A quick peek into the report

Table of Contents

2.1 Overview: Report Scope

2.2 Segmentation of the Global Hematology Testing Market

2.3 Assumptions and Limitations

2.4 Key Questions Answered in the Report

2.5 Base Year and Forecast Period

3.1 Overview: Report Methodology

4.1 Market Overview

4.2 Introduction to Hematology

4.3 Importance of Hematology Testing

4.4 Market Dynamics

4.5 Global Market Scenario

4.6 Assumptions and Limitations

5.1 Overview

5.2 Key Developments and Strategies

5.2.1 Product Launch and Development

5.2.2 Product Approvals and Certifications

5.2.3 Collaborations, Partnerships, and Joint Ventures

5.2.4 Business Expansions and Acquisitions

5.2.5 Others

5.3 Market Share Analysis

6.1 Validation of Hematology Systems

6.2 Regulatory Scenario

6.3 Key Industry Insight

6.3.1 Paradigm Shift toward Putting Hematology Analyzers on Lease instead of Sale

7.1 Overview

7.2 Instruments and Software

7.2.1 Hematology Analyzer and Software

7.2.2 Image Analyzer and Cell Counter

7.2.3 Flow Cytometer

7.2.4 Others

7.3 Consumables

7.3.1 Hematology Reagents

7.3.2 Flow Cytometry Reagents

7.3.3 Stains, Controls, and Calibrators

8.1 Overview

8.2 Hospitals

8.3 Clinical Testing Laboratories

8.4 Research Institutes

8.5 Patient Self-Testing

8.6 Others

9.1 Overview

9.2 North America

9.2.1 Overview

9.2.2 U.S.

9.2.3 Canada

9.3 Europe

9.3.1 Overview

9.3.2 Germany

9.3.3 U.K.

9.3.4 France

9.3.5 Italy

9.3.6 Rest-of-Europe

9.4 Asia-Pacific

9.4.1 Overview

9.4.2 Japan

9.4.3 China

9.4.4 India

9.4.5 Australia

9.4.6 South Korea

9.4.7 Rest-of-Asia-Pacific

9.5 Rest-of-the-World

9.5.1 Overview

10.1 Overview

10.2 Abbott Laboratories

10.2.1 Company Overview

10.2.2 Role of Abbott Laboratories in the Global Hematology Testing Market

10.2.3 Financials

10.2.4 SWOT Analysis

10.3 Agilent Technologies, Inc.

10.3.1 Company Overview

10.3.2 Role of Agilent Technologies, Inc. in the Global Hematology Testing Market

10.3.3 Financials

10.3.4 SWOT Analysis

10.4 Bio-Rad Laboratories, Inc.

10.4.1 Company Overview

10.4.2 Role of Bio-Rad Laboratories, Inc. in the Global Hematology Testing Market

10.4.3 Financials

10.4.4 SWOT Analysis

10.5 Boule Diagnostics AB

10.5.1 Company Overview

10.5.2 Role of Boule Diagnostics AB in the Global Hematology Testing Market

10.5.3 Financials

10.5.4 SWOT Analysis

10.6 Danaher Corporation

10.6.1 Company Overview

10.6.2 Role of Danaher Corporation in the Global Hematology Testing Market

10.6.3 Financials

10.6.4 SWOT Analysis

10.7 Drew Scientific Inc.

10.7.1 Company Overview

10.7.2 Role of Drew Scientific Inc. in the Global Hematology Testing Market

10.7.3 SWOT Analysis

10.8 EKF Diagnostics Holdings plc

10.8.1 Company Overview

10.8.2 Role of EKF Diagnostics Holdings plc in the Global Hematology Testing Market

10.8.3 Financials

10.8.4 SWOT Analysis

10.9 F. Hoffmann-La Roche Ltd

10.9.1 Company Overview

10.9.2 Role of F. Hoffmann-La Roche Ltd in the Global Hematology Testing Market

10.9.3 Financials

10.9.4 SWOT Analysis

10.10 HORIBA, Ltd.

10.10.1 Company Overview

10.10.2 Role of HORIBA, Ltd. in the Global Hematology Testing Market

10.10.3 Financials

10.10.4 SWOT Analysis

10.11 Mindray Medical International Limited

10.11.1 Company Overview

10.11.2 Role of Mindray Medical International Limited in the Global Hematology Testing Market

10.11.3 SWOT Analysis

10.12 Nihon Kohden Corporation

10.12.1 Company Overview

10.12.2 Role of Nihon Kohden Corporation in the Global Hematology Testing Market

10.12.3 Financials

10.12.4 SWOT Analysis

10.13 Siemens Healthineers AG

10.13.1 Company Overview

10.13.2 Role of Siemens Healthineers AG in the Global Hematology Testing Market

10.13.3 Financials

10.13.4 SWOT Analysis

10.14 Sysmex Corporation

10.14.1 Company Overview

10.14.2 Role of Sysmex Corporation in the Global Hematology Testing Market

10.14.3 Financials

10.14.4 SWOT Analysis

10.15 Thermo Fisher Scientific Inc.

10.15.1 Company Overview

10.15.2 Role of Thermo Fisher Scientific Inc. in the Global Hematology Testing Market

10.15.3 Financials

10.15.4 SWOT Analysis

10.16 Transasia Bio-Medicals Ltd.

10.16.1 Company Overview

10.16.2 Role of Transasia Bio-Medicals Ltd. in the Global Hematology Testing Market

10.16.3 SWOT Analysis

Table 1: Global Hematology Testing Market, 2018 and 2029

Table 2: Impact Analysis of Market Drivers

Table 3: Impact Analysis of Market Challenges

Table 4.1: Common Hematology Tests and Uses

Table 6.1: Guidelines Under ISLH

Table 6.2: Regulatory Authorities/Associations/Consortiums of the Global Hematology Testing Market

Table 7.1: Examples of Hematology Analyzers Offered by Key Companies of Hematology Testing Market

Table 7.2: Examples of Hematology Reagents Offered by Key Companies of Hematology Testing Market

Table 7.3: Examples of Stains, Controls, and Calibrators Offered by Key Companies of Hematology Testing Market

Table 9.1: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in the U.S. for the Time Period between 2010 and 2017

Table 9.2: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in the Canada between 2010 and 2017

Table 9.3: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in the Germany for the Time Period between 2010 and 2017

Table 9.4: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in the U.K. for the Time Period between 2010 and 2017

Table 9.5: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in France between 2010 and 2017

Table 9.6: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in Italy for the Time Period between 2010 and 2017

Table 9.7: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in Japan for the Time Period between 2010 and 2017

Table 9.8: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in China for the Time Period between 2010 and 2017

Table 9.9: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in India for the Time Period between 2010 and 2017

Table 9.10: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in Australia for the Time Period between 2010 and 2017

Table 9.11: Number of Deaths, Incidence, and Prevalence of Common Hematologic Diseases in South Korea for the Time Period between 2010 and 2017

Figure 1: Global Hematology Testing Market Segmentation, 2018 and 2029

Figure 2: Share of Key Developments and Strategies, January 2016-July 2019

Figure 3: Global Hematology Testing Market Share (by Company), 2018

Figure 4: Global Hematology Testing Market Share (by Product Type), 2018 and 2029

Figure 5: Global Hematology Testing Market Share (by End User), 2018 and 2029

Figure 6: Global Hematology Testing Market Share (by Region), 2018 and 2029

Figure 2.1: Global Hematology Testing Market Segmentation

Figure 3.1: Global Hematology Testing Market Research Methodology

Figure 3.2: Primary Research

Figure 3.3: Secondary Research

Figure 3.4: Data Triangulation

Figure 3.5: Bottom-up Approach (Segment-wise Analysis)

Figure 3.6: Top-Down Approach (Segment-wise Analysis)

Figure 3.7: Assumptions and Limitations

Figure 4.1: Drivers and Challenges of the Global Hematology Testing Market

Figure 4.2: Global Hematology Testing Market, 2018-2029

Figure 5.1: Competitive Landscape (January 2016-September- 2019)

Figure 5.2: Share of Key Developments and Strategies, January 2016-September 2019

Figure 5.3: Product Launches and Developments (by Company), January 2016 and September 2019

Figure 5.4: Product Approvals and Certifications (by Company), January 2016 and September 2019

Figure 5.5: Collaborations, Partnerships, and Joint Ventures (by Company), January 2016 and September 2019

Figure 5.6: Business Expansions (by Company), January 2016 and September 2019

Figure 5.7: Market Share Analysis of Global Hematology Testing Market, 2017 and 2018

Figure 7.1: Global Hematology Testing Market Segmentation (by Product Type)

Figure 7.2: Global Hematology Testing Market (by Product), 2018-2029

Figure 7.3: Global Hematology Testing Market (by Instrument and Software), 2018-2029

Figure 7.4: Global Hematology Testing Market (Hematology Analyzer and Software), 2018-2029

Figure 7.5: Global Hematology Testing Market (Image Analyzer and Cell Counter), 2018-2029

Figure 7.6: Global Hematology Testing Market (Flow Cytometer), 2018-2029

Figure 7.7: Global Hematology Testing Market (Others), 2018-2029

Figure 7.8: Global Hematology Testing Market (by Consumable), 2018-2029

Figure 7.9: Global Hematology Testing Market (Hematology Reagents), 2018-2029

Figure 7.10: Global Hematology Testing Market (Flow Cytometry Reagents), 2018-2029

Figure 7.11: Global Hematology Testing Market (Stains, Controls, and Calibrators Reagents), 2018-2029

Figure 8.1: Global Hematology Testing Market Segmentation (by End User)

Figure 8.2: Global Hematology Testing Market (by End User), 2018-2029

Figure 8.3: Global Hematology Testing Market (Hospitals), 2018-2029

Figure 8.4: Global Hematology Testing Market (Clinical Testing Laboratories), 2018-2029

Figure 8.4: Global Hematology Testing Market (Research Institutes), 2018-2029

Figure 8.5: Global Hematology Testing Market (Patient Self-Testing), 2018-2029

Figure 8.6: Global Hematology Testing Market (Others), 2018-2029

Figure 9.1: Global Hematology Testing Market (by Region), 2018-2029

Figure 9.2: North America: Hematology Testing Market, 2018-2029

Figure 9.3: North America: Market Dynamics

Figure 9.4: North America: Hematology Testing Market (by Country), 2018-2029

Figure 9.5: U.S.: Hematology Testing Market, 2018-2029

Figure 9.6: Canada: Hematology Testing Market, 2018-2029

Figure 9.7: Europe: Hematology Testing Market, 2018-2029

Figure 9.8: Europe: Market Dynamics

Figure 9.9: Europe: Hematology Testing Market (by Country), 2018-2029

Figure 9.10: Germany: Hematology Testing Market, 2018-2029

Figure 9.11: U.K.: Hematology Testing Market, 2018-2029

Figure 9.12: France: Hematology Testing Market, 2018-2029

Figure 9.13: Italy: Hematology Testing Market, 2018-2029

Figure 9.14: Rest-of-Europe: Hematology Testing Market, 2018-2029

Figure 9.15: Asia-Pacific: Hematology Testing Market, 2018-2029

Figure 9.16: Asia-Pacific: Market Dynamics

Figure 9.17: Asia-Pacific: Hematology Testing Market (by Country), 2018-2029

Figure 9.18: Japan: Hematology Testing Market, 2018-2029

Figure 9.19: China: Hematology Testing Market, 2018-2029

Figure 9.20: India: Hematology Testing Market, 2018-2029

Figure 9.21: Australia: Hematology Testing Market, 2018-2029

Figure 9.22: South Korea: Hematology Testing Market, 2018-2029

Figure 9.23: Rest-of-Asia-Pacific: Hematology Testing Market, 2018-2029

Figure 9.24: Rest-of-the-World: Hematology Testing Market, 2018-2029

Figure 9.25: Rest-of-the-World: Market Dynamics

Figure 10.1: Shares of Key Company Profiles

Figure 10.2: Abbott Laboratories: Product Portfolio for Global Hematology Testing Market

Figure 10.3: Abbott Laboratories: Overall Financials, 2016-2018

Figure 10.4: Abbott Laboratories: Revenue (by Business Segment), 2016-2018

Figure 10.5: Abbott Laboratories: Revenue (by Region), 2016-2018

Figure 10.6: Abbott Laboratories: R&D Expenditure (2016-2018)

Figure 10.7: Abbott Laboratories: SWOT Analysis

Figure 10.8: Agilent Technologies, Inc.: Product Portfolio for Global Hematology Testing Market

Figure 10.9: Agilent Technologies, Inc.: Overall Financials, 2016-2018

Figure 10.10: Agilent Technologies, Inc.: Revenue (by Business Segment), 2016-2018

Figure 10.11: Agilent Technologies, Inc.: (by Region), 2016-2018

Figure 10.12: Agilent Technologies, Inc.: R&D Expenditure (2016-2018)

Figure 10.13: Agilent Technologies, Inc.: SWOT Analysis

Figure 10.14: Bio-Rad Laboratories, Inc.: Product Portfolio for Global Hematology Testing Market

Figure 10.15: Bio-Rad Laboratories, Inc.: Overall Financials, 2016-2018

Figure 10.16: Bio-Rad Laboratories, Inc.: Revenue (by Business Segment), 2016-2018

Figure 10.17: Bio-Rad Laboratories, Inc.: Revenue (by Region), 2016-2018

Figure 10.18: Bio-Rad Laboratories, Inc.: R&D Expenditure (2016-2018)

Figure 10.19: Bio-Rad Laboratories, Inc.: SWOT Analysis

Figure 10.20: Boule Diagnostics AB: Product Portfolio for Global Hematology Testing Market

Figure 10.21: Boule Diagnostics AB: Overall Financials, 2016-2018

Figure 10.22: Boule Diagnostics AB: Revenue (by Business Segment), 2016-2018

Figure 10.23: Boule Diagnostics AB: Revenue (by Region), 2016-2018

Figure 10.24: Boule Diagnostics AB: R&D Expenditure (2016-2018)

Figure 10.25: Boule Diagnostics AB: SWOT Analysis

Figure 10.26: Danaher Corporation: Product Portfolio for Global Hematology Testing Market

Figure 10.27: Danaher Corporation: Overall Financials, 2016-2018

Figure 10.28: Danaher Corporation: Revenue (by Business Segment), 2016-2018

Figure 10.29: Danaher Corporation: Revenue (by Region), 2016-2018

Figure 10.30: Danaher Corporation: R&D Expenditure (2016-2018)

Figure 10.31: Danaher Corporation: SWOT Analysis

Figure 10.32: Drew Scientific Inc.: Product Portfolio for Global Hematology Testing Market

Figure 10.33: Drew Scientific Inc.: SWOT Analysis

Figure 10.34: EKF Diagnostics Holdings plc: Product Portfolio for Global Hematology Testing Market

Figure 10.35: EKF Diagnostics Holdings plc: Overall Financials, 2016-2018

Figure 10.36: EKF Diagnostics Holdings plc: Revenue (by Business Segment), 2016-2018

Figure 10.37: EKF Diagnostics Holdings plc: (by Region), 2016-2018

Figure 10.38: EKF Diagnostics Holdings plc: R&D Expenditure (2016-2018)

Figure 10.39: EKF Diagnostics Holdings plc: SWOT Analysis

Figure 10.40: F. Hoffmann-La Roche Ltd: Product Portfolio for Global Hematology Testing Market

Figure 10.41: F. Hoffmann-La Roche Ltd: Overall Financials, 2016-2018

Figure 10.42: F. Hoffmann-La Roche Ltd: Revenue (by Business Segment), 2016-2018

Figure 10.43: F. Hoffmann-La Roche Ltd: (Revenue by Diagnostics Segment), 2016-2018

Figure 10.44: F. Hoffmann-La Roche Ltd: Revenue (by Region), 2016-2018

Figure 10.45: F. Hoffmann-La Roche Ltd: R&D Expenditure (2016-2018)

Figure 10.46: F. Hoffmann-La Roche Ltd: SWOT Analysis

Figure 10.47: HORIBA, Ltd.: Product Portfolio for Global Hematology Testing Market

Figure 10.48: HORIBA, Ltd.: Overall Financials, 2016-2018

Figure 10.49: HORIBA, Ltd.: Revenue (by Business Segment), 2016-2018

Figure 10.50: HORIBA, Ltd.: Medical-Diagnostic Instruments & Systems Revenue (by Region), 2016-2018

Figure 10.51: HORIBA, Ltd.: R&D Expenditure (2016-2018)

Figure 10.52: HORIBA, Ltd.: SWOT Analysis

Figure 10.53: Mindray Medical International Limited: Product Portfolio for Global Hematology Testing Market

Figure 10.54: Mindray Medical International Limited: SWOT Analysis

Figure 10.55: Nihon Kohden Corporation: Product Portfolio for Global Hematology Testing Market

Figure 10.56: Nihon Kohden Corporation: Overall Financials, 2016-2018

Figure 10.57: Nihon Kohden Corporation: Revenue (by Business Segment), 2016-2018

Figure 10.58: Nihon Kohden Corporation: Revenue (by Region), 2016-2018

Figure 10.59: Nihon Kohden Corporation: R&D Expenditure (2016-2018)

Figure 10.60: Nihon Kohden Corporation: SWOT Analysis

Figure 10.61: Siemens Healthineers AG: Product Portfolio for Global Hematology Testing Market

Figure 10.62: Siemens Healthineers AG: Overall Financials, 2016-2018

Figure 10.63: Siemens Healthineers AG: Revenue (by Business Segment), 2016-2018

Figure 10.64: Siemens Healthineers AG: Revenue (by Region), 2016-2018

Figure 10.65: Siemens Healthineers AG: R&D Expenditure (2016-2018)

Figure 10.66: Siemens Healthineers AG: SWOT Analysis

Figure 10.67: Sysmex Corporation: Product Portfolio for Global Hematology Testing Market

Figure 10.68: Sysmex Corporation: Overall Financials, 2016-2018

Figure 10.69: Sysmex Corporation: Revenue (by Business Segment), 2016-2018

Figure 10.70: Sysmex Corporation: Revenue (by Region), 2016-2018

Figure 10.71: Sysmex Corporation: R&D Expenditure (2016-2018)

Figure 10.72: Sysmex Corporation: SWOT Analysis

Figure 10.73: Thermo Fisher Scientific Inc.: Product Portfolio for Global Hematology Testing Market

Figure 10.74: Thermo Fisher Scientific Inc.: Overall Financials, 2016-2018

Figure 10.75: Thermo Fisher Scientific Inc.: Revenue (by Business Segment), 2016-2018

Figure 10.76: Thermo Fisher Scientific Inc.: Revenue (by Region), 2016-2018

Figure 10.77: Thermo Fisher Scientific Inc.: R&D Expenditure (2016-2018)

Figure 10.78: Thermo Fisher Scientific Inc.: SWOT Analysis

Figure 10.79: Transasia Bio-Medicals Ltd.: Product Portfolio for Global Hematology Testing Market

Figure 10.80: Transasia Bio-Medicals Ltd.: SWOT Analysis

Market Overview

Overview on the Global Hematology Testing Market

The ability of hematology test to effectively measure several blood components has made it an essential screening tool to diagnose a wide range of blood-related disorders, including anemia, blood cancer, hemorrhagic conditions, and blood infections, among others that affect millions of people each year across all age groups. Increasing incidences of hematology disorders and growing awareness related to the availability of wide range of diagnostic option to treat these targeted disorders are the primary factors driving the growth of the hematology testing market. Automation, being the primary focus of the hematology testing, the market has been witnessing considerable technological advancements with respect to products that offer effective, accurate, and fast testing results. The availability of automated hematology analyzers has further led to reduced administrative error, making the process more effective and efficient in disease diagnosis, as compared to manual hematology testing. The market also witnesses a paradigm shift toward patient-self-testing that eliminates the requirement to travel to a lab, clinic or physicians’ office for having the tests done. With the emergence of high throughput hematology analyzers and point-of-care devices, more companies are expected to enter into the market, investing more in its research and development with an effort to develop cost-effective and advanced hematology systems.

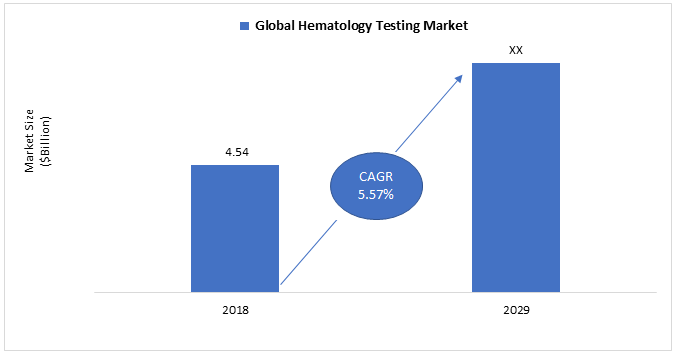

Global Hematology Testing Market Forecast, 2019-2029

Source: Secondary Research, Expert Views, and BIS Research Analysis

The global hematology testing market was valued to be $4.54 billion in 2018 and is anticipated to witness an impressive single-digit growth rate, to reach $XX billion by 2029.

Expert Quote

“Technological advancements in hematology products and the need to develop sophisticated analyzers are propelling huge research activities by established players to develop innovative product lines. Most of the companies in the industry are working toward developing compact, user-friendly, and accurate hematology analyzers that are efficient and provide fast results. The advent of point-of-care hematology testing equipment is also expected to bring about a boom in the market in the upcoming years”

Scope of the Global Hematology Testing Market

The report constitutes of an in-depth study of the global hematology testing market, including a thorough analysis of the types of products. The study also presents a detailed analysis of the market dynamics and the estimation of the market size over the forecast period 2019-2029. The scope of this report is focused on the different products of Global Hematology Testing, and end-users as well as country-wise analysis.

The purpose of the study is to gain a holistic view of the global hematology testing market in terms of various factors influencing it, including regulatory reforms and technological advancements. The market has been segmented into ‘product type’, ‘end-user’, and ‘region’. The scope of this report is centered upon conducting a detailed study of the products allied with the global hematology testing market. In addition, the study also includes exhaustive information on the unmet needs, new products, competitive landscape, market share of leading manufacturers, growth potential of each product, application, nature, technology and region, as well as other vital information with respect to the global hematology testing market.

Market Segmentation

By Product Type

Instruments and Software

• Hematology Analyzer and Software

• Flow Cytometer

• Image Analyzer and Cell Counter

• Others

Consumables

• Hematology Reagents

• Flow Cytometry Reagents

• Stains, Controls and Calibrators

By End User

• Hospitals

• Clinical Testing Laboratories

• Research Institutions

• Patient Self-Testing

• Others

By Region

• North America

• Europe

• Asia-Pacific

• Rest-of-the-World

Key Companies of the Global Hematology Testing Industry

The key players contributing to the global hematology testing market are Abbott laboratories, Agilent Technologies, Bio-Rad Laboratories, Inc., Boule Diagnostics AB, Danaher Corporation, Drew Scientific, EKF Diagnostics, F. Hoffmann-La Roche Ltd, HORIBA, Ltd., Mindray Medical International Limited, Nihon Kohden Corporation, Siemens Healthineers, Sysmex Corporation, Thermo Fisher Scientific Inc, and Transasia Bio-Medicals Ltd.

Key Questions Answered in this Report:

• What is the importance of hematology testing and what are the products involved in hematology testing?

• What are the key trends of the global hematology testing market? How is the market evolving and what is its future scope?

• What are the major drivers, challenges, and opportunities of the global hematology testing market?

• What are the key developmental strategies implemented by the key players of the global hematology testing market to sustain the competition of the market? What is the percentage share of each of the key players in different key developmental strategies?

• Which are the key companies offering hematology products in the market or have their products in the pipeline? Which are the leading companies dominating the global hematology testing market? What was the market share of each of the key players of the global hematology testing market in 2017 and 2018?

• What is the regulatory scenario of the global hematology testing market? What are the initiatives implemented by different governmental bodies and guidelines put forward to regulate the commercialization of hematology testing products?

• What was the market size of the global hematology testing market in 2018 and what is the market size anticipated to be in 2029? What is the expected growth rate of the global hematology testing market during the time period between 2019 and 2029?

• What are the different instruments and consumables involved in hematology testing? Which instrument type and consumable dominate the market in 2018 and why? Which instrument and consumable are expected to witness highest growth rate and to dominate in market in 2029?

• What are the different end-users of the global hematology testing market? Which end-user type dominates the market in 2018 and is expected to dominate in 2029?

• What was the market value of the leading segments and sub-segments of the global hematology testing market? What are the different macro and micro factors influencing the growth of the market?

• How is the industry expected to evolve during the forecast period 2019-2029? How is each segment of the global hematology market expected to grow during the forecast period, and what is the revenue expected to be generated by each of the segments by the end of 2029?

• Which region is expected to contribute the highest sales of the global hematology testing market during the time period between 2018 and 2029? Which region and country carries the potential for the significant expansion of key companies for different hematology testing products? What are the leading countries of different regions that contribute significantly toward the growth of the hematology testing market?

• What are the key players of the global hematology testing market and what is their role in the market?

Report Description

Scope of the Global Hematology Testing Market

The report constitutes of an in-depth study of the global hematology testing market, including a thorough analysis of the types of products. The study also presents a detailed analysis of the market dynamics and the estimation of the market size over the forecast period 2019-2029. The scope of this report is focused on the different products of Global Hematology Testing, and end-users as well as country-wise analysis.

The purpose of the study is to gain a holistic view of the global hematology testing market in terms of various factors influencing it, including regulatory reforms and technological advancements. The market has been segmented into ‘product type’, ‘end-user’, and ‘region’. The scope of this report is centered upon conducting a detailed study of the products allied with the global hematology testing market. In addition, the study also includes exhaustive information on the unmet needs, new products, competitive landscape, market share of leading manufacturers, growth potential of each product, application, nature, technology and region, as well as other vital information with respect to the global hematology testing market.

Market Segmentation

By Product Type

Instruments and Software

• Hematology Analyzer and Software

• Flow Cytometer

• Image Analyzer and Cell Counter

• Others

Consumables

• Hematology Reagents

• Flow Cytometry Reagents

• Stains, Controls and Calibrators

By End User

• Hospitals

• Clinical Testing Laboratories

• Research Institutions

• Patient Self-Testing

• Others

By Region

• North America

• Europe

• Asia-Pacific

• Rest-of-the-World

Key Companies of the Global Hematology Testing Industry

The key players contributing to the global hematology testing market are Abbott laboratories, Agilent Technologies, Bio-Rad Laboratories, Inc., Boule Diagnostics AB, Danaher Corporation, Drew Scientific, EKF Diagnostics, F. Hoffmann-La Roche Ltd, HORIBA, Ltd., Mindray Medical International Limited, Nihon Kohden Corporation, Siemens Healthineers, Sysmex Corporation, Thermo Fisher Scientific Inc, and Transasia Bio-Medicals Ltd.

Global Hematology Testing Market

Focus on Product Type, End-User, 11 Countries’ Data, and Competitive Landscape – Analysis and Forecast, 2019-2029