A quick peek into the report

Table of Contents

Product Definition

2.1 Research Scope

2.2 Key Questions Answered in the Report

2.3 Forecast Period Selection Criteria

3.1 Primary Research

3.2 Secondary Research

3.3 Data Sources Categorization

3.4 Companies Profiled in the Report

3.5 Market Estimation and Forecast Methodology

3.6 Data Validation

3.7 Assumptions and Limitations

4.1 Global Minimally Invasive Gastrointestinal Surgical Systems Market Overview

4.2 Industry Structure

4.2.1 Key Players

4.2.1.1 Conventional Technologies Manufacturers

4.2.1.2 Surgical Robotic Systems Manufacturers

4.2.1.3 Emerging Players

4.2.2 Regional Players

4.2.2.1 North America

4.2.2.2 Europe

4.2.2.3 Asia-Pacific (APAC)

4.2.2.4 Rest-of-the-World

4.3 Industry Supply Chain Analysis

4.4 Legal Regulations

4.4.1 U.S.

4.4.2 European Union (EU)

4.4.3 China

4.4.4 Japan

4.5 Pricing Analysis

4.5.1 Colonoscopy vs. Capsule Endoscopy

4.5.2 Average Selling Price for Different Types of Endoscopes

4.6 Impact of COVID-19

5.1 Key Developments and Strategies

5.1.1 Regulatory and Legal

5.1.2 New Offerings

5.1.3 Partnerships, Alliances, and Business Expansions

5.1.4 Mergers and Acquisitions

5.1.5 Funding Activities

5.2 Market Share Analysis

5.2.1 Overview

5.2.2 Conventional Technologies

5.2.2.1 Conventional Endoscopy

5.2.2.2 Capsule Endoscopy

5.2.3 Surgical Robotics

5.3 Growth Share Analysis

5.3.1 Product Type

5.3.2 Surgery Type

5.3.3 End User

5.3.4 Region

6.1 Market Overview

6.2 Impact Analysis

6.3 Market Drivers

6.3.1 Advantages of Minimally Invasive Surgical Procedures Over Conventional Open Surgical Procedures

6.3.2 Availability of Technological Advanced Products in the Field of GI Surgical Procedures

6.3.3 Increasing Healthcare Spending

6.3.4 Growth in Robotics GI Surgical Procedures

6.4 Market Restraints

6.4.1 High Cost of Minimally Invasive GI Surgical Procedures

6.4.2 Shortage of Skilled Professionals

6.4.3 Restrictive Reimbursement Framework

6.5 Market Opportunities

6.5.1 Development of Long-Distance Teleoperated Surgical Robotic Systems

6.5.2 Engagement in Mergers and Acquisitions to Diversify Endoscopic Portfolio

6.5.3 Invest in Regional Expansion

6.5.4 Development of Autonomous Surgical Robotic Systems

7.1 Overview

7.2 Global Minimally Invasive Gastrointestinal Surgical Systems Market Scenario

7.3 Conventional Minimally Invasive Gastrointestinal Surgical Systems (MISS)

7.3.1 Endoscopes and Endoscopy Systems

7.3.1.1 Rigid Endoscopes

7.3.1.2 Flexible Endoscopes

7.3.1.3 Capsule Endoscopy

7.3.1.3.1 Workstations and Data Recorders

7.3.1.3.2 Capsules

7.3.1.3.3 Others (Services and Patency System)

7.3.2 Videoscopes

7.3.3 Endoscopic Ultrasound

7.3.4 Therapeutic Energy Devices

7.4 Surgical Robotics

7.4.1 Robotic Systems

7.4.2 Robotic Surgery Instruments and Accessories

7.4.3 Services

8.1 Market Overview

8.2 Global Minimally Invasive GI Surgical Systems Market (by Surgery), $Million, 2020-2031

8.2.1 Adrenalectomy

8.2.2 Appendectomy

8.2.3 Bariatric Surgery

8.2.4 Cholecystectomy

8.2.5 Colon and Rectal Surgery

8.2.6 Foregut Surgery

8.2.7 Hernia Repair

9.1 Market Overview

9.2 Conventional Technologies (by End User), 2020-2031

9.2.1 Specialty Clinics

9.2.2 Hospitals

9.2.3 Ambulatory Surgical Centers

9.3 Surgical Robotics (by End User), 2020-2031

9.3.1 Hospitals

9.3.2 Ambulatory Surgical Centers

9.3.3 Specialty Clinics

10.1 Overview

10.2 North America

10.2.1 Market Size and Forecast

10.2.2 Key Vendors

10.2.3 U.S.

10.2.3.1 U.S. Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.2.4 Canada

10.2.4.1 Canada Minimally Invasive Gastrointestinal Surgical Analysis (by Product Type)

10.3 Europe

10.3.1 Overview

10.3.2 Market Size and Forecast

10.3.3 Key Vendors

10.3.4 Germany

10.3.4.1 Germany Minimally Invasive Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.3.5 France

10.3.5.1 France Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.3.6 Italy

10.3.6.1 Italy Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.3.7 U.K.

10.3.7.1 U.K. Minimally Invasive Gastrointestinal Surgical Analysis (by Product Type)

10.3.8 Spain

10.3.8.1 Spain Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.3.9 Rest-of-Europe

10.3.9.1 Rest-of-Europe Minimally Invasive Gastrointestinal Surgical Analysis (by Product Type)

10.4 Asia-Pacific

10.4.1 Overview

10.4.2 Market Size and Forecast

10.4.3 Key Vendors

10.4.4 Japan

10.4.4.1 Japan Minimally Invasive gastrointestinal Surgical Systems Analysis (by Product Type)

10.4.5 China

10.4.5.1 China Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.4.6 India

10.4.6.1 India Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.4.7 South Korea

10.4.7.1 South Korea Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.4.8 Australia and New Zealand

10.4.8.1 Australia and New Zealand Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.4.9 Rest-of-Asia-Pacific

10.4.9.1 Rest-of-Asia-Pacific Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

10.5 Rest-of-the-World

10.5.1 Overview

10.5.2 Market Size and Forecast

10.5.2.1 Rest-of-the-World Minimally Invasive Gastrointestinal Surgical Systems Analysis (by Product Type)

11.1 Market Overview

11.2 Global Minimally Invasive GI Surgical Systems Market (by Organ)

11.2.1 Upper GI Tract

11.2.1.1 Gastroscope

11.2.1.2 Duodenoscope

11.2.2 Lower GI Tract

11.2.2.1 Enteroscope

11.2.2.2 Colonoscope

11.2.2.3 Sigmoidoscope

11.2.2.4 Anoscope

11.2.2.5 Rectoscope/Proctoscope

11.2.3 Others

11.2.3.1 Laparoscope

11.2.3.2 Capsule Endoscope

12.1 Overview

12.2 B. Braun Melsungen AG

12.2.1 Company Overview

12.2.2 Role of the Company

12.2.3 Financials

12.2.4 SWOT Analysis

12.3 Conmed Corporation

12.3.1 Company Overview

12.3.2 Role of the Company

12.3.3 Financials

12.3.4 SWOT Analysis

12.4 Karl Storz SE & Co. KG

12.4.1 Company Overview

12.4.2 Role of the Company

12.4.3 SWOT Analysis

12.5 Medtronic plc

12.5.1 Company Overview

12.5.2 Role of the Company

12.5.3 Financials

12.5.4 SWOT Analysis

12.6 Olympus Corporation

12.6.1 Company Overview

12.6.2 Role of the Company

12.6.3 Financials

12.6.4 SWOT Analysis

12.7 Stryker Corporation

12.7.1 Company Overview

12.7.2 Role of the Company

12.7.3 Financials

12.7.4 SWOT Analysis

12.8 TransEnterix, Inc.

12.8.1 Company Overview

12.8.2 Role of the Company

12.8.3 Financials

12.8.4 SWOT Analysis

12.9 Boston Scientific Corporation

12.9.1 Company Overview

12.9.2 Role of the Company

12.9.3 Financials

12.9.4 SWOT Analysis

12.10 Cook Medical, Inc.

12.10.1 Company Overview

12.10.2 Role of the Company

12.10.3 SWOT Analysis

12.11 Richard Wolf GmbH

12.11.1 Company Overview

12.11.2 Role of the Company

12.11.3 SWOT Analysis

12.12 Intuitive Surgical, Inc.

12.12.1 Company Overview

12.12.2 Role of the Company

12.12.3 Financials

12.12.4 SWOT Analysis

12.13 Ambu A/S

12.13.1 Company Overview

12.13.2 Role of the Company

12.13.3 Financials

12.13.4 SWOT Analysis

12.14 Schölly Fiber Optic GmbH

12.14.1 Company Overview

12.14.2 Role of the Company

12.14.3 SWOT Analysis

12.15 Xenocor, Inc.

12.15.1 Company Overview

12.15.2 Role of the Company

12.15.3 SWOT Analysis

12.16 Fujifilm Holdings Corporation

12.16.1 Company Overview

12.16.2 Role of the Company

12.16.3 Financials

12.16.4 SWOT Analysis

12.17 Pentax Medical (Hoya Corporation)

12.17.1 Company Overview

12.17.2 Role of the Company

12.17.3 Financials

12.17.4 SWOT Analysis

Table 1: Impact of Market Drivers, 2021-2031

Table 2: Impact of Market Restraints, 2021-2031

Table 4.1: Minimally Invasive GI Surgical Systems: FDA Product Classification

Table 4.2: Average Selling Price for Different Types of Endoscopes (in $)

Table 4.3: Average Selling Price for Different Types of Visualization Systems (in $)

Table 6.1: Impact of Market Drivers, 2021-2031

Table 6.2: Impact of Market Restraints, 2021-2031

Table 6.3: Few Technological Advancements in the Field of GI Surgery

Table 7.1. Commercially Available Endoscope Products

Table 7.2: Commercially Available Endoscope Products

Table 12.1: TransEnterix, Inc.: Net Revenue (U.S. and International Market) ($Million), 2017-2019

Figure 1: Evolution of Surgery

Figure 2: Global Minimally Invasive Gastrointestinal Surgical Systems Market Size and Forecast, $Million, 2020-2031

Figure 3: Share of Key Developments and Strategies (by Category), January 2016–January 2021

Figure 4: Global Minimally Invasive GI Surgical Systems Market Share (by Surgery Type), 2020 and 2031

Figure 5: Global Minimally Invasive Gastrointestinal Surgical Systems Market Share (by End User), 2020 and 2031

Figure 6: Growth Share Analysis (by Region), 2021-2031

Figure 1.1: Comparative Analysis: Incision Length for Various Types of Surgery

Figure 2.1: Global Minimally Invasive Gastrointestinal Surgical Systems Market Segmentation

Figure 2.2: Regional Minimally Invasive Gastrointestinal Surgical Systems Market Segmentation

Figure 3.1: Global Minimally Invasive Gastrointestinal Surgical Systems Market Research Methodology

Figure 3.2: Primary Research

Figure 3.3: Secondary Research

Figure 3.4: Assumptions and Limitations

Figure 4.1: Global Minimally Invasive GI Surgical Systems Market Supply Chain Analysis

Figure 4.2: Regulatory Process for Medical Devices in the U.S.

Figure 4.3: MDR Transitional Provisions (EU)

Figure 4.4: Timeline and Impact of MDR (EU)

Figure 4.5: Regulatory Process for Medical Devices in European Union

Figure 4.6: Regulatory Process for Medical Devices in China

Figure 4.7: Regulatory Process for Medical Devices in Japan

Figure 5.1: Share of Key Developments and Strategies (by Category), January 2016–January 2021

Figure 5.2: Number of Key Developments and Strategies (by Year), January 2016–January 2021

Figure 5.3: Number of Key Developments and Strategies (Regulatory and Legal Activities), January 2016–January 2021

Figure 5.4: Number of Key Developments and Strategies (New Offerings), January 2016–January 2021

Figure 5.5: Number of Key Developments and Strategies (Partnerships, Alliances, and Business Expansions), January 2016–January 2021

Figure 5.6: Minimally Invasive Conventional Endoscopes Manufacturers Market Share (by Company)

Figure 5.7: Minimally Invasive Capsule Endoscopes Manufacturers Market Share (by Company)

Figure 5.8: Surgical Robotic Systems Manufacturers Market Share (by Company)

Figure 5.9: Growth Share Analysis (by Product Type), 2021-2031

Figure 5.10: Growth Share Analysis (by Surgery), 2021-2031

Figure 5.11: Growth Share Analysis (by End User), 2021-2031

Figure 5.12: Growth Share Analysis (by Region), $Million, 2021-2031

Figure 6.1: Market Dynamics

Figure 6.2: Advantages of Minimally Invasive Surgical Procedures

Figure 6.3: Healthcare Expenditure (by Country), All Financing Schemes, 2019

Figure 6.4: Factors Contributing to Adverse Events in Robotic-Assisted Surgical Procedures

Figure 6.5: Overview of Telesurgery Workflow

Figure 6.6: Telesurgery: Bridging the Gap Associated with Healthcare Accessibility

Figure 6.7: Inbound Medical Tourism Spending, 2017

Figure 7.1: Global Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type)

Figure 7.2: Global Minimally Invasive Gastrointestinal Surgical Systems Market Size and Forecast, $Million,2020-2031

Figure 7.3: Global Minimally Invasive Gastrointestinal Surgical Systems Market Share (by Product Type), 2020 and 2031

Figure 7.4: Global Minimally Invasive Gastrointestinal Surgical Systems Market Share (by Conventional MISS), 2020 and 2031

Figure 7.5: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (by Endoscopes and Endoscopy Systems)

Figure 7.6: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Share (by Endoscopes and Endoscopy System), 2020 and 2031

Figure 7.7: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Endoscopes and Endoscopy Systems), $Million, 2020-2031

Figure 7.8: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Rigid Endoscopes), $Million, 2020-2031

Figure 7.9: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Flexible Endoscopes), $Million, 2020-2031

Figure 7.10: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (by Capsule Endoscopy)

Figure 7.11: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Capsule Endoscopy), $Million, 2020-2031

Figure 7.12: Global Conventional Gastrointestinal Surgical Systems Market Share (by Capsule Endoscopy), 2020 and 2031

Figure 7.13: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Workstations and Data Recorders), $Million, 2020-2031

Figure 7.14: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Capsules), $Million, 2020-2031

Figure 7.15: Global Conventional Gastrointestinal Surgical Systems Market (Services and Patency System), $Million, 2020-2031

Figure 7.16: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Videoscopes), $Million, 2020-2031

Figure 7.17: Global Conventional Gastrointestinal Surgical Systems Market (Endoscopic Ultrasound), 2020-2031

Figure 7.18: Global Conventional Gastrointestinal Surgical Systems Market (Therapeutic Energy Devices), $Million, 2020-2031

Figure 7.19: Global Minimally Invasive Gastrointestinal Surgical Systems Market (by Surgical Robotics)

Figure 7.20: Global Minimally Invasive Gastrointestinal Surgical Systems Market Share (by Surgical Robotics), $Million, 2020 and 2031

Figure 7.21: Global Surgical Robotics Market (Robotic Systems), $Million, 2020-2031

Figure 7.22: Global Surgical Robotics Market (Robotic Surgery Instruments and Accessories), $Million, 2020-2031

Figure 7.23: Global Surgical Robotics Market (Services), $Million, 2020-2031

Figure 8.1: Global Minimally Invasive GI Surgical Systems Market (by Surgery)

Figure 8.2: Global Minimally Invasive GI Surgical Systems Market (by Surgery), $Million, 2020 and 2031

Figure 8.3: Global Minimally Invasive GI Surgical Systems Market (Adrenalectomy), $Million, 2020-2031

Figure 8.4: Global Minimally Invasive GI Surgical Systems Market (Appendectomy), $Million, 2020-2031

Figure 8.5: Global Minimally Invasive GI Surgical Systems Market (Bariatric Surgery), $Million, 2020-2031

Figure 8.6: Global Minimally Invasive GI Surgical Systems Market (Cholecystectomy), $Million, 2020-2031

Figure 8.7: Global Minimally Invasive GI Surgical Systems Market (Invasive Colon and Rectal Surgery), $Million, 2020-2031

Figure 8.8: Global Minimally Invasive GI Surgical Systems Market (Foregut Surgery), $Million, 2020-2031

Figure 8.9: Global Minimally Invasive GI Surgical Systems Market (Hernia Repair), $Million, 2020-2031

Figure 9.1: Global Minimally Invasive Gastrointestinal Surgical Systems Market (by End User)

Figure 9.2: Global Minimally Invasive Gastrointestinal Surgical Systems Market (Share by End User), $Million, 2020 and 2031

Figure 9.3: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Specialty Clinics), $Million, 2020-2031

Figure 9.4: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Hospitals), $Million, 2020-2031

Figure 9.5: Global Conventional Minimally Invasive Gastrointestinal Surgical Systems Market (Ambulatory Surgical Centers) $Million, 2020-2031

Figure 9.6: Global Surgical Robotics Minimally Invasive Gastrointestinal Surgical Systems Market (Hospitals), $Million, 2020-2031

Figure 9.7: Global Surgical Robotics Market (Ambulatory Surgical Centers), $Million, 2020-2031

Figure 9.8: Global Surgical Robotics Market (Specialty Clinics), $Million, 2020-2031

Figure 10.1: Global Minimally Invasive Gastrointestinal Surgical Systems Market (by Region), $Million, 2020 and 2031

Figure 10.2: North America Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.3: North America Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031 (by Product Type)

Figure 10.4: North America Minimally Invasive Gastrointestinal Surgical Systems Market (by Conventional System), $Million, 2020-2031

Figure 10.5: North America Minimally Invasive Gastrointestinal Surgical Systems (by Country), $Million, 2020 and 2031

Figure 10.6: U.S. Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.7: U.S. Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.8: Canada Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.9: Canada Minimally Invasive Surgical Gastrointestinal Systems Market (by Product Type), $Million, 2020-2031

Figure 10.10: Europe Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.11: Europe Minimally Invasive Gastrointestinal Surgical Systems Market, 2020-2031

Figure 10.12: Europe Minimally Invasive Gastrointestinal Surgical Systems Market (by Country), $Million, 2020 and 2031

Figure 10.13: Germany Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.14: Germany Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.15: France Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.16: France Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.17: Italy Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.18: Italy Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.19: U.K. Minimally Invasive Surgical Gastrointestinal Systems Market, $Million, 2020-2031

Figure 10.20: U.K. Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.21: Spain Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.22: Spain Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.23: Rest-of-Europe Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.24: Rest-of-Europe Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), 2020-2031

Figure 10.25: Asia-Pacific Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.26: Asia-Pacific Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.27: Asia-Pacific Minimally Invasive Gastrointestinal Surgical Systems Market (by Country), $Million, 2020 and 2031

Figure 10.28: Japan Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.29: Japan Minimally Invasive gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.30: China Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.31: China Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), 2020-2031

Figure 10.32: India Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.33: India Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.34: South Korea Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.35: South Korea Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.36: Australia and New Zealand Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.37: Australia and New Zealand Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.38: Rest-of-Asia-Pacific Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.39: Rest-of-Asia-Pacific Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 10.40: Rest-of-the-World Minimally Invasive Gastrointestinal Surgical Systems Market, $Million, 2020-2031

Figure 10.41: Rest-of-the-World Minimally Invasive Gastrointestinal Surgical Systems Market (by Product Type), $Million, 2020-2031

Figure 11.1: Global Minimally Invasive GI Surgical Systems Market (by GI Tract)

Figure 12.1: Shares of Key Companies Profiled

Figure 12.2: B. Braun Melsungen AG: Overall Financials, $Million, 2017-2019

Figure 12.3: B. Braun Melsungen AG: Net Revenue (by Segment), 2017-2019

Figure 12.4: B. Braun Melsungen AG: Net Revenue (by Region), 2017-2019

Figure 12.5: Conmed Corporation: Overall Financials, $Million, 2017-2019

Figure 12.6: Conmed Corporation: Net Revenue (by Segment), $Million, 2017-2019

Figure 12.7: Conmed Corporation: Net Revenue (by Region), $Million, 2017-2019

Figure 12.8: Medtronic plc: Overall Financials, $Million, 2018-2020

Figure 12.9: Medtronic plc: Net Revenue (by Segment), $Million, 2018-2020

Figure 12.10: Medtronic plc: Net Revenue (by Region), $Million, 2018-2020

Figure 12.11: Olympus Corporation: Overall Financials, $Million, 2018-2020

Figure 12.12: Olympus Corporation: Net Revenue (by Segment), $Million, 2018-2020

Figure 12.13: Olympus Corporation: Net Revenue (by Region), $Million, 2018-2020

Figure 12.14: Stryker Corporation: Overall Financials, $Million, 2017-2019

Figure 12.15: Stryker Corporation: Net Revenue (by Segment), $Million, 2017-2019

Figure 12.16: Stryker Corporation: Net Revenue (by Region), $Million, 2017-2019

Figure 12.17: TransEnterix, Inc.: Overall Financials $Million, 2017-2019

Figure 12.18: TransEnterix, Inc.: Net Revenue (by Segment), $Million, 2017-2019

Figure 12.19: TransEnterix, Inc.: Net Revenue (by Region), $Million, 2017-2019

Figure 12.20: Boston Scientific Corporation: Overall Financials $Million, 2017-2019

Figure 12.21: Boston Scientific Corporation: Net Revenue (by Segment), $Million, 2017-2019

Figure 12.22: Boston Scientific Corporation: Net Revenue (by Region), $Million, 2017-2019

Figure 12.23: Intuitive Surgical, Inc.: Overall Financials $Million, 2017-2019

Figure 12.24: Intuitive Surgical, Inc.: Net Revenue (by Segment), $Million, 2017-2019

Figure 12.25: Intuitive Surgical, Inc.: Net Revenue (by Region), $Million, 2017-2019

Figure 12.26: Ambu A/S: Overall Financials $Million, 2018-2020

Figure 12.27: Ambu A/S: Net Revenue (by Segment), $Million, 2018-2020

Figure 12.28: Ambu A/S: Net Revenue (by Region), $Million, 2018-2020

Figure 12.29: Fujifilm Holdings Corporation: Overall Financials $Million, 2018-2020

Figure 12.30: Fujifilm Holdings Corporation: Net Revenue (by Segment), $Million, 2018-2020

Figure 12.31: Fujifilm Holdings Corporation: Net Revenue (by Region), $Million, 2018-2020

Figure 12.32: Hoya Corporation: Overall Financials, $Million, 2018-2020

Figure 12.33: Hoya Corporation: Net Revenue (by Segment), $Million, 2018-2020

Figure 12.34: Hoya Corporation: Net Revenue (by Region), $Million, 2020

Report Description

|

Market Report Coverage - Minimally Invasive Gastrointestinal Surgical Systems |

|||

|

Base Year |

2020 |

Market Size in 2020 |

$5,021.8 Million |

|

Forecast Period |

2021-2031 |

Value Projection and Estimation by 2031 |

$10,441.0 Million |

|

CAGR During Forecast Period |

6.8% |

Number of Tables |

11 |

|

Number of Pages |

244 |

Number of Figures |

155 |

|

Research Hours |

190 |

|

|

|

Market Segmentation |

• Product Type • Surgery • End User |

||

|

Regional Segmentation |

• North America: U.S. and Canada • Europe: Germany, U.K, Italy, Spain, France, and Rest-of-Europe • Asia-Pacific: Japan, China, South Korea, Australia and New Zealand, and Rest-of-Asia-Pacific • Rest-of-the-World |

||

|

Growth Drivers |

• Advantages of Minimally Invasive Surgical Procedures Over Conventional Open Surgical Procedures |

||

|

Market Challenges |

• High Cost of Minimally Invasive GI Surgical Procedures • Shortage of Skilled Professionals • Restrictive Reimbursement Framework |

||

|

Market Opportunities |

• Development of Long-Distance Teleoperated Surgical Robotic Systems • Mergers and Acquisitions to Diversify Endoscopic Portfolio • Investment for Regional Expansion |

||

|

Key Companies Profiled |

Ambu A/S, B. Braun Melsungen AG, Boston Scientific Corporation, Conmed Corporation, Cook Medical Inc., Intuitive Surgical, Inc., Olympus Corporation, Medtronic plc, Karl Storz SE & Co. KG, Stryker Corporation, Schölly Fiberoptic GmbH, Xenocor Inc., Fujifilm Holdings Corporation, Pentax Medical (Hoya Corporation), Richard Wolf GmbH, and TransEnterix, Inc. |

||

Key Questions Answered in this Report:

• What is the current market size and future potential of these products?

• What is the current market share and growth share of the different products in the market?

• What are the guidelines implemented by different government bodies to regulate the approval of minimally invasive gastrointestinal surgical systems?

• What are the major market drivers, restraints, and opportunities in the global minimally invasive gastrointestinal surgical systems market?

• What is the impact of the COVID-19 pandemic on the market?

• Which technology is being researched and worked upon to improve the gastrointestinal surgical systems?

• Who are the leading players dominating the global minimally invasive gastrointestinal surgical systems market?

• What are the key development and strategies incorporated by the players of global minimally invasive gastrointestinal surgical systems market, to sustain the competition and retain their supremacy?

• Which countries contribute to the major share of current demand and which countries hold significant scope for expansion for business activities, by players of the global minimally invasive gastrointestinal surgical systems market?

• How advanced technologies such as surgical robotics is gaining traction in terms of market share in in gastrointestinal space?

Market Overview

Overview on the Global Minimally Invasive Gastrointestinal Surgical Systems Market

The global minimally invasive gastrointestinal surgical systems market is currently witnessing a significant change in the market landscape. There is rising investment in the development of healthcare infrastructure, increasing evidence for efficient and promising results in surgery assistance. Thus, this is leading to potential growth opportunities for the minimally invasive gastrointestinal surgical systems market. Moreover, there is an extensive entry of emerging players developing MIS surgical systems. All these predominant factors have led to a significant rise in sales of minimally invasive gastrointestinal surgical systems across the globe.

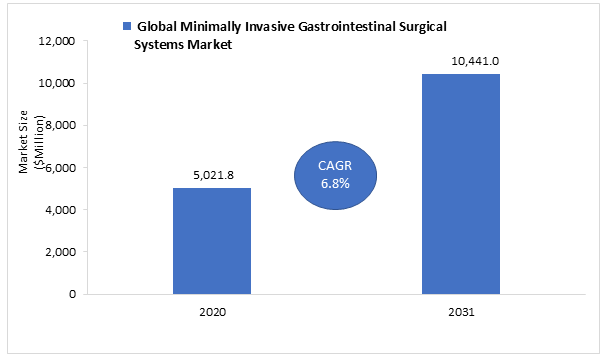

Global Minimally Invasive Gastrointestinal Surgical Systems Market (2020-2031)

Source: Secondary Research, Expert Views, and BIS Research Analysis

The global minimally invasive gastrointestinal surgical systems market was valued at $5,021.8 million in 2020 and is anticipated to reach $10,441.0 million by 2031, growing at a CAGR of 6.8% during the forecast period 2021-2031. The increasing complexities in clinical decision-making, rising radiologist workload, and huge R&D investments are the major factors fueling the market growth. In addition to these factors, there are significant challenges and restraints, which are restricting the market growth. These challenges include the shortage of skilled professionals, high cost of minimally invasive GI surgical procedures, and restrictive reimbursement framework. Hence, it is anticipated that these trends will have a significant impact on the minimally invasive gastrointestinal surgical systems market in the during the forecast period, and the market will grow multifold.

Competitive Landscape

The global minimally invasive gastrointestinal surgical systems market consists of numerous large-scale as well as small-scale manufacturers and vendors. Presently, with the increasing adoption of technologies in healthcare, the manufacturers in the market have an ample number of opportunities to expand their offerings and to establish a strong foothold in the market.

From January 2015 to January 2021, the market witnessed approximately 25 regulatory and legal developments, 11 new offerings, 44 partnerships, alliances, and business expansions, four funding activities, and seven mergers and acquisitions activities. Joint ventures, collaborations, and partnerships were among the most frequently followed strategies incorporated by numerous players to establish a strong foothold in the market.

Most of the manufacturers in the market are incorporating collaborations and partnerships with not only other companies but also the university and research institutions as the key strategies to develop novel minimally invasive gastrointestinal surgical systems and attain a strong financial position in the market.

The leading imaging modality providers in the global minimally invasive gastrointestinal surgical systems market include Ambu A/S, B. Braun Melsungen AG, Boston Scientific Corporation, Conmed Corporation, Cook Medical Inc., Intuitive Surgical, Inc., Olympus Corporation, Medtronic plc, Karl Storz SE & Co. KG, Stryker Corporation, Schölly Fiberoptic GmbH, Xenocor Inc., Fujifilm Holdings Corporation, Pentax Medical (Hoya Corporation), Richard Wolf GmbH, and TransEnterix, Inc., among others.

Global Minimally Invasive Gastrointestinal Surgical Systems Market

12 Countries Analysis - Analysis and Forecast, 2021-2031

Frequently Asked Questions

The minimally invasive gastrointestinal surgical systems market is estimated to grow at a CAGR of 6.8% during the forecast period, 2021-2030. The market is expected to reach $10,441.0 million by the end of 2030.

Factors that can boost the growth of the market include advantages of minimally invasive surgical procedures over conventional open surgical procedures, availability of technological advanced products in the field of GI surgical procedures, increasing healthcare spending, and growth in robotics GI surgical procedures.

Surgeries for which minimally invasive gastrointestinal surgical systems can be used include Adrenalectomy, Appendectomy, Bariatric Surgery, Cholecystectomy, Colon and Rectal Surgery, Foregut Surgery, and Hernia Repair.

End-users that use minimally invasive gastrointestinal surgical systems include hospitals, ambulatory surgical centers, and specialty clinics.

Key players operating in the market include Ambu A/S, B. Braun Melsungen AG, Boston Scientific Corporation, Conmed Corporation, Cook Medical Inc., Intuitive Surgical, Inc., Olympus Corporation, Medtronic plc, Karl Storz SE & Co. KG, Stryker Corporation, Schölly Fiberoptic GmbH, Xenocor Inc., Fujifilm Holdings Corporation, Pentax Medical (Hoya Corporation), Richard Wolf GmbH, and TransEnterix, Inc.