A quick peek into the report

Table of Contents

1.1 Industry Outlook

1.1.1 Energy Management Standards and Specifications

1.1.2 Investment and Funding Landscape

1.1.3 Stakeholders Analysis

1.1.3.1 Energy Management System Impact Matrix and Analysis

1.1.3.1.1 Impact of Energy Management System

1.1.3.1.2 Contribution to Energy Management System

1.1.3.1.3 Investable Opportunity

1.1.4 Associations and Consortiums

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Increasing Demand for Energy Conservation and Environmental Safety

1.2.1.2 Evolution of Smart Grid

1.2.1.3 Favorable Government Policies and Incentive Programs

1.2.2 Business Challenges

1.2.2.1 High Cost of Deployment

1.2.2.2 Privacy and Security Risk

1.2.3 Business Strategies

1.2.3.1 Product Development and Innovation

1.2.3.2 Market Developments

1.2.4 Corporate Strategies

1.2.4.1 Mergers and Acquisitions

1.2.4.2 Partnerships, Collaborations, and Joint Ventures

1.2.5 Business Opportunities

1.2.5.1 Arising Demand for Electric Vehicle (EV) Charging Infrastructure

1.2.5.2 Increasing Adoption of Smart Buildings

1.2.5.3 Rising Scope for Energy Management in HVAC Systems

2.1 Global Energy Management System Market (by End User)

2.2 Demand Analysis of Global Energy Management System Market (by End User)

2.2.1 Industrial

2.2.2 Commercial

2.2.3 Residential

3.1 Global Energy Management System Market (by Product)

3.2 Demand Analysis of Global Energy Management System (by Product)

3.2.1 Software

3.2.2 Hardware

3.2.2.1 Demand Analysis of Energy Management System Hardware Market (by Sub Type)

3.2.2.2 Sensors

3.2.2.2.1 Demand Analysis of Energy Management System Sensor Market (by Sub Type)

3.2.2.3 Actuators

3.2.2.4 Controllers

3.2.2.5 Thermostats

3.2.2.6 Others

3.2.3 Support Services

3.3 Global Energy Management System Market (by Type)

3.4 Demand Analysis of Global Energy Management System (by Type)

3.4.1 Industrial Energy Management System (IEMS)

3.4.2 Building Energy Management System (BEMS)

3.4.3 Home Energy Management System (HEMS)

4.1 North America

4.1.1 Market

4.1.1.1 Key Providers in North America

4.1.1.2 Business Drivers

4.1.1.3 Business Challenges

4.1.2 Application

4.1.2.1 North America Energy Management System Market (by End User)

4.1.3 Product

4.1.3.1 North America Energy Management System Market (by Product)

4.1.3.2 North America Energy Management System Market (by Hardware)

4.1.3.3 North America Energy Management System Market (by Type)

4.1.4 North America (by Country)

4.1.4.1 U.S.

4.1.4.1.1 Market

4.1.4.1.1.1 Buyer Attributes

4.1.4.1.1.2 Key Manufacturers in U.S.

4.1.4.1.1.3 Business Challenges

4.1.4.1.1.4 Business Drivers

4.1.4.2 Canada

4.1.4.2.1 Market

4.1.4.2.1.1 Buyer Attributes

4.1.4.2.1.2 Key Manufacturers in Canada

4.1.4.2.1.3 Business Challenges

4.1.4.2.1.4 Business Drivers

4.1.4.3 Mexico

4.1.4.3.1 Market

4.1.4.3.1.1 Buyer Attributes

4.1.4.3.1.2 Key Manufacturers in Mexico

4.1.4.3.1.3 Business Challenges

4.1.4.3.1.4 Business Drivers

4.1.4.4 Rest-of-North America

4.1.4.4.1 Market

4.1.4.4.1.1 Buyer Attributes

4.1.4.4.1.2 Key Manufacturers in Rest-of-North America

4.1.4.4.1.3 Business Challenges

4.1.4.4.1.4 Business Drivers

4.2 South America

4.2.1 Market

4.2.1.1 Key Manufacturers and Suppliers in South America

4.2.1.2 Business Drivers

4.2.1.3 Business Challenges

4.2.2 Application

4.2.2.1 South America Energy Management System Market (by End User)

4.2.3 Product

4.2.3.1 South America Energy Management System Market (by Product)

4.2.3.2 South America Energy Management System Market (by Hardware)

4.2.3.3 South America Energy Management System Market (by Type)

4.2.4 South America (by Country)

4.2.4.1 Brazil

4.2.4.1.1 Market

4.2.4.1.1.1 Buyer Attributes

4.2.4.1.1.2 Key Manufacturers in Brazil

4.2.4.1.1.3 Business Challenges

4.2.4.1.1.4 Business Drivers

4.2.4.2 Argentina

4.2.4.2.1 Market

4.2.4.2.1.1 Buyer Attributes

4.2.4.2.1.2 Key Manufacturers in Argentina

4.2.4.2.1.3 Business Challenges

4.2.4.2.1.4 Business Drivers

4.2.4.3 Rest-of-South America

4.2.4.3.1 Market

4.2.4.3.1.1 Buyer Attributes

4.2.4.3.1.2 Key Manufacturers in Rest-of-South America

4.2.4.3.1.3 Business Drivers

4.2.4.3.1.4 Business Challenges

4.3 Europe

4.3.1 Market

4.3.1.1 Key Manufacturers and Suppliers in Europe

4.3.1.2 Business Drivers

4.3.1.3 Business Challenges

4.3.2 Application

4.3.2.1 Europe Energy Management System Market (by End User)

4.3.3 Product

4.3.3.1 Europe Energy Management System Market (by Product)

4.3.3.2 Europe Energy Management System Market (by Hardware)

4.3.3.3 Europe Energy Management System Market (by Type)

4.3.4 Europe (by Country)

4.3.4.1 Germany

4.3.4.1.1 Market

4.3.4.1.1.1 Buyer Attributes

4.3.4.1.1.2 Key Manufacturers in Germany

4.3.4.1.1.3 Business Challenges

4.3.4.1.1.4 Business Drivers

4.3.4.2 France

4.3.4.2.1 Market

4.3.4.2.1.1 Buyer Attributes

4.3.4.2.1.2 Key Manufacturers in France

4.3.4.2.1.3 Business Challenges

4.3.4.2.1.4 Business Drivers

4.3.4.3 Norway

4.3.4.3.1 Market

4.3.4.3.1.1 Buyer Attributes

4.3.4.3.1.2 Key Manufacturers in Norway

4.3.4.3.1.3 Business Challenges

4.3.4.3.1.4 Business Drivers

4.3.4.4 Italy

4.3.4.4.1 Markets

4.3.4.4.1.1 Buyer Attributes

4.3.4.4.1.2 Key Manufacturers in Italy

4.3.4.4.1.3 Business Challenges

4.3.4.4.1.4 Business Drivers

4.3.4.5 Denmark

4.3.4.5.1 Market

4.3.4.5.1.1 Buyer Attributes

4.3.4.5.1.2 Key Manufacturers in Denmark

4.3.4.5.1.3 Business Challenges

4.3.4.5.1.4 Business Drivers

4.3.4.6 Rest-of-Europe

4.3.4.6.1 Market

4.3.4.6.1.1 Buyer Attributes

4.3.4.6.1.2 Key Manufacturers in Rest-of-Europe

4.3.4.6.1.3 Business Challenges

4.3.4.6.1.4 Business Drivers

4.4 U.K.

4.4.1 Market

4.4.1.1 Buyer Attributes

4.4.1.2 Key Manufacturers in U.K.

4.4.1.3 Business Challenges

4.4.1.4 Business Drivers

4.4.2 Application

4.4.2.1 U.K. Energy Management System Market (by End User)

4.4.3 Product

4.4.3.1 U.K. Energy Management System Market (by Product)

4.4.3.2 U.K. Energy Management System Market (by Hardware)

4.4.3.3 U.K. Energy Management System Market (by Type)

4.5 Middle East and Africa

4.5.1 Market

4.5.1.1 Key Manufacturers and Suppliers in Middle East and Africa

4.5.1.2 Business Drivers

4.5.1.3 Business Challenges

4.5.2 Application

4.5.2.1 Middle East and Africa Energy Management System Market (by End User)

4.5.3 Product

4.5.3.1 Middle East and Africa Energy Management System Market (by Product)

4.5.3.2 Middle East and Africa Energy Management System Market (by Hardware)

4.5.3.3 Middle East and Africa Energy Management System Market (by Type)

4.5.4 Middle East and Africa (by Country)

4.5.4.1 Saudi Arabia

4.5.4.1.1 Market

4.5.4.1.1.1 Buyer Attributes

4.5.4.1.1.2 Key Manufacturers in Saudi Arabia

4.5.4.1.1.3 Business Challenges

4.5.4.1.1.4 Business Drivers

4.5.4.2 U.A.E.

4.5.4.2.1 Market

4.5.4.2.1.1 Buyer Attributes

4.5.4.2.1.2 Key Manufacturers in U.A.E.

4.5.4.2.1.3 Business Challenges

4.5.4.2.1.4 Business Drivers

4.5.4.3 South Africa

4.5.4.3.1 Market

4.5.4.3.1.1 Buyer Attributes

4.5.4.3.1.2 Key Manufacturers in South Africa

4.5.4.3.1.3 Business Challenges

4.5.4.3.1.4 Business Drivers

4.5.4.4 Rest-of-Middle East and Africa

4.5.4.4.1 Market

4.5.4.4.1.1 Buyer Attributes

4.5.4.4.1.2 Key Manufacturers in Rest-of-Middle East and Africa

4.5.4.4.1.3 Business Challenges

4.5.4.4.1.4 Business Drivers

4.6 China

4.6.1 Market

4.6.1.1 Buyer Attributes

4.6.1.2 Key Manufacturers in China

4.6.1.3 Business Challenges

4.6.1.4 Business Drivers

4.6.2 Application

4.6.2.1 China Energy Management System Market (by End User)

4.6.3 Product

4.6.3.1 China Energy Management System Market (by Product)

4.6.3.2 China Energy Management System Market (by Hardware)

4.6.3.3 China Energy Management System Market (by Type)

4.7 Asia-Pacific and Japan

4.7.1 Market

4.7.1.1 Key Manufacturers and Suppliers in Asia-Pacific and Japan

4.7.1.2 Business Drivers

4.7.1.3 Business Challenges

4.7.2 Application

4.7.2.1 Asia-Pacific and Japan Energy Management System Market (by End User)

4.7.3 Product

4.7.3.1 Asia-Pacific and Japan Energy Management System Market (by Product)

4.7.3.2 Asia-Pacific and Japan Energy Management System Market (by Hardware)

4.7.3.3 Asia-Pacific and Japan Energy Management System Market (by Type)

4.7.4 Asia-Pacific and Japan (by Country)

4.7.4.1 Japan

4.7.4.1.1 Market

4.7.4.1.1.1 Buyer Attributes

4.7.4.1.1.2 Key Manufacturers in Japan

4.7.4.1.1.3 Business Challenges

4.7.4.1.1.4 Business Drivers

4.7.4.2 India

4.7.4.2.1 Market

4.7.4.2.1.1 Buyer Attributes

4.7.4.2.1.2 Key Manufacturers in India

4.7.4.2.1.3 Business Challenges

4.7.4.2.1.4 Business Drivers

4.7.4.3 South Korea

4.7.4.3.1 Market

4.7.4.3.1.1 Buyer Attributes

4.7.4.3.1.2 Key Manufacturers in South Korea

4.7.4.3.1.3 Business Challenges

4.7.4.3.1.4 Business Drivers

4.7.4.4 Australia

4.7.4.4.1 Market

4.7.4.4.1.1 Buyer Attributes

4.7.4.4.1.2 Key Manufacturers in Australia

4.7.4.4.1.3 Business Challenges

4.7.4.4.1.4 Business Drivers

4.7.4.5 Singapore

4.7.4.5.1 Market

4.7.4.5.1.1 Buyer Attributes

4.7.4.5.1.2 Key Manufacturers in Singapore

4.7.4.5.1.3 Business Challenges

4.7.4.5.1.4 Business Drivers

4.7.4.6 Rest-of-Asia-Pacific and Japan

4.7.4.6.1 Market

4.7.4.6.1.1 Buyer Attributes

4.7.4.6.1.2 Key Manufacturers in Rest-of-Asia-Pacific and Japan

4.7.4.6.1.3 Business Challenges

4.7.4.6.1.4 Business Drivers

5.1 Competitive Benchmarking

5.2 ABB Ltd.

5.2.1 Company Overview

5.2.1.1 Role of ABB Ltd. in Energy Management System Market

5.2.1.2 Product Portfolio

5.2.1.3 Production Sites

5.2.2 Business Strategies

5.2.2.1 Product Developments

5.2.3 Corporate Strategies

5.2.3.1 Partnership and Collaboration

5.2.4 Strength and Weakness of ABB Ltd.

5.2.5 R&D Analysis

5.3 C3.ai

5.3.1 Company Overview

5.3.1.1 Role of C3.ai in Energy Management System Market

5.3.1.2 Product Portfolio

5.3.2 Corporate Strategies

5.3.2.1 Partnership and Collaboration

5.3.3 Strength and Weakness of C3.ai

5.4 Cisco Systems Inc.

5.4.1 Company Overview

5.4.1.1 Role of Cisco Systems Inc. in Energy Management System Market

5.4.1.2 Product Portfolio

5.4.2 Business Strategies

5.4.2.1 Market Development

5.4.3 Corporate Strategies

5.4.3.1 Partnership and Collaboration

5.4.4 Strength and Weakness of Cisco Systems Inc.

5.4.5 R&D Analysis

5.5 Cylon Controls Ltd.

5.5.1 Company Overview

5.5.1.1 Role of Cylon Controls Ltd. in Energy Management System Market

5.5.1.2 Product Portfolio

5.5.2 Business Strategies

5.5.2.1 Product Development

5.5.3 Strength and Weakness of Cylon Controls Ltd.

5.6 Emerson Electric Co.

5.6.1 Company Overview

5.6.1.1 Role of Emerson Electric in Energy Management System Market

5.6.1.2 Product Portfolio

5.6.1.3 Production Sites

5.6.2 Business Strategies

5.6.2.1 Product Development

5.6.3 Corporate Strategies

5.6.3.1 Merger and Acquisition

5.6.4 Strength and Weakness of Emerson Electric Co.

5.6.5 R&D Analysis

5.7 Engie S.A.

5.7.1 Company Overview

5.7.1.1 Role of Engie S.A. in Energy Management System Market

5.7.1.2 Product Portfolio

5.7.2 Business Strategies

5.7.2.1 Product Development

5.7.3 Corporate Strategies

5.7.3.1 Merger and Acquisition

5.7.4 Strength and Weakness of Engie S.A.

5.7.5 R&D Analysis

5.8 General Electric

5.8.1 Company Overview

5.8.1.1 Role of General Electric in Energy Management System Market

5.8.1.2 Product Portfolio

5.8.1.3 Production Sites

5.8.2 Business Strategies

5.8.2.1 Product Development

5.8.3 Corporate Strategies

5.8.3.1 Partnership and Collaboration

5.8.4 Strength and Weakness of General Electric

5.8.5 R&D Analysis

5.9 Honeywell International Inc.

5.9.1 Company Overview

5.9.1.1 Role of Honeywell International Inc. in Energy Management System Market

5.9.1.2 Product Portfolio

5.9.1.3 Production Sites

5.9.2 Business Strategies

5.9.2.1 Product Developments

5.9.2.2 Market Development

5.9.3 Corporate Strategies

5.9.3.1 Merger and Acquisition

5.9.4 Strength and Weakness of Honeywell International Inc.

5.9.5 R&D Analysis

5.10 Ingersoll-Rand plc

5.10.1 Company Overview

5.10.1.1 Role of Ingersoll-Rand plc in Energy Management System Market

5.10.1.2 Product Portfolio

5.10.1.3 Production Sites

5.10.2 Business Strategies

5.10.2.1 Product Development

5.10.2.2 Market Development

5.10.3 Strength and Weakness of Ingersoll-Rand plc

5.10.4 R&D Analysis

5.11 International Business Machines Corporation (IBM Corporation)

5.11.1 Company Overview

5.11.1.1 Role of IBM Corporation in Energy Management System Market

5.11.1.2 Product Portfolio

5.11.2 Business Strategies

5.11.2.1 Product Development

5.11.3 Corporate Strategies

5.11.3.1 Partnership and Collaboration

5.11.4 Strength and Weakness of IBM Corporation

5.11.5 R&D Analysis

5.12 Johnson Controls

5.12.1 Company Overview

5.12.1.1 Role of Johnson Controls in Energy Management System Market

5.12.1.2 Product Portfolio

5.12.1.3 Production Sites

5.12.2 Corporate Strategies

5.12.2.1 Partnership and Collaboration

5.12.2.2 Merger and Acquisition

5.12.3 Strength and Weakness of Johnson Controls

5.12.4 R&D Analysis

5.13 Rockwell Automation Inc.

5.13.1 Company Overview

5.13.1.1 Role of Rockwell Automation in Energy Management System Market

5.13.1.2 Product Portfolio

5.13.2 Business Strategies

5.13.2.1 Market Development

5.13.3 Strength and Weakness of Rockwell Automation

5.13.4 R&D Analysis

5.14 Siemens AG

5.14.1 Company Overview

5.14.1.1 Role of Siemens AG in Energy Management System Market

5.14.1.2 Product Portfolio

5.14.2 Business Strategies

5.14.2.1 Product Developments

5.14.2.2 Market Development

5.14.3 Corporate Strategies

5.14.3.1 Partnership and Collaboration

5.14.4 Strength and Weakness of Siemens AG.

5.14.5 R&D Analysis

5.15 Schneider Electric

5.15.1 Company Overview

5.15.1.1 Role of Schneider Electric in Energy Management System Market

5.15.1.2 Product Portfolio

5.15.1.3 Production Sites

5.15.2 Business Strategies

5.15.2.1 Product Developments

5.15.3 Corporate Strategies

5.15.3.1 Merger and Acquisition

5.15.4 Strength and Weakness of Schneider Electric

5.15.5 R&D Analysis

5.16 Wattics Ltd

5.16.1 Company Overview

5.16.1.1 Role of Wattics Ltd. in Energy Management System Market

5.16.1.2 Product Portfolio

5.16.2 Corporate Strategies

5.16.2.1 Partnership and Collaboration

5.16.3 Strength and Weakness of Wattics Ltd.

Research Methodology

7.1 Annexure A: List of Business and Corporate Strategies in Global Energy Management System Market (January 2017 - August 2020)

7.2 Annexure B: List of Investments and Fundings in Global Energy Management System Market (January 2018 - September 2020)

Table 1: Difference between ISO 50001:2011 and BS EN 16001:2009

Table 2: Associations/Consortiums in Global Energy Management System Market

Table 3: Initiatives by Governments of Various Countries to Promote Energy Management Systems

Table 4: Product Portfolio of Key Energy Management System Offerings for Industrial End Users

Table 5: Product Portfolio of Key Energy Management System Offerings for Commercial End Users

Table 6: Product Portfolio of Key Energy Management System Offerings for Residential End Users

Table 7: Global Energy Management System Hardware Market (by Sub Type), $Billion, 2019-2025

Table 8: Global Energy Management System Sensor Market (by Sub Type),$Billion, 2019-2025

Table 9: Global Energy Management System Market (by Region), $Billion, 2019-2025

Table 10: North America Energy Management System Market (by End User), $Billion, 2019-2025

Table 11: North America Energy Management System Market (by Product), $Billion, 2019-2025

Table 12: North America Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 13: North America Energy Management System Market (by Type), $Billion, 2019-2025

Table 14: North America Energy Management System Market (by Country), $Billion, 2019-2025

Table 15: South America Energy Management System Market (by End User), $Billion, 2019-2025

Table 16: South America Energy Management System Market (by Product), $Billion, 2019-2025

Table 17: South America Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 18: South America Energy Management System Market (by Type), $Billion, 2019-2025

Table 19: South America Energy Management System Market (by Country), $Billion, 2019-2025

Table 20: Brazil Government Initiatives to Reduce Energy Consumption

Table 21: Energy Efficient Measures by Government of Argentina

Table 22: Europe Energy Management System Market (by End User), $Billion, 2019-2025

Table 23: Europe Energy Management System Market (by Product), $Billion, 2019-2025

Table 24: Europe Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 25: Europe Energy Management System Market (byType), $Billion, 2019-2025

Table 26: Europe Energy Management System Market (by Country), $Billion, 2019-2025

Table 27: Energy Conservation Plan for Commercial Sector in France

Table 28: U.K. Energy Management System Market (by End User), $Billion, 2019-2025

Table 29: U.K. Energy Management System Market (by Product), $Billion, 2019-2025

Table 30: U.K. Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 31: U.K. Energy Management System Market (by Type), $Billion, 2019-2025

Table 32: Middle East and Africa Energy Management System Market (by End User), $Billion, 2019-2025

Table 33: Middle East and Africa Energy Management System Market (by Product), $Billion, 2019-2025

Table 34: Middle East and Africa Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 35: Middle East and Africa Energy Management System Market (by Type), $Billion, 2019-2025

Table 36: Middle East and Africa Energy Management System Market (by Countries, $Billion, 2019-2025

Table 37: China Energy Management System Market (by End User), $Billion, 2019-2025

Table 38: China Energy Management System Market (by Product), $Billion, 2019-2025

Table 39: China Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 40: China Energy Management System Market (by Type), $Billion, 2019-2025

Table 41: Asia-Pacific and Japan Energy Management System Market (by End User), $Billion, 2019-2025

Table 42: Asia-Pacific and Japan Energy Management System Market (by Product), $Billion, 2019-2025

Table 43: Asia-Pacific and Japan Energy Management System Market (by Hardware), $Billion, 2019-2025

Table 44: Asia-Pacific and Japan Energy Management System Market (by Type), $Billion, 2019-2025

Table 45: Asia-Pacific and Japan Energy Management System Market (by Country), $Billion, 2019-2025

Table 46: Initiatives Taken by Government of Australia for Energy Conservation

Table 47: Initiatives Taken by Government of Singapore for Energy Conservation

Table 48: ABB Ltd.: Product Portfolio

Table 49: Table: Product Developments

Table 50: Partnership and Collaboration

Table 51: C3.ai: Product Portfolio

Table 52: Partnership and Collaboration

Table 53: Cisco Systems Inc.: Product Portfolio

Table 54: Market Development

Table 55: Partnership and Collaboration

Table 56: Cylon Controls Ltd: Product Portfolio

Table 57: Product Development

Table 58: Emerson Electric: Product Portfolio

Table 59: Product Development

Table 60: Merger and Acquisition

Table 61: Engie S.A.: Product Portfolio

Table 62: General Electric: Product Portfolio

Table 63: Table: Product Development

Table 64: Partnership and Collaboration

Table 65: Honeywell International Inc: Product Portfolio

Table 66: Table: Product Developments

Table 67: Table: Market Development

Table 68: Merger and Acquisition

Table 69: Ingersoll-Rand plc: Product Portfolio

Table 70: Product Development

Table 71: Market Development

Table 72: Table: IBM Corporation: Product Portfolio

Table 73: Product Development

Table 74: Partnership and Collaboration

Table 75: Johnson Controls: Product Portfolio

Table 76: Partnership and Collaboration

Table 77: Merger and Acquisition

Table 78: Rockwell Automation: Product Portfolio

Table 79: Market Development

Table 80: Siemens AG: Product Portfolio

Table 81: Product Developments

Table 82: Market Development

Table 83: Partnership and Collaboration

Table 84: Schneider Electric: Product Portfolio

Table 85: Product Developments

Table 86: Merger and Acquisition

Table 87: Wattics Ltd: Product Portfolio

Table 88: Partnership and Collaboration

Figure 1: Global Energy Management System Market, $Billion, 2019-2025

Figure 2: Global Energy Management System Market (by Application), $Billion, 2019-2025

Figure 3: Global Energy Management System Market (by Product), $Billion, 2019-2025

Figure 4: Global Energy Management System Market (by Type), $Billion, 2019-2025

Figure 5: Global Energy Management System Market (by Region), $Billion, 2020

Figure 6: Figure Energy Management System Market Coverage

Figure 7: ISO 50001:2011 Energy Management System Model

Figure 8: Global Energy Management System Market: Investment and Funding, January 2018-September 2020

Figure 9: Investment and Funding Landscape Share (by Round), $Million

Figure 10: Investment and Funding Landscape Share (by Application), $Million

Figure 11: Energy Management System Stakeholders

Figure 12: Impact Analysis Matrix – Energy Management System

Figure 13: Global Energy Management System Market, Business Dynamics

Figure 14: Global Energy Demand Projection, 2015-2040

Figure 15: Share of Key Market Strategies and Developments, January 2017- August 2020

Figure 16: Product Development and Innovation (by Company), January 2017- August 2020

Figure 17: Business Expansions and Investments (by Company), January 2017- August 2020

Figure 18: Share of Key Corporate Strategies, January 2017- August 2020

Figure 19: Mergers and Acquisitions (by Company), January 2017- August 2020

Figure 20: Partnerships, Collaborations, and Joint Ventures (by Company), January 2017- August 2020

Figure 21: Features of Smart Buildings

Figure 22: Global Energy Management System Market (by End User)

Figure 23: Global Energy Management System Market (by Industrial End User), $Billion, 2019-2025

Figure 24: Global Energy Management System Market (by Commercial End User), $Billion, 2019-2025

Figure 25: Global Energy Management System Market (by Residential End User), $Billion, 2019-2025

Figure 26: Global Energy Management System Market (by Product)

Figure 27: Application Areas of Energy Management System Software

Figure 28: Global Energy Management System Software Market, $Billion, 2019-2025

Figure 29: Hardware Components in Energy Management System

Figure 30: Global Energy Management System Hardware Market, $Billion, 2019-2025

Figure 31: Key Energy Management Support Services

Figure 32: Global Energy Management System Support Services Market, $Billion, 2019-2025

Figure 33: Global Energy Management System Market (by Type)

Figure 34: Global IEMS Market, $Billion, 2019-2025

Figure 35: Functions of Building Energy Management System

Figure 36: Global BEMS Market, $Billion, 2019-2025

Figure 37: Global HEMS Market, $Billion, 2019-2025

Figure 38: Competitive Benchmarking Matrix

Figure 39: ABB Ltd.: R&D (2017-2019)

Figure 40: Cisco Systems Inc.: R&D (2017-2019)

Figure 41: Emerson Electric Co. R&D (2017-2019)

Figure 42: Engie S.A.: R&D (2017-2019)

Figure 43: General Electric: R&D (2017-2019)

Figure 44: Honeywell International Inc. R&D (2017-2019)

Figure 45: Ingersoll-Rand plc R&D (2017-2019)

Figure 46: IBM Corporation R&D (2017-2019)

Figure 47: Johnson Controls: R&D (2017-2019)

Figure 48: Rockwell Automation R&D (2017-2019)

Figure 49: Siemens AG R&D (2018-2019)

Figure 50: Schneider Electric R&D (2017-2019)

Figure 51: Research Methodology

Figure 52: Top-Down and Bottom-Up Approach

Figure 53: Energy Management System Market Influencing Factors

Figure 54: Assumptions and Limitations

Report Description

|

Global Energy Management System Market |

|||

|

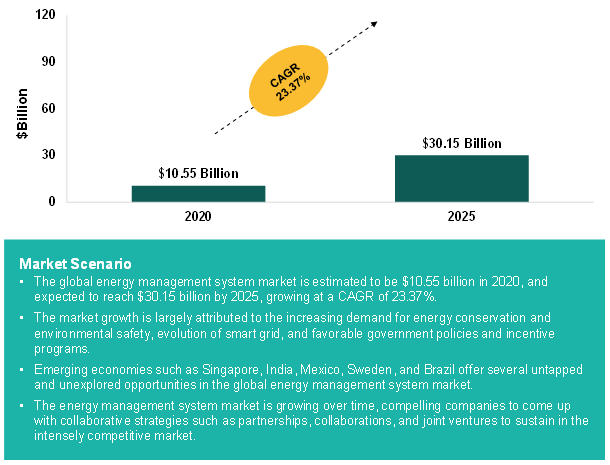

Base Year |

2019 |

Market Size in 2020 |

$10.55 Billion |

|

Forecast Period |

2020-2025 |

Value Projection and Estimation by 2025 |

$30.15 Billion |

|

CAGR During Forecast Period |

23.37% |

Number of Tables |

88 |

|

Number of Pages |

200 |

Number of Figures |

54 |

|

Research Hours |

1125 |

|

|

|

Market Segmentation |

• Product – Software, Hardware, and Support Services • End User – Industrial, Commercial, and Residential • Type – Industrial Energy Management System, Building Energy Management System, and Home Energy Management System • Region – North America, South America, Europe, U.K., China, Asia-Pacific and Japan, and Middle East and Africa |

||

|

Regional Segmentation |

• North America – U.S., Canada, Mexico, and Rest-of-North America • South America – Brazil, Argentina, and Rest-of-South America • Europe –Germany, France, Italy, Norway, Denmark, and Rest-of-Europe • U.K. • China • Asia-Pacific and Japan – Japan, South Korea, India, Australia, Singapore, and Rest-of-Asia-Pacific and Japan • Middle East Africa – Saudi Arabia, U.A.E., South Africa, and Rest-of-Middle East Africa |

||

|

Market Growth Drivers |

• Increasing Demand for Energy Conservation and Environmental Safety • Evolution of Smart Grid • Favorable Government Policies and Incentive Programs |

||

|

Market Growth Restraints |

• High Cost of Deployment • Privacy and Security Risk |

||

|

Market Opportunities |

• Arising Demand for Electric Vehicle (EV) Charging Infrastructure • Increasing Adoption of Smart Buildings • Rising Scope for Energy Management in HVAC Systems |

||

|

Key Energy Management System Companies Profiled |

ABB Ltd., C3.ai, Cisco Systems Inc., Cylon Controls Ltd., Engie S.A., General Electric, Honeywell International Inc., Ingersoll Rand plc, Johnson Controls, Rockwell Automation, Siemens AG, Schneider Electric, and Wattics Ltd. |

||

Key Questions Answered in this Report:

• What are the key trends and expansion opportunities in the global energy management system market?

• What are the estimations for the global energy management system market size in terms of revenue for the period 2019-2025, and what is the expected compound annual growth rate (CAGR) during the forecast period 2020-2025?

• What are the expected outlook and revenue to be generated by the different types of product offerings, including software, hardware, and services, for the period 2019-2025?

• What are the expected outlook and estimated revenue of different types of energy management systems, namely, industrial energy management system, building energy management system, and home energy management system, for the period 2019-2025?

• What are the expected outlook and estimated revenue of different end users, namely industrial, commercial, and residential, for the period 2019-2025?

• What is the current market size, forecast, regional market trends of the energy management system across different regions, namely North America, South America, the U.K., Europe, Asia-Pacific and Japan, China, and the Middle East and Africa?

• What will be the impact of COVID-19 on the market size, market forecast, CAGR, and market dynamics of the global energy management system market across different market segmentations?

• What are the major driving forces that are expected to increase the demand for the global energy management system market during the forecast period 2020-2025?

• What are the major restraints inhibiting the growth of the global energy management system market?

• What kind of new growth strategies (mergers and acquisitions, partnerships, expansions, products, others) are being adopted by the existing market players to expand their market share in the industry?

• How is the funding and investment landscape in the global energy management system market?

• Which type of players and stakeholders operate in the market ecosystem of the energy management system, and what are their impacts on the dynamics of the global energy management system market?

• Which companies have achieved higher market coverage compared to their market potential in the global energy management system market?

Market Overview

Market Size, Forecast, and Analysis

Figure: Global Energy Management System Market Snapshot

Source: Expert Interviews and BIS Research Analysis

The global energy management system market is projected to grow from $10.55 billion in 2020 to $30.15 billion by 2025, at a CAGR of 23.37% from 2020 to 2025. The growth in the energy management system market is expected to be driven by the increasing demand for energy conservation and environmental safety, the evolution of smart grid, and favorable government policies and incentive programs.

This system has garnered the attention of all types of end users, namely industrial, commercial, and residential. Catering to industrial end users, the demand for energy management systems is due to the increase in higher electricity consumption caused in order to run heavy load equipment such as transformers, AC/DC motors, and cranes on a 24*7 basis.

The energy management system has garnered adoption in commercial sectors across various business organizations. Catering to the commercial end users, the growth in the adoption of energy management system is due to the increase in the energy cost applicable to commercial facilities due to high electricity consuming devices such as commercial transformers, DG sets, data centers, and HVAC systems.

The use of energy management systems has helped the residential consumers to analyze a set of data collected from sensors planted at the site. The energy management system has been adapted to not only improve the operational performance but also ensure a secure living environment for the end users.

Impact of COVID-19 on Global Energy Management System Market

In 2020, the energy management system market is expected to experience a downfall of 9.20% from $11.62 billion in 2019 due to the COVID-19 pandemic, as energy consumption has reduced from commercial and industrial consumers in the first quarter of the year. With the lockdown being imposed in most parts across the world, there has been a drop in global energy demand as the energy consumption was majorly at the residential consumers, which is expected to impact the global energy management system market for this particular year. However, the growth of the energy management system market has been reviving from Q3 2020 once the operational activities regained normalcy with reduction in operational restrictions. The increasing operational activities and escalating electricity demand would allow the industrialized world and the business organizations to adopt energy management practices to meet the global electricity demand, without any blackouts.

Competitive Landscape

The competitive landscape of the energy management system market consists of different strategies undertaken by major players across the industry to gain market presence. Some of the strategies adopted by the energy management system providers are partnerships, and collaborations, new product launches, and business expansions. Among all the strategies adopted, partnerships and collaborations have been the most prominent strategy adopted by the energy management system providers. For instance, in June 2020, Zen Ecosystems and Ferguson HVAC partnered to provide intelligent energy management solution for solving commercial challenges of energy management. Additionally, in August 2020, Schneider Electric and Cisco collaborated on developing, testing and validating designs that help connect building management systems to an IP network that is easier to manage and is more scalable.

Most of the energy management system providers have numerous tie-ups with various power utilities and other technology providers. The industry landscape is quite competitive because of the market dominance of the few players in the market. Therefore, innovation and development have been the key factors for large scale growth in this market. To increase their overall global footprint, the energy management system providers are entering into strategic partnerships and expanding their businesses to increase their customer base.

Regional Market Dynamics

The energy management system market holds a prominent share in various countries of North America, Europe, Asia-Pacific and Japan, and the Middle East and Africa. North America is at the forefront of the global energy management system market, with a high market penetration rate in the U.S., Canada, and others, which are expected to display robust market growth in the coming five years.

During the forecast period, the Asia-Pacific and Japan region is expected to flourish as one of the most lucrative markets for energy management systems. The Asia-Pacific and Japan region is expected to exhibit significant growth opportunities for energy management system due to the increasing industrialization, which has led to increased energy consumption in countries such as Japan, South Korea, and India, thereby increasing the adoption of energy management system across organizations.

Energy Management System Market - A Global Market and Regional Analysis

Focus on Energy Management System Product and Application, Stakeholders Analysis and Country Analysis - Analysis and Forecast, 2019-2025

Frequently Asked Questions

Answer: The energy management system market is expected to reach $30.15 billion by 2025, growing at a CAGR of 23.37% during the forecast period.

Answer: The different opportunities that can possibly boost the growth of the market, include growing demand for electric vehicle (EV) charging infrastructure, increasing adoption of smart buildings, and rising scope for energy management in HVAC systems

Answer: The market growth is driven by factors such as increasing demand for energy conservation and environmental safety, evolution of smart grid, and favorable government policies and incentive programs.

Answer: The end user segment for the energy management system market, include industrial, commercial, and residential.

Answer: The key players operating in the market include ABB Ltd., C3.ai, Cisco Systems Inc., Cylon Controls Ltd., Engie S.A., General Electric, Honeywell International Inc., Ingersoll Rand plc, Johnson Controls, Rockwell Automation, Siemens AG, Schneider Electric, and Wattics Ltd.