North America Deep Space Exploration and Technology Market (by Country)

10.2.6.1 U.S.

10.2.6.2 Canada

10.3 Europe

10.3.1 Europe Deep Space Exploration and Technology Market Size (by Subsystem)

10.3.1.1 Europe Deep Space Exploration and Technology Market for Propulsion system (by Type)

10.3.2 Europe Deep Space Exploration and Technology Market (by Technology Mode)

10.3.3 Europe Deep Space Exploration and Technology Market (by Mission Type)

10.3.4 Europe Deep Space Exploration and Technology Market (by Application)

10.3.5 Europe Deep Space Exploration and Technology Market (by End User)

10.3.6 Europe Deep Space Exploration and Technology Market (by Country)

10.3.6.1 The U.K.

10.3.6.2 Germany

10.3.6.3 France

10.3.6.4 Russia

10.3.6.5 Rest-of-Europe

10.4 Asia-Pacific

10.4.1 Asia-Pacific Deep Space Exploration and Technology Market (by Subsystem)

10.4.1.1 Asia-Pacific Deep Space Exploration and Technology Market for Propulsion System (by Type)

10.4.2 Asia-Pacific Deep Space Exploration and Technology Market (by Technology Mode)

10.4.3 Asia-Pacific Deep Space Exploration and Technology Market (by Mission Type)

10.4.4 Asia-Pacific Deep Space Exploration and Technology Market (by Application)

10.4.5 Asia-Pacific Deep Space Exploration and Technology Market (by End User)

10.4.6 Asia-Pacific Deep Space Exploration and Technology Market (by Country)

10.4.6.1 China

10.4.6.2 Japan

10.4.6.3 India

10.4.6.4 Rest-of-Asia-Pacific

10.5 Rest-of-the-World

10.5.1 Rest-of-the-World Deep Space Exploration and Technology Market (by Subsystem)

10.5.1.1 Rest-of-the-World Deep Space Exploration and Technology Market for Propulsion System (By Type)

10.5.2 Rest-of-the-World Deep Space Exploration and Technology Market (by Technology Mode)

10.5.3 Rest-of-the-World Deep Space Exploration and Technology Market (By Mission Type)

10.5.4 Rest-of-the-World Deep Space Exploration and Technology Market (by Application)

10.5.5 Rest-of-Asia-Pacific Deep Space Exploration and Technology Market (By End User)

10.5.6 Rest-of-the-World Deep Space Exploration and Technology market (by Region)

10.5.6.1 Latin America

10.5.6.2 Middle East

10.5.6.3 Africa

11.1 Airbus S.A.S

11.1.1 Company Overview

11.1.2 Role of Airbus S.A.S in Global Deep Space Exploration and technology Market

11.1.3 Financials

11.1.4 SWOT Analysis

11.2 Astrobotic

11.2.1 Company Overview

11.2.2 Role of Astrobotic in Global Deep Space Exploration and Technology Market

11.2.3 SWOT Analysis

11.3 Axiom Space

11.3.1 Company Overview

11.3.2 Role of Axiom Space in Global Deep Space Exploration and Technology Market

11.3.3 SWOT Analysis

11.4 Bradford

11.4.1 Company Overview

11.4.2 Role of Bradford in Global Deep Space Exploration and Technology Market

11.4.3 SWOT Analysis

11.5 Blue Origin

11.5.1 Company Overview

11.5.2 Product Portfolio

11.5.3 Role of Blue Origin in Global Deep Space Exploration and Technology Market

11.5.4 SWOT Analysis

11.6 Lockheed Martin Corporation

11.6.1 Company Overview

11.6.2 Role of Lockheed Martin Corporation in Global Deep Space Exploration and Technology Market

11.6.3 Financials

11.6.4 SWOT Analysis

11.7 Masten Space Systems

11.7.1 Company Overview

11.7.2 Role of Masten Space Systems in Global Deep Space Exploration and Technology Market

11.7.3 SWOT Analysis

11.8 MAXAR Technologies Inc.

11.8.1 Company Overview

11.8.2 Role of MAXAR Technologies in Global Deep Space Exploration and Technology Market

11.8.3 Financials

11.8.4 SWOT Analysis

11.9 Nanoracks LLC

11.9.1 Company Overview

11.9.2 Role of Nanoracks LLC in Global Deep Space Exploration and Technology Market

11.9.3 SWOT Analysis

11.10 Northrop Grumman Corporation

11.10.1 Company Overview

11.10.2 Role of Northrop Grumman Corporation in Global Deep Space Exploration and Technology Market

11.10.3 Financials

11.10.4 SWOT Analysis

11.11 Planetary Resources

11.11.1 Company Overview

11.11.2 Role of Planetary Resources in Global Deep Space Exploration and Technology Market

11.11.3 SWOT Analysis

11.12 Sierra Nevada Corporation

11.12.1 Company Overview

11.12.2 Role of Sierra Nevada Corporation in Global Deep Space Exploration and Technology Market

11.12.3 SWOT Analysis

11.13 Space Exploration Technologies Corp. (SpaceX)

11.13.1 Company Overview

11.13.2 Role of SpaceX in Global Deep Space Exploration and Technology Market

11.13.3 SWOT Analysis

11.14 Thales Group

11.14.1 Company Overview

11.14.2 Role of Thales Group in Global Deep Space Exploration and Technology Market

11.14.3 Financials

11.14.4 SWOT Analysis

11.15 The Boeing Company

11.15.1 Company Overview

11.15.2 Role of The Boeing Company in Global Deep Space Exploration and Technology Market

11.15.3 Financials

11.15.4 SWOT Analysis

12.1 Scope of the Report

12.2 Global Deep Space Exploration and Technology Market Research Methodology

12.3 Assumptions and Limitations

13.1 Related Reports

Table 1.1: Human Space Exploration Program Baselines and Current Plans ($Billion)

Table 3.1: Upcoming Space Missions

Table 3.2: NASA Centers and Facilities

Table 3.3: Space Products by CNSA

Table 3.4: ISRO Space Missions

Table 3.5: Russia Space Launch Programs

Table 3.6: U.S. President’s FY2020 Budget Amendment for NASA

Table 3.7: Value Chain Analysis -Space Market Segments

Table 3.8: Global Exploration Roadmap: Critical Technologies

Table 3.9: Patent Analysis

Table 6.1: Future Lunar Exploration Missions

Table 6.2: Future Mars Robotic Missions

Table 10.1: Global Deep Space Exploration and Technology Market (by Region), $Million, 2020-2030

Table 10.2: North America Deep Space Exploration and Technology Market (By Subsystem), $Billion, 2020-2030

Table 10.3: North America Deep Space Exploration and Technology Market for Propulsion System (by Type), $Million, 2020-2030

Table 10.4: North America Deep Space Exploration and Technology Market (by Technology Mode), $Billion, 2020-2030

Table 10.5: North America Deep Space Exploration and Technology Market (by Technology Mode), $Billion, 2020-2030

Table 10.6: North America Deep Space Exploration and Technology Market (by Application), $Billion, 2020-2030

Table 10.7: North America Deep Space Exploration and Technology Market (by End user), $Billion, 2020-2030

Table 10.8: Europe Deep Space Exploration and Technology Market (by Subsystem), $Million, 2020-2030

Table 10.9: Europe Deep Space Exploration and Technology Market for Propulsion System (by Type), $Million, 2020-2030

Table 10.10: Europe Deep Space Exploration and Technology Market (by technology mode), $Million, 2020-2030

Table 10.11: Europe Deep Space Exploration and Technology Market (by Mission Type), $Million, 2020-2030

Table 10.12: Europe Deep Space Exploration and Technology Market (by Application), $Million, 2020-2030

Table 10.13: Europe Deep Space Exploration and Technology Market (by End User), $Million, 2020-2030

Table 10.14: Asia-Pacific Deep Space Exploration and Technology Market (by Subsystem), $Million, 2020-2030

Table 10.15: Asia-Pacific Deep Space Exploration and Technology Market for Propulsion System (by Type), $Million, 2020-2030

Table 10.16: Asia-Pacific Deep Space Exploration and Technology Market (by Technology Mode), $Million, 2020-2030

Table 10.17: Asia-Pacific Deep Space Exploration and Technology Market (by Mission Type), $Million, 2020-2030

Table 10.18: Asia-Pacific Deep Space Exploration and Technology Market (by Application), $Million, 2020-2030

Table 10.19: Asia-Pacific Deep Space Exploration and Technology Market (By End User), $Million, 2020-2030

Table 10.20: Rest-of-the-World Deep Space Exploration and Technology Market (by Subsystem), $Million, 2020-2030

Table 10.21: Rest-of-the-World Deep Space Exploration and Technology Market for Propulsion System (by Type), $Million, 2020-2030

Table 10.22: Rest-of-the-World Deep Space Exploration and Technology Market (by Technology Mode), $Million 2020-2030

Table 10.23: Rest-of-the-World Deep Space Exploration and Technology Market (By Mission Type), $Million, 2020-2030

Table 10.24: Rest-of-the-World Deep Space Exploration and Technology Market (by Application), $Million, 2020-2030

Table 10.25: Rest-of-Asia-Pacific Deep Space Exploration and Technology Market (By End User), $Million, 2020-2030

Figure 1.1: Market Dynamics Snapshot

Figure 1.2: Global Leading Space Agencies (by Government Space Budget), 2018

Figure 2.1: Key Strategies Adopted by Market Players

Figure 2.2: Percentage Share of Strategies Adopted by Market Players, January 2017- January 2020

Figure 2.3: Partnerships, Agreements, and Contracts by Key Market Players, Jan 2017- Jan 2020

Figure 2.4: New Product Launch and Development, Jan 2017- Jan 2020

Figure 2.5: Acquisitions by Key Market Players, Jan 2017- Jan2020

Figure 2.6: Other Developments

Figure 2.7: Competitive Benchmarking Analysis

Figure 3.1: Industry Insights

Figure 3.2: Global Deep Space Exploration Roadmap

Figure 3.3: International Space Exploration Coordination Group (ISECG) Mission Scenario (2020-2030)

Figure 3.4: European Drivers for Space Exploration

Figure 3.5: Global Leading Space Agencies (by Government Space Budget), 2018

Figure 3.6: Value Chain Analysis

Figure 4.1: Global Deep Space Exploration and Technology Market, 2020-2030

Figure 5.1: Classification of the Global Deep Space Exploration and Technology Market (by Technology Mode)

Figure 5.2: Global Deep Space Exploration and Technology Market (by Technology Mode), $Billion, 2020-2030

Figure 6.1: Classification of the Global Deep Space Exploration and Technology Market (by Application)

Figure 6.2: Global Deep Space Exploration and Technology Market (by Application), $Billion, 2020-2030

Figure 7.1: Classification of the Global Deep Space Exploration and Technology Market (by Subsystem)

Figure 7.2: Global Deep Space Exploration and Technology Market (by Subsystem), $Billion, 2020-2030

Figure 7.3: Global Deep Space Exploration and Technology Market for Propulsion System (by Type), $Billion, 2020-2030

Figure 8.1: Classification of the Global Deep Space Exploration and Technology Market (by Mission Type)

Figure 8.2: Global Deep Space Exploration and Technology Market (by Mission Type), $Billion, 2020-2030

Figure 9.1: Classification of the Global Deep Space Exploration and Technology Market (by End User)

Figure 9.2: Global Deep Space Exploration and Technology Market (by End User), $Billion, 2020-2030

Figure 10.1: Classification of Deep Space Exploration and Technology Market (by Region)

Figure 10.2: The U.S. Deep Space Exploration Market, $Billion, 2020-2030

Figure 10.3: Canada Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.4: The U.K. Deep Space Exploration and Technology, $Million, 2020-2030

Figure 10.5: Germany Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.6: France Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.7: Russia Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.8: Rest-of-Europe Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.9: China Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.10: Japan Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.11: India Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.12: Rest-of-Asia-Pacific Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.13: Latin America Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.14: Middle East Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 10.15: Africa Deep Space Exploration and Technology Market, $Million, 2020-2030

Figure 11.1: Airbus Defense and Space - Product Offerings

Figure 11.2: Airbus S.A.S – Financials, 2016-2018

Figure 11.3: Airbus S.A.S – Business Revenue Mix, 2016-2018

Figure 11.4: Airbus S.A.S – Region Revenue Mix, 2016-2018

Figure 11.5: Airbus S.A.S: R&D Expenditure, 2016-2018

Figure 11.6: SWOT Analysis - Airbus S.A.S

Figure 11.7: Astrobotic - Product Offerings

Figure 11.8: SWOT Analysis - Astrobotic

Figure 11.9: Axiom Space – Product Offerings

Figure 11.10: SWOT Analysis – Axiom Space

Figure 11.11: Bradford – Product Offerings

Figure 11.12: SWOT Analysis – Bradford

Figure 11.13: Blue Origin -- Product Offerings

Figure 11.14: Blue Origin -- SWOT Analysis

Figure 11.15: Lockheed Martin Corporation – Product Offerings

Figure 11.16: Lockheed Martin Corporation - Financials, 2016-2018

Figure 11.17: Lockheed Martin Corporation - Business Revenue Mix, 2016-2018

Figure 11.18: Lockheed Martin Corporation - Region Revenue Mix, 2016-2018

Figure 11.19: Lockheed Martin Corporation - Research and Development Expenditure, 2016-2018

Figure 11.20: SWOT Analysis – Lockheed Martin Corporation

Figure 11.21: Masten Space Systems – Product Offerings

Figure 11.22: SWOT Analysis – Masten Space Systems

Figure 11.23: MAXAR Technologies: Product Portfolio

Figure 11.24: MAXAR Technologies–Financials, 2016-2018

Figure 11.25: MAXAR Technologies –Business Revenue Mix, 2016-2018

Figure 11.26: MAXAR Technologies –Region Revenue Mix, 2016-2018

Figure 11.27: MAXAR Technologies – Research and Development Expenditure, 2016-2018

Figure 11.28: MAXAR Technologies - SWOT Analysis

Figure 11.29: Nanoracks LLC – Product Offerings

Figure 11.30: SWOT Analysis – Nanoracks LLC

Figure 11.31: Northrop Grumman Corporation: Product Offerings

Figure 11.32: Northrop Grumman Corporation - Financials, 2016-2018

Figure 11.33: Northrop Grumman Corporation - Business Revenue Mix, 2016-2018

Figure 11.34: Northrop Grumman Corporation - Region Revenue Mix, 2016-2018

Figure 11.35: Northrop Grumman Corporation – Research and Development Expenditure, 2016-2018

Figure 11.36: SWOT Analysis – Northrop Grumman Corporation

Figure 11.37: Planetary Resources -- SWOT Analysis

Figure 11.38: Sierra Nevada Corporation – Product Offerings

Figure 11.39: SWOT Analysis – Sierra Nevada Corporation

Figure 11.40: SpaceX - Product Offerings

Figure 11.41: SpaceX - SWOT Analysis

Figure 11.42: Thales Group – Product Offerings

Figure 11.43: Thales Group - Financials, 2016-2018

Figure 11.44: Thales Group - Business Revenue Mix, 2016-2018

Figure 11.45: Thales Group - Region Revenue Mix, 2016-2018

Figure 11.46: Thales Group – Research and Development Expenditure, 2016-2018

Figure 11.47: SWOT Analysis – Thales Group

Figure 11.48: The Boeing Company – Product Offerings

Figure 11.49: The Boeing Company - Financials, 2016-2018

Figure 11.50: The Boeing Company - Business Revenue Mix, 2016-2018

Figure 11.51: The Boeing Company - Region Revenue Mix, 2016-2018

Figure 11.52: The Boeing Company – Research and Development Expenditure, 2016-2018

Figure 11.53: SWOT Analysis – The Boeing Company

Figure 12.1: Global Deep Space Exploration and Technology Market Segmentation

Figure 12.2: Global Deep Space Exploration and Technology Market Research Methodology

Figure 12.3: Data Triangulation

Figure 12.4: Top-Down and Bottom-Up Approach

Figure 12.5: Deep Space Exploration and Technology Market Influencing Factors:

Figure 12.6: Assumptions and Limitations

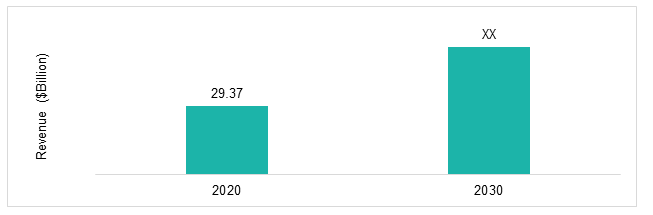

Market Overview

Global Deep Space Exploration and Technology Market Forecast, 2020-2030

The Global Deep Space Exploration and Technology Market report by BIS Research projects the market to grow at a CAGR of 6.42% on the basis of value during the forecast period from 2020 to 2030. North America is expected to dominate the global deep space exploration and technology market with an estimated share of 62.45% in 2020. North America, including major countries such as the U.S., is the most prominent region for the deep space exploration and technology market. In North America, the U.S. is estimated to account for a major market share in 2020 due to the rising number of space exploration missions led by the country.

The global deep space exploration and technology market is gaining widespread importance owing to increasing efforts from the national space agencies as well as their increasing investment for deep space exploration missions. Development of technologies such as AI and emergence of private entities in the space sector are some of the factors that may propel the market growth.

Expert Quote

“The rising demand for global deep space exploration technologies, namely artificial intelligence, solar electric propulsion, navigation, and guidance technology, for supporting deep space missions is forcing the key stakeholders to develop products with advanced technologies. Moreover, the continuous efforts of the space agencies as well as the leading space companies is expected to drive the market.”

Key Questions Answered in this Report

• What are the major forces that tend to increase the demand for the global deep space exploration and technology during the forecast period, 2020-2030?

• What are the major challenges inhibiting the growth of the global deep space exploration and technology market?

• Which are the key players in the global deep space exploration and technology market?

• What is the estimated revenue generated by the global deep space exploration and technology market by segments (subsystem, technology mode, application, mission type, and end user) in 2020, and what are the estimates for the time period 2020-2030?

• What are the industry trends in the global deep space exploration and technology market?

• How is the industry expected to evolve during the forecast period 2020-2030?

• What are the new strategies adopted by the existing market players to catalyze deep space exploration?

• What are the major opportunities that the deep space exploration and technology stakeholders foresee?

Report Description

Scope of the Global Deep Space Exploration and Technology Market

The purpose of the market analysis is to examine the deep space exploration and technology market outlook in terms of factors driving the market, trends, technological developments, and competitive benchmarking, among others.

The report further takes into consideration the market dynamics and the competitive landscape along with the detailed financial and product contribution of the key players operating in the market.

Market Segmentation

The deep space exploration and technology market is further segmented on the basis of technology mode, application, subsystem, mission type, end user, and region. While highlighting the key driving and restraining forces for this market, the report also provides a detailed study of the industry. The report also analyzes different applications that include moon exploration, transportation, orbital infrastructure, mars exploration, and others (asteroid missions). In the technology mode segment, the market is segmented into rockets, landers, robots, satellites and, orbiters. In the subsystem segment, the market is segmented into propulsion system, navigation and guidance system, and command and control system.

The deep space exploration and technology market is segregated by region under four major regions, namely North America, Europe, APAC, and Rest-of-the-World. Data for each of these regions (by country) is provided in the market study.

Key Companies in the Global Deep Space Exploration and Technology Market

The key market players in the global deep space exploration and technology market include Airbus Defence & Space, Lockheed Martin, The Boeing Company, Northrop Grumman, Thales Alenia Space, MAXAR Technologies, Sierra Nevada Corporation, SpaceX, Astrobotic, and Blue Origin, among others.

Global Deep Space Exploration and Technology Market - Analysis and Forecast, 2020-2030

Focus on Subsystem, Technology Mode, Mission Type, Application, And End User