A quick peek into the report

Table of Contents

1.1 Inclusion and Exclusion

2.1 Scope of Work

2.2 Key Questions Answered in the Report

3.1 Global DNA Methylation Market: Research Methodology

3.2 Data Sources

3.3 Secondary Data Sources

3.4 Market Estimation Model

3.5 Criteria for Company Profiling

4.1 Market Definition

4.2 DNA Methylation: Impact on Human Health

4.3 Market Size and Growth Potential, $Million, 2019-2030

4.4 Future Potential

4.5 COVID-19 Impact on the Global DNA Methylation Market

5.1 Overview

5.2 Legal Requirements and Framework in the U.S.

5.3 Legal Requirements and Framework in Europe

5.4 Legal Requirements and Framework in Asia-Pacific

5.4.1 China

5.4.2 Japan

6.1 Overview

6.2 Iceberg Analysis

6.3 Impact Analysis

6.4 Market Drivers

6.4.1 Global Increase in Cancer Prevalence

6.4.2 Increasing Government Funding for Healthcare

6.4.3 Declining Costs and Increasing Output of Sequencing

6.5 Market Restraints

6.5.1 High Cost of Instrument

6.5.2 Lack of High-Complexity Testing Centers and Skilled Professionals in High-Growth Regions

6.5.3 Low Adoption in Diagnostic Applications

6.6 Market Opportunities

6.6.1 Growing Trend of Methylome Sequencing for Precision Medicine

6.6.2 Advancing Technological Developments for Methylome Sequencing

6.6.3 Growth in Non-Oncology Applications of DNA Methylation

7.1 Product Launches and Upgrades

7.2 Synergistic Activities

7.3 Acquisitions

7.4 Product Approvals, Business Expansion, and Other Activities

7.5 Market Share Analysis, 2018-2019

7.6 Growth Share Analysis

7.6.1 Growth Share Analysis (by Company)

7.6.2 Growth Share Analysis (by Technology)

7.6.3 Growth Share Analysis (by Application)

8.1 Overview

8.2 Consumables

8.3 Instruments

8.4 Software

9.1 Overview

9.2 Polymerase Chain Reaction (PCR)

9.3 Sequencing

9.3.1 Next-Generation Sequencing (NGS)

9.3.2 Traditional Sequencing

9.4 Microarray

9.5 Other Technologies

10.1 Overview

10.2 Clinical Applications

10.3 Translational Research

10.3.1 Oncology Research

10.3.2 Non-Oncology Research

10.3.3 Other Research Applications

11.1 Overview

11.2 Pharmaceutical and Biotechnology Companies

11.3 Research and Academic Institutions

11.4 Contract Research Organizations

11.5 Other End Users

12.1 Overview

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 North America DNA Methylation Market (by Translational Research), 2019-2030

12.3 Europe

12.3.1 Germany

12.3.2 U.K.

12.3.3 France

12.3.4 Italy

12.3.5 Spain

12.3.6 Rest-of-Europe

12.3.7 Europe DNA Methylation Market (by Translational Research), 2019-2030

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 South Korea

12.4.5 Australia

12.4.6 Rest-of-APAC

12.4.7 Asia-Pacific DNA Methylation Market (by Translational Research), 2019-2030

12.5 Latin America

12.5.1 Brazil

12.5.2 Mexico

12.5.3 Rest-of-Latin America

12.5.4 Latin America DNA Methylation Market (by Translational Research), 2019-2030

12.6 Rest-of-the-World

13.1 Overview

13.2 Abcam plc

13.2.1 Company Overview

13.2.2 Role of Abcam plc in the Global DNA Methylation Market

13.2.3 Financials

13.2.4 Key Insights About Financial Health of the Company

13.2.5 SWOT Analysis

13.3 Active Motif, Inc.

13.3.1 Company Overview

13.3.2 Role of Active Motif, Inc. in the Global DNA Methylation Market

13.3.3 SWOT Analysis

13.4 Agilent Technologies, Inc.

13.4.1 Company Overview

13.4.2 Role of Agilent Technologies, Inc. in the Global DNA Methylation Market

13.4.3 Financials

13.4.4 Key Insights About Financial Health of the Company

13.4.5 SWOT Analysis

13.5 Bio-Rad Laboratories, Inc.

13.5.1 Company Overview

13.5.2 Role of Bio-Rad Laboratories, Inc. in the Global DNA Methylation Market

13.5.3 Financials

13.5.4 Key Insights About Financial Health of the Company

13.5.5 SWOT Analysis

13.6 Diagenode Diagnostics S.A.

13.6.1 Company Overview

13.6.2 Role of Diagenode Diagnostics S.A. in the Global DNA Methylation Market

13.6.3 SWOT Analysis

13.7 EpiGentek Group Inc.

13.7.1 Company Overview

13.7.2 Role of EpiGentek Group Inc. in the Global DNA Methylation Market

13.7.3 SWOT Analysis

13.8 Exact Sciences Corporation

13.8.1 Company Overview

13.8.2 Role of Exact Sciences Corporation in the Global DNA Methylation Market

13.8.3 Financials

13.8.4 Key Insights About Financial Health of the Company

13.8.5 SWOT Analysis

13.9 F. Hoffmann-La Roche Ltd.

13.9.1 Company Overview

13.9.2 Role of F. Hoffmann-La Roche Ltd in the Global DNA Methylation Market

13.9.3 Financials

13.9.4 Key Insights About Financial Health of the Company

13.9.5 SWOT Analysis

13.10 Illumina, Inc.

13.10.1 Company Overview

13.10.2 Role of Illumina, Inc. in the Global DNA Methylation Market

13.10.3 Financials

13.10.4 Key Insights About Financial Health of the Company

13.10.5 SWOT Analysis

13.11 Merck KGaA

13.11.1 Company Overview

13.11.2 Role of Merck KGaA in the Global DNA Methylation Market

13.11.3 Financials

13.11.4 Key Insights About Financial Health of the Company

13.11.5 SWOT Analysis

13.12 New England Biolabs, Inc.

13.12.1 Company Overview

13.12.2 Role of New England Biolabs, Inc. in the Global DNA Methylation Market

13.12.3 SWOT Analysis

13.13 Pacific Biosciences of California, Inc.

13.13.1 Company Overview

13.13.2 Role of Pacific Biosciences of California, Inc. in the Global DNA Methylation Market

13.13.3 Financials

13.13.4 Key Insights About Financial Health of the Company

13.13.5 SWOT Analysis

13.14 PerkinElmer, Inc.

13.14.1 Company Overview

13.14.2 Role of PerkinElmer, Inc. in the Global DNA Methylation Market

13.14.3 Financials

13.14.4 Key Insights About Financial Health of the Company

13.14.5 SWOT Analysis

13.15 QIAGEN N.V.*

13.15.1 Company Overview

13.15.2 Role of QIAGEN N.V. in the Global DNA Methylation Market

13.15.3 Financials

13.15.4 Key Insights About Financial Health of the Company

13.15.5 SWOT Analysis

13.16 Thermo Fisher Scientific Inc.

13.16.1 Company Overview

13.16.2 Role of Thermo Fisher Scientific Inc. in the Global DNA Methylation Market

13.16.3 Financials

13.16.4 Key Insights About Financial Health of the Company

13.16.5 SWOT Analysis

13.17 Zymo Research Corporation

13.17.1 Company Overview

13.17.2 Role of Zymo Research Corporation in the Global DNA Methylation Market

13.17.3 SWOT Analysis

Table 5.1: Classification Rules of IVDs Under the IVDR

Table 5.2: Registration Criteria for IVD Medical Devices as per the NMPA

Table 8.1: Examples of Consumables in the Global DNA Methylation Market

Table 8.2: Examples of Instruments in Global DNA Methylation Market

Table 8.3: Examples of Software in the Global DNA Methylation Market

Figure 1: Cancer Epigenetic Biomarker Publications Per Annum Vs. Cumulative Registered DNA Methylation-based In Vitro Diagnostics, 2010-2019

Figure 2: Impact Analysis of Market Drivers and Market Challenges on the Global DNA Methylation Market

Figure 3: Global DNA Methylation Market (by Product), 2019 vs. 2030 ($Million)

Figure 4: Global DNA Methylation Market (by Technology), 2019 vs. 2030 ($Million)

Figure 5: Global DNA Methylation Market (by Application), 2019 vs. 2030 ($Million)

Figure 6: Global DNA Methylation Market (by End User), 2019 vs. 2030 ($Million)

Figure 7: Global DNA Methylation Market Snapshot

Figure 2.1: Global DNA Methylation Market Segmentation

Figure 3.1: Global DNA Methylation Market Research Methodology

Figure 3.2: Primary Research Methodology

Figure 3.3: Bottom-Up Approach (Segment-Wise Analysis)

Figure 3.4: Top-Down Approach (Segment-Wise Analysis)

Figure 4.1: Global DNA Methylation Market, 2019-2030

Figure 4.2: Global DNA Methylation Market: COVID-19 Impact

Figure 5.1: Components Considered for Clinical Evidence as per the IVDR

Figure 5.2: Medical Device Designation Process by MHLW and PMDA

Figure 6.1: Iceberg Analysis – Global DNA Methylation Market

Figure 6.2: Impact Analysis

Figure 6.3: Global Cancer Burden, 2018

Figure 6.4: Increasing Government Spending for Healthcare, 2017

Figure 6.5: Decreasing Cost and Increasing Output (TB) of Genome Sequencing (2009-2025)

Figure 6.6: Milestones for Clinical Implementation of a Candidate DNA Methylation Biomarker

Figure 6.7: Evolution of NGS-Based Techniques Applied to DNA Methylation Profiling

Figure 7.1: Share of Key Developments and Strategies, January 2017–May 2020

Figure 7.2: Product Launches Share (by Company), January 2017–May 2020

Figure 7.3: Synergistic Activities Share (by Company), January 2017–May 2020

Figure 7.4: Share of Acquisitions (by Company), January 2016–February 2020

Figure 7.5: Market Share Analysis for Global DNA Methylation Market, 2018 and 2019

Figure 7.6: Growth Share Analysis for Global DNA Methylation Market (by Company), 2019

Figure 7.7: Growth Share Analysis for Global DNA Methylation Market (by Technology), 2019-2030

Figure 7.8: Growth Share Analysis for Global DNA Methylation Sequencing Market (by Application), 2019-2030

Figure 8.1: Global DNA Methylation Market (by Product Type)

Figure 8.2: Global DNA Methylation Market (by Product Type), 2019 and 2030

Figure 8.3: Global DNA Methylation Market (by Consumable), 2019-2030

Figure 8.4: Global DNA Methylation Market (by Consumable), 2019 and 2030

Figure 8.5: Global DNA Methylation Market (Consumable, by Technology), 2019 and 2030

Figure 8.6: Global DNA Methylation Market (by Instruments), 2019-2030

Figure 8.7: Global DNA Methylation Market (Instrument, by Technology), 2019 and 2030

Figure 8.8: Global DNA Methylation Market (by Software), 2019-2030

Figure 9.1: Global DNA Methylation Market (by Technology)

Figure 9.2: Global DNA Methylation Market (by Technology), 2019-2030

Figure 9.3: Global DNA Methylation Market (by PCR), 2019-2030

Figure 9.4: Evolution of Sequencing for Molecular Diagnostics

Figure 9.5: Global DNA Methylation Market (by Sequencing), 2019 and 2030

Figure 9.6: Global DNA Methylation Market (by NGS), 2019-2030

Figure 9.7: Global DNA Methylation Market (by Traditional Sequencing), 2019-2030

Figure 9.8: Global DNA Methylation Market (by Microarray), 2019-2030

Figure 9.9: Global DNA Methylation Market (by Other Technologies), 2019-2030

Figure 10.1: Global DNA Methylation Market (by Application)

Figure 10.2: Global DNA Methylation Market (by Application), 2019-2030

Figure 10.3: Global DNA Methylation Market (by Clinical Applications), 2019-2030

Figure 10.4: Global DNA Methylation Market (by Translational Research), 2019 and 2030

Figure 10.5: Global DNA Methylation Market (by Oncology Research), 2019-2030

Figure 10.6: Global DNA Methylation Market (by Non-Oncology Research), 2019-2030

Figure 10.7: Global DNA Methylation Market (by Non-Oncology Research), 2019 and 2030

Figure 10.8: Global DNA Methylation Market (by Other Research Applications), 2019-2030

Figure 11.1: Global DNA Methylation Market (by End User)

Figure 11.2: Global DNA Methylation Market (by Pharmaceutical and Biotechnology Companies), 2019-2030

Figure 11.3: Global DNA Methylation Market (by Research and Academic Institutions), 2019-2030

Figure 11.4: Global DNA Methylation Market (by Contract Research Organizations), 2019-2030

Figure 11.5: Global DNA Methylation Market (by Other End Users), 2019-2030

Figure 12.1: Global DNA Methylation Market (by Region)

Figure 12.2: Global DNA Methylation Market (by Region), 2019-2030

Figure 12.3: North America DNA Methylation Market, 2019-2030

Figure 12.4: North America: Market Dynamics

Figure 12.5: North America DNA Methylation Market (by Country), 2019-2030

Figure 12.6: U.S. DNA Methylation Market, 2019-2030

Figure 12.7: Canada DNA Methylation Market, 2019-2030

Figure 12.8: North America DNA Methylation Market (by Translational Research), 2019-2030

Figure 12.9: Europe DNA Methylation Market, 2019-2030

Figure 12.10: Europe: Market Dynamics

Figure 12.11: Europe DNA Methylation Market (by Country), 2019-2030

Figure 12.12: Germany DNA Methylation Market, 2019-2030

Figure 12.13: U.K. DNA Methylation Market, 2019-2030

Figure 12.14: France DNA Methylation Market, 2019-2030

Figure 12.15: Italy DNA Methylation Market, 2019-2030

Figure 12.16: Spain DNA Methylation Market, 2019-2030

Figure 12.17: Rest-of-Europe DNA Methylation Market, 2019-2030

Figure 12.18: Europe DNA Methylation Market (by Translational Research), 2019-2030

Figure 12.19: Asia-Pacific DNA Methylation Market, 2019-2030

Figure 12.20: APAC: Market Dynamics

Figure 12.21: APAC DNA Methylation Market (by Country), 2019-2030

Figure 12.22: China DNA Methylation Market, 2019-2030

Figure 12.23: Japan DNA Methylation Market, 2019-2030

Figure 12.24: India DNA Methylation Market, 2019-2030

Figure 12.25: South Korea DNA Methylation Market, 2019-2030

Figure 12.26: Australia DNA Methylation Market, 2019-2030

Figure 12.27: RoAPAC DNA Methylation Market, 2019-2030

Figure 12.28: Asia-Pacific DNA Methylation Market (by Translational Research), 2019-2030

Figure 12.29: Latin America DNA Methylation Market, 2019-2030

Figure 12.30: Latin America: Market Dynamics

Figure 12.31: Latin America DNA Methylation Market (by Country), 2019-2030

Figure 12.32: Brazil DNA Methylation Market, 2019-2030

Figure 12.33: Mexico DNA Methylation Market, 2019-2030

Figure 12.34: Rest-of-Latin America DNA Methylation Market, 2019-2030

Figure 12.35: Latin America DNA Methylation Market (by Translational Research), 2019-2030

Figure 12.36: RoW DNA Methylation Market, 2019-2030

Figure 13.1: Total Number of Companies Profiled

Figure 13.2: Abcam plc: Product Portfolio

Figure 13.3: Abcam plc: Overall Financials, 2016-2018

Figure 13.4: Abcam plc: Revenue (by Region), 2016-2018

Figure 13.5: Abcam plc: R&D Expenditure, 2016-2018

Figure 13.6: Abcam plc: SWOT Analysis

Figure 13.7: Active Motif, Inc.: Product Portfolio

Figure 13.8: Active Motif, Inc.: SWOT Analysis

Figure 13.9: Agilent Technologies, Inc.: Product Portfolio

Figure 13.10: Agilent Technologies, Inc.: Overall Financials, 2017-2019

Figure 13.11: Agilent Technologies, Inc.: Revenue (by Segment), 2017-2019

Figure 13.12: Agilent Technologies, Inc.: Revenue (by Region), 2017-2019

Figure 13.13: Agilent Technologies, Inc.: R&D Expenditure, 2017-2019

Figure 13.14: Agilent Technologies, Inc.: SWOT Analysis

Figure 13.15: Bio-Rad Laboratories, Inc.: Portfolio

Figure 13.16: Bio-Rad Laboratories, Inc.: Overall Financials, 2017-2019

Figure 13.17: Bio-Rad Laboratories, Inc.: Revenue (by Segment), 2017-2019

Figure 13.18: Bio-Rad Laboratories, Inc.: Revenue (by Region), 2017-2019

Figure 13.19: Bio-Rad Laboratories, Inc.: R&D Expenditure, 2017-2019

Figure 13.20: Bio-Rad Laboratories

Figure 13.21: Diagenode Diagnostics S.A.: Product Portfolio

Figure 13.22: Diagenode Diagnostics S.A.: SWOT Analysis

Figure 13.23: EpiGentek Group Inc.: Product Portfolio

Figure 13.24: EpiGentek Group Inc.: SWOT Analysis

Figure 13.25: Exact Sciences Corporation: Portfolio

Figure 13.26: Exact Sciences Corporation: Overall Financials, 2017-2019

Figure 13.27: Exact Sciences Corporation: Revenue (by Segment), 2017-2019

Figure 13.28: Exact Sciences Corporation: Revenue (by Region), 2017-2019

Figure 13.29: Exact Sciences Corporation: R&D Expenditure, 2017-2019

Figure 13.30: Exact Sciences Corporation

Figure 13.33: F. Hoffmann-La Roche Ltd: Sales (by Segment), 2017-2019

Figure 13.34: F. Hoffmann-La Roche Ltd: Sales (by Region), 2017-2019

Figure 13.35: F. Hoffmann-La Roche Ltd: R&D Expenditure, 2017-2019

Figure 13.36: F. Hoffmann-La Roche: SWOT Analysis

Figure 13.37: Illumina, Inc.: Product Portfolio

Figure 13.38: Illumina, Inc.: Overall Financials, 2017-2019

Figure 13.39: Illumina, Inc.: Revenue (by Segment), 2017-2019

Figure 13.40: Illumina, Inc.: Revenue (by Region), 2016-2018

Figure 13.41: Illumina, Inc.: R&D Expenditure, 2016-2018

Figure 13.42: Illumina, Inc.: SWOT Analysis

Figure 13.43: Merck KGaA: Overall Product Portfolio

Figure 13.44: Merck KGaA: Overall Financials, 2017-2019

Figure 13.45: Merck KGaA: Revenue (by Segment), 2017-2019

Figure 13.46: Merck KGaA: Revenue (by Region), 2017-2019

Figure 13.47: Merck KGaA: Life Science Segment Revenue (by Region), 2017-2019

Figure 13.48: Merck KGaA: R&D Expenditure, 2016-2018

Figure 13.49: Merck KGaA: SWOT Analysis

Figure 13.50: New England Biolabs, Inc.: Product Portfolio

Figure 13.51: New England Biolabs, Inc.: SWOT Analysis

Figure 13.52: Pacific Biosciences of California, Inc.: Overall Product Portfolio

Figure 13.53: Pacific Biosciences of California, Inc.: Overall Financials, 2017-2019

Figure 13.54: Pacific Biosciences of California, Inc.: Revenue (by Segment), 2017-2019

Figure 13.55: Pacific Biosciences of California, Inc.: Revenue (by Region), 2017-2019

Figure 13.56: Pacific Biosciences of California, Inc.: R&D Expenditure, 2017-2019

Figure 13.57: Pacific Biosciences of California, Inc.: SWOT Analysis

Figure 13.58: PerkinElmer, Inc.: Portfolio

Figure 13.59: PerkinElmer, Inc.: Overall Financials, 2017-2019

Figure 13.60: PerkinElmer, Inc.: Revenue (by Segment), 2017-2019

Figure 13.61: PerkinElmer, Inc.: Revenue (by Region), 2017-2019

Figure 13.62: PerkinElmer, Inc.: R&D Expenditure, 2017-2019

Figure 13.63: PerkinElmer, Inc.: SWOT Analysis

Figure 13.64: QIAGEN N.V.: Portfolio

Figure 13.65: QIAGEN N.V.: Overall Financials, 2017-2019

Figure 13.66: QIAGEN N.V.: Revenue (by Segment), 2017-2019

Figure 13.67: QIAGEN N.V.: Revenue (by Region), 2017-2019

Figure 13.68: QIAGEN N.V.: R&D Expenditure, 2017-2019

Figure 13.69: QIAGEN N.V.: SWOT Analysis

Figure 13.70: Thermo Fisher Scientific Inc.: Product Portfolio

Figure 13.71: Thermo Fisher Scientific Inc.: Overall Financials, 2017-2019

Figure 13.72: Thermo Fisher Scientific Inc.: Revenue (by Segment), 2017-2019

Figure 13.73: Thermo Fisher Scientific Inc.: Revenue (by Region), 2017-2019

Figure 13.74: Thermo Fisher Scientific Inc.: R&D Expenditure, 2017-2019

Figure 13.75: Thermo Fisher Scientific Inc.: SWOT Analysis

Figure 13.76: Zymo Research Corporation: Product Portfolio

Figure 13.77: Zymo Research Corporation: SWOT Analysis

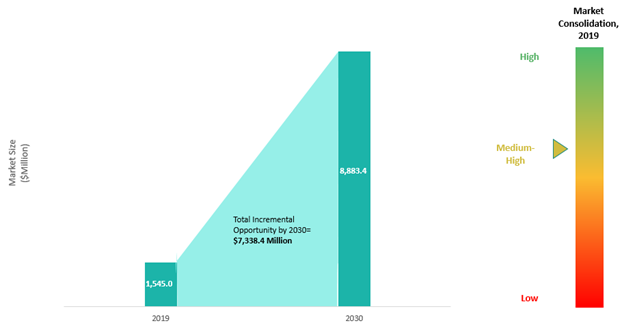

Report Description

|

Market Report Coverage - DNA Methylation |

|||

|

Base Year |

2019 |

Market Size in 2019 |

$1,545.0 Million |

|

Forecast Period |

2020-2030 |

Value Projection and Estimation by 2030 |

$8,883.4 Million |

|

CAGR During Forecast Period |

15.70% |

Number of Tables |

5 |

|

Number of Pages |

253 |

Number of Figures |

172 |

|

Research Hours |

700 |

|

|

|

Market Segmentation |

• By Product: Consumables, Instruments, and Software Tools • By Technology: Polymerase Chain Reaction (PCR), Sequencing, Microarray, and others. • By Application: Clinical and Translational Research Segments • By End User: Pharmaceutical and Biotechnology Companies, Research and Academic Institutions, Contract Research Organizations (CROs), and others. • By Region: North America, Europe, Asia-Pacific, Latin America, and Rest-of-the-World |

||

|

Regional Segmentation |

• North America: U.S. and Canada • Europe: Germany, U.K., France, Italy, Spain, and Rest-of-Europe • Asia-Pacific: China, Japan, India, South Korea, Australia, and Rest-of-Asia-Pacific • Latin America: Brazil, Mexico, and Rest-of-Latin America • Rest-of-the-World |

||

|

Growth Drivers |

• Global Increase in Cancer Prevalence • Increasing Government Funding for Healthcare • Declining Costs and Increasing Output of Sequencing |

||

|

Market Challenges |

• High Cost of Instrument • Lack of High-Complexity Testing Centers and Skilled Professionals in High-Growth Regions • Low Adoption in Diagnostic Applications |

||

|

Market Opportunities |

• Growing Trend of Methylome Sequencing for Precision Medicine • Advancing Technological Developments for Methylome Sequencing • Growth in Non-Oncology Applications of DNA Methylation |

||

|

Key Companies Profiled |

Abcam plc, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., Illumina, Inc., Merck Group, Pacific Biosciences of California, Inc., PerkinElmer, Inc., QIAGEN N.V., Thermo Fisher Scientific Inc., Active Motif, Inc., Diagenode Diagnostics SA, EpiGentek Group Inc., New England Biolabs, Inc., and Zymo Research Corporation. |

||

Key Questions Answered in this Report:

• What are the major market drivers, challenges, and opportunities in, and their respective impacts on the global DNA methylation market?

• What are the key development strategies which are implemented by the major players in order to sustain in the competitive market?

• Which is the dominant product type developed by the leading and emerging players for the global DNA methylation market?

• What are the key technologies that have been used by leading players in the global DNA methylation market?

• How each segment of the market is expected to grow during the forecast period from 2020 to 2030 based on:

o product type

o technology

o application

o end user

o region

• Which companies are anticipated to be highly disruptive in the future, and why?

• What are the key application areas for DNA methylation in 2020, and which application areas are expected to witness growth in the forecast period?

Market Overview

DNA methylation is a heritable epigenetic marker which involves the covalent transfer of a methyl group to the C-5 position of the cytosine ring of DNA by enzymes known as DNA methyltransferases (DNMTs). In humans, DNA methylation occurs primarily at cytosines in any context of the genome. More than 98% of DNA methylation occurs in a CpG dinucleotide context in somatic cells. The current DNA methylation market is mainly dominated by several diagnostic majors, such as Exact Sciences Corporation, Illumina, Inc., QIAGEN N.V., and Thermo Fisher Scientific Inc., which offer a wide variety of diagnostics and research-based products for detection of DNA methylation in genomes.

These products are generally based on technologies, such as polymerase chain reaction (PCR), microarrays, and sequencing, including both traditional and next-generation sequencing. The underlying utility of diagnostic testing for DNA methylation is based on the identification of clinically actionable genetic function, which provide crucial information on diagnosis, prognosis, and theranostics of genetic disorders and thereby facilitates clinical work-up, treatment management, and therapeutic selection.

Figure: Global DNA Methylation Market Snapshot

Source: BIS Research Analysis

The existing market of DNA methylation is favored by multiple factors, which include a global increase in cancer prevalence and declining costs and increasing output of sequencing. In addition, an increasing number of product approvals and launches pertaining to the global DNA methylation market will provide a lucrative growth for this market. Moreover, increasing use of early-stage biomarkers in cancer profiling is the key driving factor for the market.

Government funding is also one of the major growth factors for the DNA methylation market, because increasing funding by the government is expected to facilitate research institutes and key players to develop, as well as market novel assays useful for the diagnosis of several tumors. Increasing funding will lead to liquidity of the cancer profiling market, and thus, companies will develop various testing options to identify the underlying mutations that serve as a possible cause for the disease. All these factors are, therefore, expected to contribute to the market growth during the forecast period.

Within the research report, the market is segmented on the basis of product type, technology, application, end user, and region, which highlight value propositions and business models useful for industry leaders and stakeholders. The research also comprises country-level analysis, go-to-market strategies of leading players, future opportunities, among others, to detail the scope and provide a 360-degree coverage of the domain.

Competitive Landscape

On the basis of region, North America is expected to retain a leading position throughout the forecast period 2020-2030, followed by Europe. This is a result of the presence of leading industry players in this region, coupled up with the highest prevalence of cancer in 2018.

Major players, including Illumina, Inc., MDxHealth S.A., Diagenode Diagnostics S.A., and Thermo Fisher Scientific Inc., among others, led the number of key developments witnessed by the market during the period 2017-2020. The market was dominated by players such as Exact Sciences Corporation, Illumina, Inc., and QIAGEN N.V. in 2018 and 2019. These companies ensured their market stature through several key developments undertaken during the period.

Global DNA Methylation Market

Focus on Products, Technologies, Applications, End Users, Country Data (14 Countries), and Competitive Landscape - Analysis and Forecast, 2019-2030