A quick peek into the report

Table of Contents

1.1 Technology Exclusion Criteria

2.1 Key Questions Answered in the Report

2.2 Forecast Period Selection Criteria

3.1 Primary Research

3.2 Secondary Research

3.3 Data Sources and Categorization

3.4 Criteria for Company Profiles

3.5 Market Estimation and Forecast Methodology

3.6 Data Triangulation

3.7 Assumptions and Limitations

4.1 Regulatory Framework

4.1.1 U.S.

4.1.1.1 Medical Device Classification: U.S.

4.1.2 Medical Device Regulations in European Union

4.2 Global Medical Devices Testing Requirements: ASTM Standards

4.3 Global Medical Devices Testing Requirements: ISO Standards

5.1 Overview

5.2 Key Developments and Strategies

5.2.1 Acquisitions

5.2.2 Service Portfolio Expansions

5.2.3 Partnerships, Collaborations, and Joint Ventures

5.2.4 Business and Regional Expansion

5.2.5 Accreditations

5.2.6 Funding Activities

5.3 Market Share Analysis

5.4 Medical Devices Testing Services Vendor Analysis

6.1 Assumptions and Limitations

6.2 Market Overview

6.2.1 Market Drivers

6.2.1.1 Increased Pace of Medical Device Regulatory Changes Benefiting Medical Devices Testing Service Providers

6.2.1.2 Increasing Medical Device Product Recalls Reflecting the Need for Proper Implementation of Product Safety Testing

6.2.2 Market Restraints

6.2.2.1 Barriers to Innovation in Medical Device Industry

6.3 Potential Opportunities – Global Medical Devices Testing Services Market

6.3.1 Rising Medical Device Marketplace Producing Lucrative Opportunities to Medical Devices Testing Service Providers

6.3.2 Surge in Medical Device Clinical Trials on the Global Level Signify Increased Need for Outsourcing Services

7.1 Overview

7.2 Medical Device Sterility Assurance & Microbiology Testing

7.2.1 Sterilization Validation

7.2.2 Bioburden Testing

7.2.3 Reusable Device Studies and Disinfection Studies

7.2.4 Environmental Monitoring

7.2.5 Pyrogen Testing

7.2.6 Antimicrobial Testing

7.2.7 Antibiotic Potency Testing

7.3 Medical Device Biocompatibility Testing

7.3.1 Genetic Toxicology Testing

7.3.2 Sensitization Testing

7.3.3 Irritation Testing

7.3.4 Hemocompatibility Testing

7.3.5 Cytotoxicity Testing

7.3.6 Extractables & Leachables Testing

7.3.7 Systemic Toxicity Testing

7.3.8 Physicochemical Testing

7.4 Medical Device Stability Testing

7.4.1 Accelerated Aging Shelf Life Testing

7.4.2 Packaging Validation

7.4.3 Transportation and Distribution Testing

7.5 Material Characterization Analytical Testing

7.5.1 Industrial Standards Pertaining to the Medical Device Material Characterization Analytical Testing

7.5.2 Polymer Testing

7.5.3 Surface Analysis

7.5.4 Thermal Analysis

7.5.5 Elemental Analysis

7.5.6 Corrosion Testing

7.5.7 Microscopy Testing

7.6 Medical Device Preclinical Testing

7.6.1 Model Development and Testing, Feasibility Studies, and In-Silico Model Testing

7.6.2 Safety and Efficacy Studies

8.1 Overview

8.2 North America

8.2.1 Overview

8.2.2 U.S.

8.2.3 Canada

8.3 Europe

8.3.1 Overview

8.3.2 Germany

8.3.3 U.K.

8.3.4 France

8.3.5 Italy

8.3.6 Spain

8.3.7 Rest-of-Europe

8.4 Asia-Pacific

8.4.1 Overview

8.4.2 Japan

8.4.3 China

8.4.4 India

8.4.5 Australia and New Zealand

8.4.6 South Korea

8.4.7 Rest-of-Asia-Pacific

8.5 Rest-of-the-World

8.5.1 Overview

8.5.2 Latin America

8.5.3 Middle East and Africa

9.1 Overview

9.2 Absorption Systems LLC

9.2.1 Company Overview

9.2.2 Role of Absorption Systems LLC in the Global Medical Devices Testing Services Market

9.2.3 SWOT Analysis

9.3 American Preclinical Services, LLC.

9.3.1 Company Overview

9.3.2 Role of American Preclinical Services, LLC. in the Global Medical Devices Testing Services Market

9.3.3 SWOT Analysis

9.4 Bureau Veritas S.A.

9.4.1 Company Overview

9.4.2 Role of Bureau Veritas S.A. in the Global Medical Devices Testing Services Market

9.4.3 Financials

9.4.4 Key Insights About Financial Health of the Company

9.4.5 SWOT Analysis

9.5 Charles River Laboratories International, Inc.

9.5.1 Company Overview

9.5.2 Role of Charles River Laboratories International, Inc. in the Global Medical Devices Testing Services Market

9.5.3 SWOT Analysis

9.6 Eurofins Scientific Group

9.6.1 Company Overview

9.6.2 Role of Eurofins Scientific Group in the Global Medical Devices Testing Services Market

9.6.3 Financials

9.6.4 SWOT Analysis

9.7 Element Materials Technology Group

9.7.1 Company Overview

9.7.2 Role of Element Materials Technology Group in the Global Medical Devices testing services market

9.7.3 SWOT Analysis

9.8 Intertek Group plc

9.8.1 Company Overview

9.8.2 Role of Intertek Group plc. in the Global Medical Devices Testing Services Market

9.8.3 Financials

9.8.4 SWOT Analysis

9.9 North American Science Associates, Inc.

9.9.1 Company Overview

9.9.2 Role of North American Science Associates, Inc. in the Global Medical Device Services Market

9.9.3 SWOT Analysis

9.10 Pace Analytical Services, LLC.

9.10.1 Company Overview

9.10.2 Role of Pace Analytical Services, LLC in the Medical Devices testing services market

9.11 Pacific BioLabs Inc.

9.11.1 Company Overview

9.11.2 Role of Pacific BioLabs Inc in the Global Medical Devices testing services market

9.11.3 SWOT Analysis

9.12 Sotera Health LLC

9.12.1 Company Overview

9.12.2 Role of Sotera Health LLC in the Global Medical Devices Testing Services Market

9.12.3 SWOT Analysis

9.13 SGS S.A.

9.13.1 Company Overview

9.13.2 Role of SGS S.A. in the Global Medical Devices testing services market

9.13.3 Financials

9.13.4 SWOT Analysis

9.14 TÜV SÜD AG

9.14.1 Company Overview

9.14.2 Role of TÜV SÜD AG in the Global Medical Devices Testing Services Market

9.14.3 Financials

9.14.4 SWOT Analysis

9.15 Toxikon Corporation

9.15.1 Company Overview

9.15.2 Role of Toxikon Corporation in the Global Medical Devices testing services market

9.15.3 SWOT Analysis

9.16 WuXi AppTec Co., Ltd.

9.16.1 Company Overview

9.16.2 Role of TÜV SÜD AG in the Global Medical Devices Testing Services Market

9.16.3 SWOT Analysis

Table 1: Medical Devices Testing Services at a Glance

Table 2: Impact Analysis of Market Drivers

Table 3: Impact Analysis of Market Restraints

Table 4: Impact Analysis of Market Opportunities

Table 4.1: Medical Devices Testing Requirements: ASTM Standards

Table 4.2: Medical Devices Testing Requirements: ISO Standards

Table 6.1: Impact Analysis of Market Drivers

Table 6.2: Impact Analysis of Market Restraints

Table 7.1: ISO Materials Biocompatibility Matrix

Table 8.1: Test Revenue: Global Medical Devices Testing Services Market (Region), $Million, 2018-2029

Table 8.2: Test Volume: Global Medical Devices Testing Services Market (by Region), Thousand Units, 2018-2029

Table 8.3: North America: Medical Devices Testing Services Market (by Country), 2018-2029

Table 8.4: Test Revenue: Europe Medical Devices Testing Services Market (by Country), 2018-2029

Table 8.5: Asia-Pacific: Medical Devices Testing Services Market (by Country), 2018-2029

Table 9.1: Charles River Laboratories International, Inc.: Key Financials (2016-2018)

Table 9.2: Charles River Laboratories International, Inc.: Net Revenue, by Segment (2016-2018)

Table 9.3: Charles River Laboratories International, Inc.: Net Revenue, by Region (2016-2018)

Table 9.4: Eurofins Scientific Group.: Key Financials (2016-2018)

Table 9.5: Eurofins Scientific Group: Net Revenue, by Region (2016-2018)

Table 9.6: Eurofins Scientific Group: Net Revenue, by Western Europe (2016-2018)

Table 9.7: Intertek Group plc: Key Financials (2016-2018)

Table 9.8: Intertek Group plc: Net Revenue, by Region (2016-2018)

Table 9.9: SGS S.A.: Key Financials (2017-2019)

Table 9.10: SGS S.A.: Net Revenue, by Segment (2017-2019)

Table 9.11: SGS S.A.: Net Revenue, by Region (2017-2019)

Table 9.12: TÜV SÜD AG: Key Financials (2016-2018)

Table 9.13: TÜV SÜD AG: Net Revenue, by Segment (2016-2018)

Table 9.14: TÜV SÜD AG: Net Revenue, by Region (2016-2018)

Table 9.15: WuXi AppTec Co., Ltd.: Key Financials (2016-2018)

Table 9.16: WuXi AppTec Co., Ltd.: Net Revenue, by Segment (2017-2018)

Table 9.17: WuXi AppTec Co., Ltd.: Net Revenue, by Region (2017-2018)

Figure 1: Global Medical Devices Market Outlook

Figure 2: U.S. Medical Devices Product Recalls (2013-2018)

Figure 3: Medical Devices Testing Services at a Glance

Figure 4: Global Medical Device Testing Services Market Share Analysis

Figure 5: Global Medical Devices testing services market (Test Revenue) (2018, 2022, 2025, and 2029)

Figure 6: Global Medical Devices Testing Services Market (Type of Test) (2018 and 2029)

Figure 7: Global Medical Devices Testing Services Market, by Test Revenue (by Region) (2018, 2022, 2025, and 2029)

Figure 8: Global Medical Devices testing services market, by Test Volume (2018, 2022, 2025, and 2029)

Figure 9: Global Medical Devices testing services market, by Test Volume (2018, and 2029)

Figure 10: Global Medical Devices Testing Services Market, by Test Volume (by Region) (2018, 2022, 2025, and 2029)

Figure 11: North America Medical Devices Testing Services Market Share (by Region), 2018 and 2029

Figure 12: Europe Medical Devices Testing Services Market Share (by Region), 2018 and 2029

Figure 13: Asia-Pacific Medical Devices Testing Services Market Share (by Region), 2018 and 2029

Figure 2.1: Global Medical Devices Testing Services Market Segmentation (by Test Type)

Figure 3.1: Research Methodology

Figure 3.2: Primary Research Methodology

Figure 3.3: Secondary Research

Figure 3.4: Data Triangulation

Figure 3.5: Assumptions and Limitations

Figure 4.1: Medical Devices Classification: U.S.

Figure 4.2: Regulatory Process of Medical Devices in the U.S.

Figure 4.3: MDR Transitional Provisions

Figure 4.4: Medical Device Regulations in European Union

Figure 4.5: MDR Timeline

Figure 4.6: Impact of MDR

Figure 5.1: Competitive Landscape (January 2016- February 2020)

Figure 5.2: Share of Key Developments and Strategies, January 2016-February 2020

Figure 5.3: Acquisitions (by Company), January 2016 and February 2020

Figure 5.4: Service Portfolio Expansion (by Company), January 2016 and February 2020

Figure 5.5: Partnerships, Collaborations, and Joint Ventures (by Company), January 2016- February 2020

Figure 5.6: Business and Regional Expansion (by Company), January 2016- February 2020

Figure 5.7: Accreditations (by Company), January 2016- February 2020

Figure 5.8: Market Share Analysis (by Companies), 2017 and 2018

Figure 6.1: Test Revenue and Test Volume: Medical devices testing services market, 2018-2029

Figure 6.2: Changing Regulatory Landscape Impacting Medical Device, In-Vitro Diagnostic, and Pharmaceutical Industry Verticals

Figure 6.3: Total Number of Medical Device Product Recalls in the U.S. (2012-2018)

Figure 6.4: Medical Device Product Recalls in the U.S. (by Class) (2015-2018)

Figure 6.5: Global Medical Device Market, 2016-2022 ($Billion)

Figure 6.6: Medical Device Trials, 2011-2017

Figure 6.7: Global Medical Devices Testing Services Market Size and Forecast, 2018-2029

Figure 7.1: Global Medical Devices Testing Services Market Segmentation (by Test Type)

Figure 7.2: Global Medical Devices Testing Services Market (by Test Type), 2018-2029

Figure 7.3: Test Revenue and Test Volume: Global Medical Device Testing Services Market (Sterility Assurance & Microbiology Testing), 2018-2029

Figure 7.4: Test Revenue and Test Volume: Medical Device Sterility Assurance & Microbiology Testing Market for Sterilization Validation, 2018-2029

Figure 7.5: Test Revenue and Test Volume: Sterility Assurance & Microbiology Testing Market for Bioburden Testing, 2018-2029

Figure 7.6: Test Revenue and Test Volume: Sterility Assurance & Microbiology Testing Market for Reusable Device Studies and Disinfection Studies, 2018-2029

Figure 7.7: Test Revenue and Test Volume: Sterility Assurance & Microbiology Testing Market for Environmental Monitoring, 2018-2029

Figure 7.8: Test Revenue and Test Volume: Sterility Assurance & Microbiology Testing Market for Pyrogen Testing, 2018-2029

Figure 7.9: Test Revenue and Test Volume: Sterility Assurance & Microbiology Testing Market for Antimicrobial Testing, 2018-2029

Figure 7.10: Test Revenue and Test Volume: Sterility Assurance & Microbiology Testing Market for Antibiotic Potency Testing, 2018-2029

Figure 7.11: Test Revenue and Test Volume: Biocompatibility Testing Services Market (2018, 2024, and 2029)

Figure 7.12: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Genetic Toxicology Testing, (2018-2029)

Figure 7.13: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Sensitization Testing, 2018-2029

Figure 7.14: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Irritation Testing, 2018-2029

Figure 7.15: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Hemocompatibility Testing, 2018-2029

Figure 7.16: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Cytotoxicity Testing, 2018-2029

Figure 7.17: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Extractables & Leachables Testing, 2018-2029

Figure 7.18: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Systemic Toxicity Testing, 2018-2029

Figure 7.19: Test Revenue and Test Volume: Biocompatibility Testing Services Market for Physicochemical Testing, 2018-2029

Figure 7.20: Test Revenue and Test Volume: Stability Testing Services Market (2018, 2024, and 2029)

Figure 7.21: Test Revenue and Test Volume: Stability Testing Market for Accelerated Aging Shelf Life Testing, 2018-2029

Figure 7.22: Test Revenue and Test Volume: Stability Testing Market for Packaging Validation, 2018-2029

Figure 7.23: Test Revenue and Test Volume: Stability Testing Market for Transportation and Distribution Testing, 2018-2029

Figure 7.24: Test Revenue and Test Volume: Material Characterization Analytical Testing Services Market, 2018-2029

Figure 7.25: Medical Device Material Characterization Analytical Testing Market for Polymer Testing, 2018-2029

Figure 7.26: Medical Device Material Characterization Analytical Testing Market for Surface Analysis, 2018-2029

Figure 7.27: Medical Device Material Characterization Analytical Testing for Thermal Analysis, 2018-2029

Figure 7.28: Medical Devices Material Characterization Analytical Testing for Elemental Analysis, 2018-2029

Figure 7.29: Medical Devices Material Characterization Analytical Testing Market for Corrosion Testing, 2018-2029

Figure 7.30: Medical Devices Material Characterization Analytical Testing, for Microscopy Testing, 2018-2029

Figure 7.31: Test Revenue and Test Volume: Medical Device Preclinical Testing Market, 2018-2029

Figure 7.32: Test Revenue and Test Volume: Medical Devices Preclinical Testing Market for Model Development and Testing, Feasibility Studies, and In Silico Model Testing, 2018-2029

Figure 7.33: Test Revenue and Test Volume: Medical Devices Preclinical Testing Market for Safety and Efficacy Studies, 2018-2029

Figure 8.1: Market Segmentation: Medical Devices Testing Services Market (Region)

Figure 8.2: Market Overview: Global Medical Device Testing Services Market (Region), by Test Revenue

Figure 8.3: Market Overview: Global Medical Device Testing Services Market (Region), by Test Volume

Figure 8.4: Revenue Contributions of Different Regions, 2018 and 2029

Figure 8.5: North America: Test Revenue and Test Volume: North America Medical Devices Testing Services Market (2018, 2024, and 2029)

Figure 8.6: U.S.: Medical Devices Testing Services Market, 2018-2029

Figure 8.7: Test Revenue: Canada Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.8: Europe: Medical Devices Testing Services Market, 2018-2029

Figure 8.9: Test Revenue: Germany Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.10: U.K. Medical Device Testing Services Market, $Million (2018 and 2029)

Figure 8.11: Test Revenue: France Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.12: Test Revenue: Italy Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.13: Spain: Medical Devices Testing Services Market, 2018 and 2029

Figure 8.14: Test Revenue: Rest-of-Europe Medical Devices Testing Services Market, 2018 and 2029

Figure 8.15: Test Revenue and Test Volume: Asia-Pacific Medical Devices Testing Services Market (2018, 2024, and 2029)

Figure 8.16: Japan: Medical Devices Testing Services Market, 2018-2029

Figure 8.17: Test Revenue: China Medical Devices Testing Services Market, 2018 and 2029

Figure 8.18: Test Revenue: India Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.19: Test Revenue: Australia and New Zealand Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.20: Test Revenue: South Korea Medical Devices Testing Services Market, $Million (2018 and 2029)

Figure 8.21: Rest-of-Asia-Pacific: Medical Devices Testing Services Market, 2018 and 2029

Figure 8.22: Test Revenue and Test Volume: Rest-of-the-World Medical Devices Testing Services Market (2018-2029)

Figure 8.23: Latin America Medical Devices Testing Services Market, 2018 and 2029

Figure 8.24: Middle East and Africa Medical Devices Testing Services Market, 2018 and 2029

Figure 9.1: Shares of Key Company Profiles

Figure 9.2: Absorption Systems LLC: Service Portfolio for the Global Medical Devices Testing Services Market

Figure 9.3: Absorption Systems LLC: Service Offerings for the Global Medical Devices Testing Services Market

Figure 9.4: Absorption Systems LLC: SWOT Analysis

Figure 9.5: American Preclinical Services, LLC.: Service Portfolio for Global Medical Devices Testing Services Market

Figure 9.6: American Preclinical Services, LLC: SWOT Analysis

Figure 9.7: Bureau Veritas S.A.: Overall Financials, 2016-2018

Figure 9.8: Bureau Veritas S.A.: Revenue (by Business Segment), 2016-2018

Figure 9.9: Bureau Veritas S.A.: Revenue (by Region), 2016-2018

Figure 9.10: Bureau Veritas S.A.: R&D Expenditure (2016-2018)

Figure 9.11: Bureau Veritas S.A.: SWOT Analysis

Figure 9.12: Charles River Laboratories International, Inc.: Company Revenue & Y-o-Y Growth (2014-2018)

Figure 9.13: Company’s Operating Segments

Figure 9.14: Charles River Laboratories International, Inc.: Net Revenue, by Segment (2018)

Figure 9.15: Charles River Laboratories International, Inc.: Net Revenue, by Region (2018)

Figure 9.16: Charles River Laboratories International, Inc.: SWOT Analysis

Figure 9.17: Eurofins Scientific Group.: Company Revenue & Y-o-Y Growth (2014-2018)

Figure 9.18: Eurofins Scientific Group: Net Revenue, by Region (2018)

Figure 9.19: Eurofins Scientific Group: SWOT Analysis

Figure 9.20: Element Materials Technology Group: Medical Device Testing Services offered

Figure 9.21: Operating Medical Device Industries

Figure 9.22: Element Materials Technology Group: SWOT Analysis

Figure 9.23: Intertek Group plc: Company Revenue & Y-o-Y Growth (2014-2018)

Figure 9.24: Intertek Group plc: Net Revenue, by Segment (2018)

Figure 9.26: Intertek Group plc: SWOT Analysis

Figure 9.27: North American Science Associates, Inc.: Medical Device Testing Services offered by the Company:

Figure 9.28: North American Science Associates, Inc.: Medical Device Testing Services offered by the Company:

Figure 9.29: North American Science Associates, Inc: SWOT Analysis

Figure 9.30: Pace Analytical Services, LLC.: Operating Segments in the Global Medical Devices testing services market

Figure 9.31: Pace Analytical Services, LLC: Services Offered in the Global Medical Devices testing services market

Figure 9.32: Pace Analytical Services, LLC.: SWOT Analysis

Figure 9.33: Pacific BioLabs Inc: Product Portfolio for the Global Medical Devices testing services market

Figure 9.34: Company’s Operating Segments

Figure 9.35: Pacific BioLabs Inc: SWOT Analysis

Figure 9.36: Sotera Health LLC: Product Portfolio for the Global Medical Devices Testing Services Market

Figure 9.37: Services offered by Sterigenics:

Figure 9.38: Sterilization Services offered by Sterigenics:

Figure 9.39: Services offered by Nelson Labs

Figure 9.40: Sotera Health LLC: SWOT Analysis

Figure 9.41: SGS S.A..: Overall Financials, 2015-2019

Figure 9.42: SGS S.A.: Net Revenue, by Segment (2018)

Figure 9.43: SGS S.A.: Net Revenue, by Region (2019)

Figure 9.44: SGS S.A.: SWOT Analysis

Figure 9.45: TÜV SÜD AG: Company Revenue & Y-o-Y Growth (2015-2018)

Figure 9.46: Company’s Operating Segments

Figure 9.47: Segmental Information

Figure 9.48: TÜV SÜD AG: Net Revenue, by Region (2018)

Figure 9.49: TÜV SÜD AG: SWOT Analysis

Figure 9.50: Toxikon Corporation: Operating Segments

Figure 9.51: Toxikon Corporation: Geographical Presence

Figure 9.52: Toxikon Corporation: SWOT Analysis

Figure 9.53: TÜV SÜD AG: Company Revenue & Y-o-Y Growth (2014-2018)

Figure 9.54: Company’s Operating Segments

Figure 9.55: WuXi AppTec Co., Ltd.: Net Revenue, by Segment (2018)

Figure 9.56: WuXi AppTec Co., Ltd: Net Revenue, by Region (2018)

Figure 9.57: WuXi AppTec Co., Ltd.: SWOT Analysis

Key Questions Answered in this Report:

• What are the key regulations abiding the development, commercialization, and clinical use of medical devices testing services across different regions?

• What are the key technological developments on which the current industry leaders are spending their major share of research and development (R&D) investment?

• Which leading players hold significant dominance on the global medical devices testing services, currently?

• What are the key strategies incorporated by the players of the global medical devices testing services market, to sustain the competition and retain their supremacy?

• What is the current annual demand for the global medical devices testing services across different regions and its growth potential in the forecast period?

• What is the current market potential of medical devices testing services, and what are the factors deciding the growth potential of medical devices testing services in the forecast period?

• What is the current revenue contribution of different test types, and how would it evolve in the forecast period?

• Which countries contribute to the major share of current demand and which countries hold significant scope for expansion for business activities, by players, of the global medical devices testing services market?

Market Overview

Market Overview and Estimation

Global medical device market has undergone enormous growth in the past years. There has been extensive technological advancement in specifications of medical devices for various procedures. With rise in procedural volume of different types of surgeries and rise in prevalence of chronic diseases, has led to preferences for minimally invasive surgeries. Owing to these factors, it is anticipated that the global medical device market will grow multifold in the coming years.

With the increased usage of advanced medical devices for procedures, there is a significant rise in the cases of adversity. The incidence rate of medical device product recalls is on the rise at a significant pace; for instance, in the U.S., medical device product recalls showed a CAGR of 6.6% from 2013 to 2018.

The product recalls can cost billions to the medical device industry and individual companies. There are multiple explanations for the intense jump in product recalls, including the globalization of the supply chain, the complexity of devices, and the continued race to market. As per the U.S. Food and Drug Administration, more than 400 product recalls annually could be prevented, if the manufacturer had better design control practices.

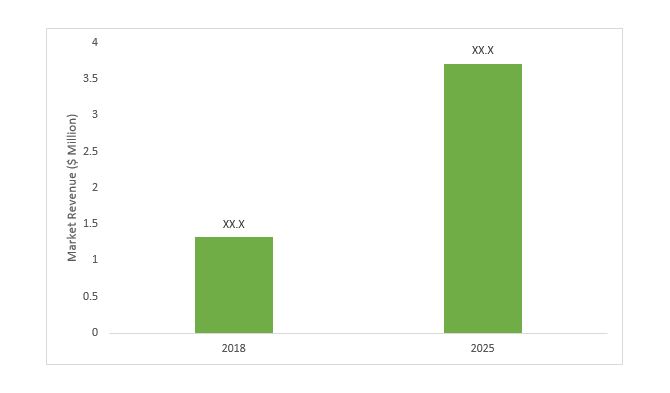

The Global Medical Devices Testing Services Market Report by BIS Research projects the market to grow at a significant CAGR of 10.81% during the forecast period, 2019-2029. The market was estimated at $1.32 billion in 2018.

Figure: Medical Devices Testing Services Market Scenario

|

Market Dynamics |

|||

|

Growth Drivers |

• Increased Pace of Medical Device Regulatory Changes Benefiting Medical Devices Testing Service Providers • Increasing Medical Device Product Recalls Reflecting the Need for Proper Implementation of Product Safety Testing |

||

|

Market Restraints |

• Barriers to Innovation in Medical Device Industry

|

||

|

Market Opportunities |

• Rising Medical Device Marketplace Producing Lucrative Opportunities to Medical Devices Testing Service Providers • Surge in Medical Device Clinical Trials on the Global Level Signify Increased Need for Outsourcing Services

|

||

Growth Factors

Keywords: Market demand, market growth, technology research, market development, market trends, industry study

- Increased Pace of Medical Device Regulatory Changes Benefiting Medical Devices Testing Service Providers: The global medical devices testing services market witnessed rapid growth from 2015 to 2018. The overall healthcare testing service provider sector is currently facing significant changes in its market dynamics as new methodologies, technologies, and practices are currently being introduced in the market. This sector is going through a period of amendments, driven by increased pace of medical device regulatory changes and requirements. However, factors such as barriers to innovation in the medical device industry, are hindering the overall medical devices testing services market. This factor is expected to highly influence the market growth both in the short and long term.

- Increasing Medical Device Product Recalls Reflecting the Need for Proper Implementation of Product Safety Testing: Over a period of time several products have been recalled owing to concerns to device complexity and supply chain issues. Such practices can cause loss of billion to the medical device industry and other stakeholders. Based on the U.S. Food and Drug Administration report that a recall of 400 products can be prevented if better control is administered over the manufacturing design. This factor is expected to have a strong impact in the short term future. However, in the long term it is expected to have only medium impact.

Market Restraints

- Barriers to Innovation in Medical Devices Industry: The development or diffusion process of innovative medical devices has been very slow mainly owing to the barriers to innovation. Though some of the barriers such as regulations are necessary considering the patient safety and device efficacy, the other barriers can be completely eradicated or removed by improvizing the policies and close cooperation among different stakeholders. Along with these factors, there exists a lack in the focus of medical device companies on emerging countries as they are reluctant to supply low priced products and hence have a low profit margin. This further hinders the growth of the medical devices testing services market globally.

Report Description

|

Market Report Coverage - Medical Devices Testing Services Market |

|||

|

Base Year |

2018 |

Market Size in 2018 |

$ 1.32 Million |

|

Forecast Period |

2019-2029 |

CAGR During Forecast Period |

10.81% |

|

Market Segmentation |

• Test Type - medical device sterility assurance & microbiology testing, medical device biocompatibility testing, medical device stability testing, material characterization analytical testing, and medical device preclinical testing. |

||

|

Regional Segmentation |

• North America – U.S. and Canada • Europe – Germany, U.K., France, Italy, Spain and Rest-of-Europe • Asia-Pacific – Japan, China, India, Australia and New Zealand, south and Rest-of-Asia-Pacific • Rest-of-the-World - Latin America, Middle East and Africa |

||

|

Key Companies Profiled |

The key players contributing to the global medical devices testing services market are Bureau Veritas S.A., Element Materials Technology Group, North American Science Associates, Inc., Eurofins Scientific Group, Charles River Laboratories, WuXi AppTec Co., Ltd., Toxikon Corporation, Sotera Health LLC, Intertek Group plc, Absorption Systems LLC, Pace Analytical Services, LLC, SGS S.A., and Pacific BioLabs, Inc, among others. |

||

Market Outlook by Type

The medical device testing services industry by type is segmented into medical device sterility assurance & microbiology testing, medical device biocompatibility testing, medical device stability testing, material characterization analytical testing, and medical device preclinical testing. The market is expected to grow significantly during the forecast period. The growth can be attributed to the increasing innovations and technological advancements in the medical device industry.

The sterility assurance and microbiology testing segment in the global medical devices testing services market was estimated to hold the largest market share in 2018 and is anticipated to grow at a double digit CAGR during the forecast period 2019-2029. The stability testing segment is expected to witness significant growth during the forecast period. This segment generated $212.2 million in 2018, growing at a double digit CAGR during the forecast period 2019-2029.

By Region

The medical devices testing services market, by test revenue, was dominated by Europe in 2018 and is anticipated to continue to do so in the forecast period 2019-2029, owing to the rising regulatory and public concerns regarding the product safety of a medical device. However, the market in Asia-Pacific region is expected to grow at the fastest rate of 12.53% during the forecast period 2019-2029, owing to the continuous innovations in the medical device industry and also, emerging regulatory framework in countries such as China and India mandating testing requirements before the market entry of a medical device, thereby, propelling the market in the Asia- Pacific region.

Global Medical Devices Testing Services Market

Focus on Tests, 14 Countries Data, and Competitive Landscape - Analysis and Forecast, 2019-2029