A quick peek into the report

Table of Contents

2.2 Exclusion Criteria of the Report

2.3 Key Questions Answered by the Research Study

4.1 Industry Ecosystem

4.1.1 Drug Delivery Device Manufacturers

4.1.2 Pharmaceutical Companies

4.1.3 Distributors

4.2 Legal and Regulatory Framework

4.3 Voice of Consortium and Associations

4.4 Patent Analysis

6.1 Assumptions and Limitations

6.2 Market Overview

6.2.1 Advent and Evolution of Drug Delivery

6.2.2 Key Findings and Emerging Trends

6.3 Market Dynamics

6.3.1 Market Drivers

6.3.1.1 Increasing Prevalence of Chronic and Lifestyle-Associated Diseases Elevating the Demand of Non-Invasive Drug Delivery Devices

6.3.1.1.1 Increase in Prevalence of Diabetes Population

6.3.1.1.2 Increase in Prevalence of Neurological Diseases

6.3.1.1.3 Increase in Prevalence of Respiratory Diseases

6.3.1.2 Growing Geriatric Population Leads to Surge in Exigency of Non-Invasive Drug Delivery Devices

6.3.1.3 Increasing Needlestick Injuries Lead to Surge in Demand of Non-Invasive Drug Delivery Devices

6.3.1.4 Increasing Demand for the Self-Administered Medication Service

6.3.1.5 Persistent Support from Government and Non-Government Organizations

6.3.2 Market Restraints

6.3.2.1 Technical Barrier to the Non-Invasive Mode of Drug Delivery

6.3.2.2 Alternative Drug Delivery Technology

6.3.3 Impact Analysis

6.3.4 Market Opportunities

6.3.4.1 Expansion into the Emerging Economies

6.3.4.2 Technological Advancement of Non-Invasive Drug Delivery Devices

6.3.4.2.1 Microneedle Patches for Vaccine Delivery

6.3.4.2.2 Organ-on-Chip

6.3.4.3 Collaboration between Pharmaceutical Companies and Drug Delivery Firms

7.1 Overview

7.2 Artificial Pancreas (Closed-Loop Insulin Pumps)

7.3 Needle-Free Injector

7.3.1 Needle-Free Injector Market (by Technology)

7.3.1.1 Gas-Based Needle-Free Injector

7.3.1.2 Spring-Based Needle-Free Injector

7.3.1.3 Other Needle-Free Injector

7.3.2 Needle-Free Injector Market (by Usability)

7.3.2.1 Reusable Needle-Free Injector

7.3.2.2 Disposable Needle-Free Injector

7.3.3 Needle-Free Injector Market (by Type)

7.3.3.1 Liquid-Based Needle-Free Injector

7.3.3.2 Powder-Based Needle-Free Injector

7.3.4 Needle-Free Injector Market (by Site of Delivery)

7.3.4.1 Subcutaneous Needle-Free Injector

7.3.4.2 Intramuscular Needle-Free Injector

7.3.4.3 Intradermal Needle-Free Injector

7.4 Digital Respiratory Devices

7.4.1 Digital Respiratory Devices Market (by Product Type)

7.4.1.1 Sensors and App

7.4.1.2 Smart Inhalers and Nebulizers

8.1 Overview

8.2 Diabetes Management

8.3 Vaccine Management

8.4 Pain Management

8.5 Respiratory Management

8.6 Others

9.1 Overview

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Rest-of-Europe

9.4 Asia-Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Australia

9.4.5 Rest-of-Asia-Pacific

9.5 Latin America, Middle East and Africa

10.1 Adherium Limited

10.1.1 Company Overview

10.1.2 Role of Adherium Limited in the Global Non-Invasive Drug Delivery Devices Market

10.1.3 Financials

10.1.4 SWOT Analysis

10.2 Capsule Technologies, Inc.

10.2.1 Company Overview

10.2.2 Role of Capsule Technologies, Inc. in the Global Non-Invasive Drug Delivery Devices Market

10.2.3 SWOT Analysis

10.3 Crossject S.A.

10.3.1 Company Overview

10.3.2 Role of Crossject S.A. in the Global Non-Invasive Drug Delivery Devices Market

10.3.3 Financials

10.3.4 SWOT Analysis

10.4 Diabeloop SA

10.4.1 Company overview

10.4.2 Role of Diabeloop SA in the Global Non-Invasive Drug Delivery Devices Market

10.4.3 SWOT Analysis

10.5 HNS International, Inc.

10.5.1 Company Overview

10.5.2 Role of HNS International, Inc. in the Global Non-Invasive Drug Delivery Devices Market

10.5.3 SWOT Analysis

10.6 Inovio Pharmaceuticals, Inc.

10.6.1 Company Overview

10.6.2 Role of Inovio Pharmaceuticals, Inc. in the Global Non-Invasive Drug Delivery Devices Market

10.6.3 Financials

10.6.4 SWOT Analysis

10.7 Medtronic Plc.

10.7.1 Company Overview

10.7.2 Role of Medtronic Plc. in the Non-Invasive Drug Delivery Devices Market

10.7.3 Financials

10.7.4 SWOT Analysis

10.8 Novartis AG

10.8.1 Company Overview

10.8.2 Role of Novartis AG in the Global Non-Invasive Drug Delivery Devices Market

10.8.3 Financials

10.8.4 SWOT Analysis

10.9 PenJet Corporation

10.9.1 Company Overview

10.9.2 Role of PenJet in the Global Non-Invasive Drug Delivery Devices Market

10.9.3 SWOT Analysis

10.10 PharmaJet

10.10.1 Company Overview

10.10.2 Role of Pharma Jet in the Global Non-Invasive Drug Delivery Devices Market

10.10.3 SWOT Analysis

10.11 Portal Instruments

10.11.1 Company Overview

10.11.2 Role of Portal Instruments in the Global Non-Invasive Drug Delivery Devices Market

10.11.3 SWOT Analysis

10.12 Propeller Health (A Subsidiary of ResMed)

10.12.1 Company Overview

10.12.2 Role of Propeller Health in the Global Non-Invasive Drug Delivery Devices Market

10.12.3 SWOT Analysis

10.13 Sensiron AG

10.13.1 Company Overview

10.13.2 Role of Sensiron AG in the Global Non-Invasive Drug Delivery Devices Market

10.13.3 Financials

10.13.4 SWOT Analysis

10.14 Tandem Diabetes Care, Inc.

10.14.1 Company Overview

10.14.2 Role of Tandem Diabetes Care, Inc. in the Global Non-Invasive Drug Delivery Devices Market

10.14.3 Financials

10.14.4 SWOT Analysis

10.15 Teva Pharmaceuticals Industries Ltd.

10.15.1 Company Overview

10.15.2 Role of Teva Pharmaceuticals Industries Ltd. in the Global Non-Invasive Drug Delivery Devices Market

10.15.3 Financials

10.15.4 SWOT Analysis

Table 4.1: Regulatory Authority of the Global Non-Invasive Drug Delivery Devices Market

Table 4.2: Association/ Society/ Consortium of the Global Non-Invasive Drug Delivery Devices Market

Table 5.1: Product Portfolio Analysis – Needle Free Injector

Table 5.2: Product Portfolio Analysis – Digital Inhalers and Nebulizers

Table 5.3: Different Data Revenue Streams

Table 6.1: Deaths due to Multiple Sclerosis in Key Countries, 2015-2017

Table 6.2: Prevalence of Asthma in Key Countries, 2015-2017

Table 6.3: Prevalence of COPD in Key Countries, 2015-2017

Table 6.4: Funding Initiatives by Government and Research Institutes

Table 6.5: Funding Initiatives by Public and Private Companies

Table 9.1: Prevalence of Diseases in North America, 2014-2017

Table 9.2: Prevalence of Diseases in the U.S., 2014-2017

Table 9.3: Prevalence of Diseases in Canada, 2014-2017

Table 9.4: Prevalence of Diseases in Europe, 2014-2017

Table 9.5: Prevalence of Diseases in Germany, 2014-2017

Table 9.6: Prevalence of Diseases in the U.K., 2014-2017

Table 9.7: Prevalence of Diseases in France, 2014-2017

Table 9.8: Prevalence of Diseases in Asia, 2014-2017

Table 9.9: Prevalence of Diseases in Japan, 2014-2017

Table 9.10: Prevalence of Diseases in China, 2014-2017

Table 9.11: Prevalence of Diseases in India, 2014-2017

Table 9.12: Prevalence of Diseases in Australia, 2014-2017

Figure 1: Number of People (20-79 years) with Diabetes in 2017 and 2045

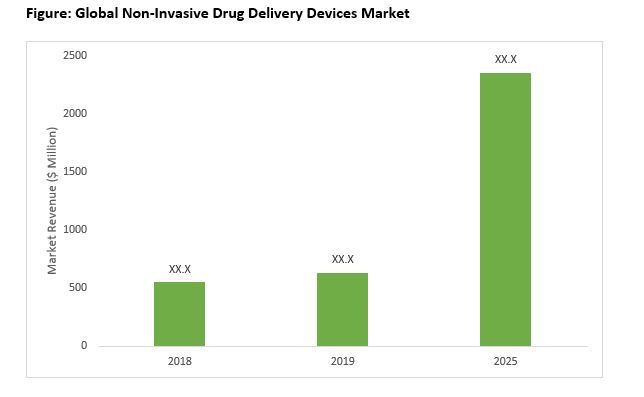

Figure 2: Global Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 3: Market Drivers and Market Restraints

Figure 4: Market Share Analysis – Needle-Free Injector (by Company), 2018

Figure 5: Market Share Analysis – Digital Inhalers and Nebulizers (by Company), 2018

Figure 6: Partnerships, Alliances, and Business Expansions Share (by Company), March 2015-March 2020

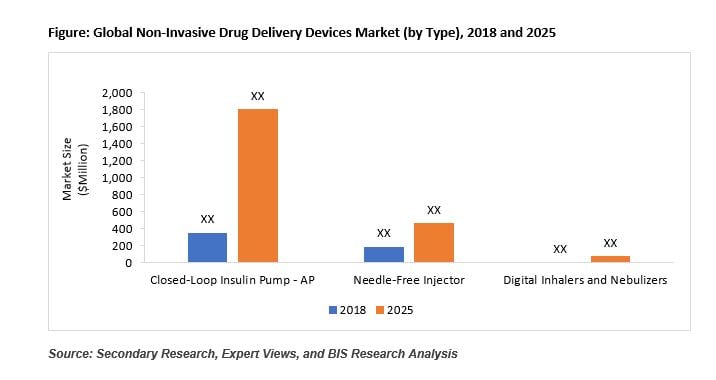

Figure 7: Global Non-Invasive Drug Delivery Devices Market (by Type), 2018 and 2025

Figure 8: Global Non-Invasive Drug Delivery Devices Market (by Region), 2018 and 2025

Figure 9: Share of Patent by Ownership, January 2016-December 2019

Figure 2.1: Global Non-Invasive Drug Delivery Devices Market Segmentation

Figure 3.1: Global Non-Invasive Drug Delivery Devices Market Research Methodology

Figure 3.2: Primary Research

Figure 3.3: Secondary Research

Figure 3.4: Total Number of Companies Profiles

Figure 3.5: Assumptions and Limitations

Figure 4.1: Share of Patent by Ownership, January 2016-December 2019

Figure 5.1: Share of Key Developments and Strategies, March 2015-March 2020

Figure 5.2: Partnerships, Alliances, and Business Expansions Share (by Company), March 2015-March 2020

Figure 5.3: Regulatory and Legal (by Company), March 2015-March 2020

Figure 5.4: Merger and Acquisition Activities (by Company), March 2015-March 2020

Figure 5.5: New Offerings Share (by Company), March 2015-March 2020

Figure 5.6: Fundings Share (by Company), March 2015-March 2020

Figure 5.7: Procurement and Sales (by Company), March 2015-March 2020

Figure 5.8: Market Share Analysis – Needle-Free Injector (by Company), 2018

Figure 5.9: Market Share Analysis – Digital Inhalers and Nebulizers (by Company), 2018

Figure 5.10: Price vs. Product Analysis – Needle-Free Injector

Figure 5.11: Shelf Life Analysis – Needle-Free Injector

Figure 5.12: Pricing Analysis – Digital Inhalers

Figure 5.13: Smart Inhaler Value Propositions for Stakeholders

Figure 5.14: Smart Inhalers and Nebulizers – An Important Element of System for Predicting Disease Worsening in Individuals

Figure 6.1: Emergence of Needle-Free Technology

Figure 6.2: Number of People (20-79 years) with Diabetes in 2017, and 2045

Figure 6.3: Geriatric Population (60 years and above) Worldwide in Different Regions, 2000, 2015, 2030, and 2050

Figure 6.4: Impact Analysis

Figure 7.1: Global Non-Invasive Drug Delivery Devices Market, (by Type), 2018 and 2025

Figure 7.2: Drivers and Restraints for the Artificial Pancreas Market

Figure 7.3: Global Artificial Pancreas Market, 2018-2025

Figure 7.4: Drivers and Restraints for the Needle-Free Injectors Market

Figure 7.5: Global Needle-Free Injector Market, 2018-2025

Figure 7.6: Segmentation of Needle-Free Injector Market (by Technology)

Figure 7.7: Global Needle-Free Injector Market (by Technology), 2018 and 2025

Figure 7.8: Global Gas-Based Needle-Free Injector Market, 2018-2025

Figure 7.9: Global Spring-Based Needle-Free Injector Market, 2018-2025

Figure 7.10: Global Other Needle-Free Injector Market, 2018-2025

Figure 7.11: Segmentation of Needle-Free Injector Market (by Usability)

Figure 7.12: Global Needle-free Injector Market (by Usability), 2018 and 2025

Figure 7.13: Global Reusable Needle-Free Injector Market, 2018-2025

Figure 7.14: Global Disposable Needle-Free Injector Market, 2018-2025

Figure 7.15: Segmentation of Needle-Free Injector Market (by Type)

Figure 7.16: Global Needle-Free Injector Market (by Type), 2018 and 2025

Figure 7.17: Global Liquid-Based Needle-Free Injector Market, 2018-2025

Figure 7.18: Global Powder-Based Needle-Free Injector Market, 2018-2025

Figure 7.19: Segmentation of Needle-Free Injector Market (by Site of Delivery)

Figure 7.20: Global Needle-Free Injector Market (by Site of Delivery), 2018 and 2025

Figure 7.21: Global Subcutaneous Needle-Free Injector Market, 2018-2025

Figure 7.22: Global Intramuscular Needle-Free Injector Market, 2018-2025

Figure 7.23: Global Intradermal Needle-Free Injector Market, 2018-2025

Figure 7.24: Drivers and Restraints for the Digital Respiratory Devices Market

Figure 7.25: Global Digital Respiratory Devices Market, 2018-2025

Figure 7.26: Segmentation of Digital Respiratory Devices Market (by Product Type)

Figure 7.27: Global Digital Respiratory Devices Market, by Sensor and App, 2018-2025

Figure 7.28: Global Digital Respiratory Devices Market, (by Digital Respiratory Devices), 2018-2025

Figure 8.1: Global Non-Invasive Drug Delivery Devices Market for Diabetes Management, 2018-2025

Figure 8.2: Global Non-Invasive Drug Delivery Devices Market for Vaccine Management, 2018-2025

Figure 8.3: Global Non-Invasive Drug Delivery Devices Market for Pain Management, 2018-2025

Figure 8.4: Global Non-Invasive Drug Delivery Devices Market for Respiratory Management, 2018-2025

Figure 8.5: Global Non-Invasive Drug Delivery Devices Market for Others, 2018-2025

Figure 9.1: Global Non-Invasive Drug Delivery Devices Market Scenario, 2018 to 2025

Figure 9.2: North America Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.3: North America: Market Dynamics

Figure 9.4: U.S. Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.5: Canada Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.6: Europe Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.7: Europe: Market Dynamics

Figure 9.8: Germany Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.9: U.K. Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.10: France Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.11: Rest-of-Europe Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.12: Asia-Pacific Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.13: Asia-Pacific: Market Dynamics

Figure 9.14: Japan Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.15: China Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.16: India Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.17: Australia Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.18: Rest-of-Asia-Pacific Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.19: Latin America, Middle East and Africa Non-Invasive Drug Delivery Devices Market, 2018-2025

Figure 9.20: Latin America, Middle East and Africa: Market Dynamics

Figure 10.1: Adherium Limited: Product Offerings

Figure 10.2: Overall Financials, 2016-2018

Figure 10.3: R&D Expense, 2016-2018

Figure 10.4: Adherium Limited: SWOT Analysis

Figure 10.5: Capsule Technologies, Inc.: Product Offerings

Figure 10.6: Capsule Technologies, Inc.: SWOT Analysis

Figure 10.7: Crossject S.A.: Product Offerings

Figure 10.8: Overall Financials, 2017-2019

Figure 10.9: Crossject S.A.: SWOT Analysis

Figure 10.10: Diabeloop SA: Product Offerings

Figure 10.11: Diabeloop SA : SWOT Analysis

Figure 10.12: HNS International, Inc.: Product Offerings

Figure 10.13: HNS International, Inc.: SWOT Analysis

Figure 10.14: Inovio Pharmaceuticals, Inc.: Product Offerings

Figure 10.15: Inovio Pharmaceuticals, Inc.: Overall Financials, 2017-2019

Figure 10.16: Inovio Pharmaceuticals, Inc.: R& D Expense, 2017-2019

Figure 10.17: Inovio Pharmaceuticals, Inc.: SWOT Analysis

Figure 10.18: Medtronic Plc.: Product Portfolio

Figure 10.19: Medtronic Plc.: Overall Financials, 2017-2019

Figure 10.20: Medtronic Plc.: Revenue (by Segment), 2017-2019

Figure 10.21: Medtronic Plc.: Revenue (by Region), 2017-2019

Figure 10.22: Medtronic Plc.: Research and Development Expense, 2017-2019

Figure 10.23: Medtronic Plc.: SWOT Analysis

Figure 10.24: Novartis AG: Product Offerings

Figure 10.25: Novartis AG: Overall Financials, 2017-2019

Figure 10.26: Novartis AG Net Revenue (by Business Segment), 2016-2018

Figure 10.27: Novartis AG: Net Revenue (by Region), 2016-2018

Figure 10.28: Novartis AG: R&D Expense, 2016-2018

Figure 10.29: Novartis AG: SWOT Analysis

Figure 10.30: PenJet: Product Offerings

Figure 10.31: PenJet :SWOT Analysis

Figure 10.32: Pharma Jet: Product Offerings

Figure 10.33: PharmaJet: SWOT Analysis

Figure 10.34: Portal Instruments: Product Offerings

Figure 10.35: Portal Instruments: SWOT Analysis

Figure 10.36: Propeller Health: Product Offerings

Figure 10.37: Propeller Health: SWOT Analysis

Figure 10.38: Sensirion AG: Product Offerings

Figure 10.39: Sensirion AG: Overall Financials, 2017-2019

Figure 10.40: Sensirion AG: Net Revenue (by Business Segment), 2017-2019

Figure 10.41: Sensirion AG: Net Revenue (by Region), 2017-2019

Figure 10.42: Sensirion AG: R&D Expense, 2017-2019

Figure 10.43: Sensirion AG: SWOT Analysis

Figure 10.44: Tandem Diabetes Care, Inc.: Overall Product Offerings

Figure 10.45: Tandem Diabetes Care, Inc.: Overall Financials, 2016-2018

Figure 10.46: Tandem Diabetes Care, Inc.: Research and Development Expense, 2017-2019

Figure 10.47: Tandem Diabetes Care, Inc.: SWOT Analysis

Figure 10.48: Teva Pharmaceuticals Industries Ltd.: Overall Product Offerings

Figure 10.49: Teva Pharmaceuticals Industries Ltd.: Overall Financials, 2016-2018

Figure 10.50: Teva Pharmaceuticals Industries Ltd.: Net Revenue (by Business Segment), 2016-2018

Figure 10.51: Teva Pharmaceuticals Industries Ltd.: Research and Development Expense, 2016-2018

Figure 10.52: Teva Pharmaceuticals Industries Ltd.: SWOT Analysis

Market Overview

Market Overview and Estimation

The global non-invasive drug delivery devices market consists of manufacturers along with the pharmaceutical companies and third-party distributors. The member either operate individually or in partnership to offer non-invasive drug delivery products in the market.

The drug delivery device manufacturers comprises all the market participants that manufacturers non-invasive drug delivery devices for a pharmaceutical company or directly sell them. A drug delivery device manufacturer can have partnerships with more than one pharmaceutical company and thus serve multiple companies.

The pharmaceutical companies manufacture often partner with drug delivery device manufacturers to sell their drugs along with drug delivery devices. In some cases, the pharma companies themselves manufacture the delivery devices as well and sell the combined product that comprises drug and the device as an individual unit.

The global non-invasive drug delivery devices market was valued at $548.5 million in 2018 and is anticipated to reach $2,354.4 million by 2025, witnessing a CAGR of 23.13% in the forecast period 2019-2025. The continued and significant investments by the healthcare companies to meet the industry demand is one of the prominent factors propelling the growth of the global non-invasive drug delivery devices market.

Further, the increasing burden of chronic diseases, an increase in the prevalence of diabetic population, growing geriatric population, high demand for needle-free injector, and a rise in demand for self-administrable drug delivery devices is bolstering the growth of the global non-invasive drug delivery devices market.

|

Market Dynamics |

|||

|

Growth Drivers |

• Increasing Prevalence of Chronic and Lifestyle-Associated Diseases Elevating the Demand of Non-Invasive Drug Delivery Devices • Growing Geriatric Population Leads to Surge in Exigency of Non-Invasive Drug Delivery Devices • Increasing Needlestick Injuries Lead to Surge in Demand of Non-Invasive Drug Delivery Devices • Increasing Demand for the Self-Administered Medication Service • Persistent Support from Government and Non-Government Organizations

|

||

|

Market Restraints |

• Technical Barrier to the Non-Invasive Mode of Drug Delivery • Alternative Drug Delivery Technology

|

||

|

Market Opportunities |

• Expansion into the Emerging Economies • Technological Advancement of Non-Invasive Drug Delivery Devices • Collaboration between Pharmaceutical Companies and Drug Delivery Firms |

||

Growth Factors

- Increasing Prevalence of Chronic and Lifestyle-Associated Diseases: Sedentary lifestyle is leading to growing obesity problems, thus resulting in a massive economic burden of chronic and lifestyle-associated diseases. Globally, mortality rate is increasing due to chronic illness such as stroke, cardiovascular diseases, and chronic neurological conditions, which leads to an increase in demand for non-invasive drug delivery devices. The escalating mortality rate due to chronic and lifestyle-associated diseases has significantly elevated the requirement for non-invasive drug delivery devices for self-administration of drugs.

- Growing Geriatric Population: The life expectancy in most of the countries had surged tremendously. The improvement in life expectancy is majorly due to significant advancement in diagnostic technology and medical science and improving awareness regarding health, nutrition, and hygiene. Increasing demand for better treatment facilities with an early diagnosis of chronic diseases surges the demand for advanced treatment facilities.

- Increasing Needlestick Injuries: The healthcare providers are exposed to an increased threat of needlestick injuries owing to their exposure to an extremely competitive work environment, which exposes them to enhance the risk of diseases transmitted by the blood, which include tuberculosis, HIV, and hepatitis B-C, among others.

- Increasing Demand for the Self-Administered Medication Service: The increasing cos of healthcare is driving the development of the new generation of injectable therapies which can be self-administered by the patient. The growing demand for self-administration has created an immense need for user-friendly drug delivery devices which are safe and efficient. In addition, these devices also boost compliance to therapy throughout various chronic conditions. This mode reduces dependability on any healthcare professional and thus is a suitable treatment option in emergency conditions such as bronchitis and asthma. It could also save time and hospital visits of a patient and will promote the growth of self-administered medication with time.

Key Questions Answered in this Report:

• What are the different types of non-invasive drug delivery systems available in the market, and what are the benefits offered by them?

• What are the major drivers, challenges, and opportunities in the global non-invasive drug delivery devices market?

• What are the key development strategies implemented by the key players to stand out in this market?

• What are the regulations pertaining to the global non-invasive drug delivery devices market?

• What are the initiatives implemented by different governmental bodies regulating the development and commercialization of non-invasive drug delivery?

• What are the leading companies dominating the global non-invasive drug delivery devices market?

• How is non-invasive drug delivery devices market taking over the injectable drug delivery devices market by 2025?

• How is the price of the needle-free injectors anticipated to affect the demand for injectable drug delivery devices?

• What is the lifespan of the different needle-free injectors by companies in the market?

• Based on the application, which non-invasive drug delivery application is anticipated to witness a massive rise in demand in the forecast period?

• What was the market value in 2018 of the leading segments and sub-segments of the global non-invasive drug delivery devices market?

• How is each segment of the global non-invasive drug delivery devices market expected to grow during the forecast period, and what is the revenue expected to be generated by each of the segments by the end of 2025?

• How is the industry anticipated to evolve during the forecast period 2019-2025?

• Which region is expected to contribute to the highest sales of the global non-invasive drug delivery devices market during the forecast period?

• What are the leading trends and consumer preferences witnessed in the global non-invasive drug delivery devices markets?

Report Description

|

Market Report Coverage - Global Non-Invasive Drug Delivery Devices Market |

|||

|

Base Year |

2018 |

Market Size in 2018 |

$548.5 Million |

|

Forecast Period |

2019-2025 |

Value Estimation by 2025 |

$ 2354.4 Million |

|

CAGR During Forecast Period |

23.13% |

Number of Tables |

22 |

|

Number of Pages |

202 |

Number of Figures |

139 |

|

Market Segmentation |

• Type - needle-free injector and digital respiratory devices • Application - diabetes management, vaccine management, pain management, respiratory management, and others |

||

|

Regional Segmentation |

• North America – U.S. and Canada • Europe – Germany, U.K., France, and Rest-of-Europe • Asia-Pacific – Japan, China, India, Australia, and Rest-of-Asia-Pacific • Latin America, Middle East and Africa |

||

|

Key Companies Profiled |

Novartis AG, Inovio Pharmaceuticals, Inc., Medtronic Plc., Tandem Diabetes Care, Inc., Teva Pharmaceutical Industries Ltd., Crossject Medical Technology, Adherium Ltd., and Sensirion AG, Diabeloop, PharmaJet, PenJet, Portal Instruments, HNS International, Inc., Capsule Technologies, Inc., and Propeller Health, among others. |

||

Market Segmentation

Market Outlook by Type

Presently, the artificial pancreas or closed loop insulin pump devices are the leading contributor to the global non-invasive drug delivery devices market. In 2018, the contribution of the artificial pancreas contributed a significant amount to the total market revenue of the global non-invasive drug delivery devices market. The dominance of artificial pancreas can be attributed to an increasing prevalence of diabetes and the rise in demand for artificial organs.

By Region

North America currently holds the largest market share in terms of revenue generation. North America non-invasive drug delivery devices market was valued at $413.4 million in 2018. The increasing burden of chronic diseases, an increase in the prevalence of diabetic population, growing geriatric population, high demand for needle-free injector, and a rise in demand for self-administrable drug delivery devices has resulted in the increased demand for non-invasive drug delivery devices.

The massive demand for such devices is the major factor for propelling the growth of the North America non-invasive drug delivery devices market. However, the non-invasive drug delivery devices market in Europe is anticipated to witness the highest growth rate during the forecast period. The increase in number of prevalence of chronic diseases and high costs associated with the needlestick injuries are driving this market forward during the forecast period.

Global Non-Invasive Drug Delivery Devices Market

Analysis and Forecast, 2019-2025