A quick peek into the report

Table of Contents

1 Product Definition

2 Scope of the Work

2.1 Overview: Report Scope

2.2 Segmentation of the Global Viral Vector and Plasmid Manufacturing Market

2.3 Assumptions and Limitations

2.4 Key Questions Answered in the Report

2.5 Base Year and Forecast Period

3 Research Methodology

3.1 Overview: Report Methodology

4 Global Viral Vector and Plasmid Manufacturing Market Overview

4.1 Market Overview

4.2 Introduction to Vectors

4.3 Importance of Viral Vectors and Plasmid DNA

4.4 Major Milestone in Vector Manufacturing

4.4.1 Manufacturing Process

4.4.1.1 Upstream Bioprocessing

4.4.1.2 Downstream Bioprocessing

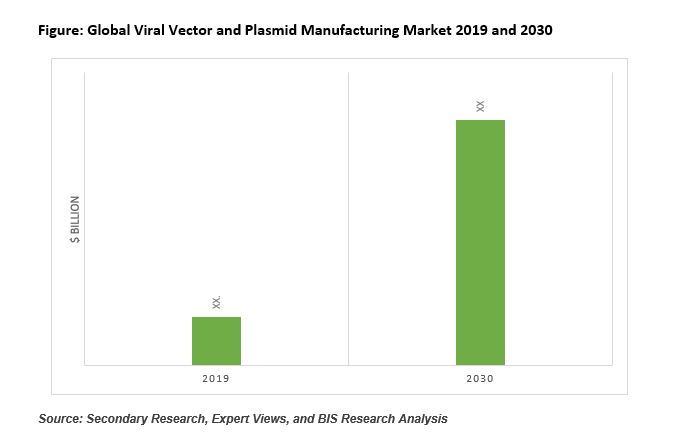

4.5 Global Viral Vector and Plasmid Manufacturing Market Size, 2019-2030

5 Market Dynamics

5.1 Market Drivers

5.1.1 Rapid Uptake of Viral Vectors and Plasmid for the Development of Innovative Therapies

5.1.2 Rising Prevalence of Cancer, Genetic Disorders, and Infectious Diseases

5.1.3 Increasing Number of Clinical Studies for the Development of Gene Therapy

5.1.4 Favorable Funding Scenario for Vector-Based Therapies

5.2 Market Restraints

5.2.1 Unaffordable Cost of Gene Therapies

5.2.2 High Manufacturing Costs of Viral Vectors and Plasmids

5.2.3 Complications Associated With Large-Scale Production of Vectors

5.3 Market Opportunities

5.3.1 Rising Demand for Synthetic Genes

5.3.2 Emergence of Next-Generation Vectors

6 Industry Insights

6.1 Overview

6.2 Regulatory Scenario

6.3 Patent Landscape

7 Competitive Landscape

7.1 Overview

7.2 Key Developments and Strategies

7.2.1 Partnerships and Alliances

7.2.2 Business Expansions

7.2.3 New Offerings

7.2.4 M & A Activities

7.2.5 Others

7.3 Market Share Analysis

8 Global Viral Vector and Plasmid Manufacturing Market (by Vector)

8.1 Overview

8.2 Viral Vector

8.2.1 Adenoviral Vector

8.2.2 Retroviral Vector

8.2.3 Adeno-Associated Viral Vector

8.2.4 Lentiviral Vector

8.2.5 Vaccinia Viral Vector

8.2.6 Other Viral Vectors

8.3 Plasmid

9 Global Viral Vector and Plasmid Manufacturing Market (by Disease)

9.1 Overview

9.2 Cancer

9.3 Genetic Disease

9.4 Infectious Disease

9.5 Cardiovascular Disease

9.6 Other Diseases

10 Global Viral Vector and Plasmid Manufacturing Market (by Application)

10.1 Overview

10.2 Gene Therapy

10.3 Vaccinology

10.4 Cell Therapy

10.5 Other Applications

11 Global Viral Vector and Plasmid Manufacturing Market (by Region)

11.1 Overview

11.2 North America

11.2.1 Overview

11.2.2 U.S.

11.2.3 Canada

11.3 Europe

11.3.1 Overview

11.3.2 Germany

11.3.3 U.K.

11.3.4 France

11.3.5 Italy

11.3.6 Switzerland

11.3.7 Belgium

11.3.8 Spain

11.3.9 Rest-of-Europe

11.4 Asia-Pacific

11.4.1 Overview

11.4.2 China

11.4.3 Australia

11.4.4 Japan

11.4.5 India

11.4.6 South Korea

11.4.7 Singapore

11.4.8 Rest-of-Asia-Pacific

11.5 Rest-of-the-World

11.5.1 Overview

12 Company Profiles

12.1 Overview

12.2 Aldevron, LLC

12.2.1 Company Overview

12.2.2 Role of Aldevron, LLC in the Global Viral Vector and Plasmid Manufacturing Market

12.2.3 SWOT Analysis

12.3 Boehringer Ingelheim

12.3.1 Company Overview

12.3.2 Role of Boehringer Ingelheim in the Global Viral Vector and Plasmid Manufacturing Market

12.3.3 SWOT Analysis

12.4 Catalent, Inc.

12.4.1 Company Overview

12.4.2 Role of Catalent, Inc. in the Global Viral Vector and Plasmid Manufacturing Market

12.4.3 Financials

12.4.4 Key Insights About Financial Health of the Company

12.4.5 SWOT Analysis

12.5 FUJIFILM Holdings Corporation

12.5.1 Company Overview

12.5.2 Role of FUJIFILM Holdings Corporation in the Global Viral Vector and Plasmid Manufacturing Market

12.5.3 Financials

12.5.4 Key Insights About Financial Health of the Company

12.5.5 SWOT Analysis

12.6 GENERAL ELECTRIC

12.6.1 Company Overview

12.6.2 Role of GENERAL ELECTRIC in the Global Viral Vector and Plasmid Manufacturing Market

12.6.3 Financials

12.6.4 Key Insights About Financial Health of the Company

12.6.5 SWOT Analysis

12.7 GenScript

12.7.1 Company Overview

12.7.2 Role of GenScript in the Global Viral Vector and Plasmid Manufacturing Market

12.7.3 Financials

12.7.4 Key Insights About Financial Health of the Company

12.7.5 SWOT Analysis

12.8 Lonza

12.8.1 Company Overview

12.8.2 Role of Lonza in the Global Viral Vector and Plasmid Manufacturing Market

12.8.3 Financials

12.8.4 Key Insights About Financial Health of the Company

12.8.5 SWOT Analysis

12.9 Merck KGaA

12.9.1 Company Overview

12.9.2 Role of Merck KGaA in the Global Viral Vector and Plasmid Market

12.9.3 Financials

12.9.4 Key Insights About Financial Health of the Company

12.9.5 SWOT Analysis

12.10 MolMed S.p.A.

12.10.1 Company Overview

12.10.2 Role of MolMed S.p.A. in the Global Viral Vector and Plasmid Manufacturing Market

12.10.3 Financials

12.10.4 SWOT Analysis

12.11 Novasep Holding SAS

12.11.1 Company Overview

12.11.2 Role of Novasep Holding SAS in the Global Viral Vector and Plasmid Manufacturing Market

12.11.3 SWOT Analysis

12.12 Oxford Biomedica plc

12.12.1 Company Overview

12.12.2 Role of Oxford Biomedica plc in the Global Viral Vector and Plasmid Manufacturing Market

12.12.3 Financials

12.12.4 Key Insights About Financial Health of the Company

12.12.5 SWOT Analysis

12.13 Sartorius AG

12.13.1 Company Overview

12.13.2 Role of Sartorius AG in the Global Viral Vector and Plasmid Manufacturing Market

12.13.3 Financials

12.13.4 Key Insights About Financial Health of the Company

12.13.5 SWOT Analysis

12.14 Takara Bio Inc.

12.14.1 Company Overview

12.14.2 Role of Takara Bio Inc. in the Global Viral Vector and Plasmid Manufacturing Market

12.14.3 Financials

12.14.4 Key Insights About Financial Health of the Company

12.14.5 SWOT Analysis

12.15 Thermo Fisher Scientific Inc.

12.15.1 Company Overview

12.15.2 Role of Thermo Fisher Scientific Inc. in the Global Viral Vector and Plasmid Manufacturing Market

12.15.3 Financials

12.15.4 Key Insights About Financial Health of the Company

12.15.5 SWOT Analysis

12.16 WuXi AppTec

12.16.1 Company Overview

12.16.2 Role of WuXi AppTec in the Global Viral Vector and Plasmid Manufacturing Market

12.16.3 Financials

12.16.4 Key Insights About Financial Health of the Company

12.16.5 SWOT Analysis: WuXi AppTec

Table 1: Leading Segments of the Global Viral Vector and Plasmid Manufacturing Market, 2019 and 2030

Table 4.1: Advantages and Disadvantages of Common Viral Vectors and Plasmids

Table 5.1: Gene Therapy for Different Types of Cancer

Table 5.2: Recent Approvals for Gene Therapy

Table 5.3: Companies Offering Gene Therapies and Their Cost

Table 6.1: Global Regulatory Scenario

Table 6.2: Patents Related to Viral Vectors and Plasmids (January 2017-February 2020)

Table 8.1: Examples of Viral Vectors Used in Gene Therapy

Table 8.2: Plasmids Used in Gene Therapy Trials

Table 9.1: Examples of Ad Vectors for Cancer Gene Therapy

Table 9.2: Features of Vectors Used in Cardiovascular Therapy

Table 10.1: Examples of Clinical Trials Using Viral Vectors

Table 10.2: Advantages and Disadvantages Associated with Major Viral Vectors

Table 11.1: Examples of Key Companies with Headquarters in the U.S.

List of Figures

Figure 1: Global Viral Vector and Plasmid Manufacturing Market (by Region), 2019 and 2030

Figure 2: Key Players of the Global Viral Vector and Plasmid Manufacturing Market

Figure 3: Drivers, Challenges, and Opportunities of the Global Viral Vector and Plasmid Manufacturing Market

Figure 4: Share of Key Developments and Strategies, January 2017-February 2020

Figure 5: Global Viral Vector and Plasmid Manufacturing Market (by Vector Type), 2019 and 2030

Figure 6: Global Viral Vector and Plasmid Manufacturing Market (by Viral Vector), 2019 and 2030

Figure 7: Global Viral Vector and Plasmid Manufacturing Market (by Disease), 2019 and 2030

Figure 8: Global Viral Vector and Plasmid Manufacturing Market (by Application), 2019 and 2030

Figure 2.1: Global Viral Vector and Plasmid Manufacturing Market Segmentation

Figure 3.1: Global Viral Vector and Plasmid Manufacturing Market Research Methodology

Figure 3.2: Primary Research

Figure 3.3: Secondary Research

Figure 3.4: Data Triangulation

Figure 3.5: Bottom-up Approach (Segment-Wise Analysis)

Figure 3.6: Top-Down Approach (Segment-Wise Analysis)

Figure 3.7: Assumptions and Limitations

Figure 4.1: Mechanism of Action of Vectors

Figure 4.2: Evolutionary History of Vectors

Figure 4.3: Typical Production Methods of Viral Vectors and Plasmids

Figure 4.4: Global Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 5.1: Drivers, Challenges, and Opportunities of the Global Viral Vector and Plasmid Manufacturing Market

Figure 5.2: Estimated New Cancer Cases and Deaths (by Sex), U.S., 2020

Figure 6.1: Workflow Associated With Biomanufacturing

Figure 6.2: Global Viral Vector and Plasmid Manufacturing Market: Patent Analysis (by Year of Publication), June 2017-December 2019

Figure 7.1: Competitive Landscape, January 2017- March 2020

Figure 7.2: Share of Key Developments and Strategies, January 2017-February 2020

Figure 7.3: Partnerships and Alliances (by Company), January 2017-February 2020

Figure 7.4: Business Expansions (by Company), January 2017-February 2020

Figure 7.5: New Offerings (by Company), January 2017-February 2020

Figure 7.6: M&A Activities (by Company), January 2017-February 2020

Figure 7.7: Others (by Company), January 2017-February 2020

Figure 7.8: Market Share Analysis of Global Viral Vector and Plasmid Manufacturing Market, 2019

Figure 8.1: Global Viral Vector and Plasmid Manufacturing Market Segmentation (by Vector)

Figure 8.2: Global Viral Vector and Plasmid Manufacturing Market (by Vector Type), 2019 and 2030

Figure 8.3: Global Viral Vector and Plasmid Manufacturing Market for Viral Vectors, 2019-2030

Figure 8.4: Global Viral Vector and Plasmid Manufacturing Market (by Viral Vector), 2019 and 2030

Figure 8.5: Global Viral Vector and Plasmid Manufacturing Market for Adenoviral Vectors, 2019-2030

Figure 8.6: Global Viral Vector and Plasmid Manufacturing Market for Retroviral Vectors, 2019-2030

Figure 8.7: Global Viral Vector and Plasmid Manufacturing Market for Adeno-Associated Viral Vectors, 2019-2030

Figure 8.8: Global Viral Vector and Plasmid Manufacturing Market for Lentiviral Vectors, 2019-2030

Figure 8.9: Global Viral Vector and Plasmid Manufacturing Market for Vaccinia Viral Vectors, 2019-2030

Figure 8.10: Global Viral Vector and Plasmid Manufacturing Market for Other Viral Vectors, 2019-2030

Figure 8.11: Global Viral Vector and Plasmid Manufacturing Market for Viral Vectors, 2019-2030

Figure 9.1: Global Viral Vector and Plasmid Manufacturing Market Segmentation (by Disease)

Figure 9.2: Global Viral Vector and Plasmid Manufacturing Market (by Disease), 2019 and 2030

Figure 9.3: Global Viral Vector and Plasmid Manufacturing Market for Cancer, 2019-2030

Figure 9.4: List of Monogenic Disorders for which Human Gene Transfer Trials Have Been Approved

Figure 9.5: Global Viral Vector and Plasmid Manufacturing Market for Genetic Diseases, 2019-2030

Figure 9.6: Global Viral Vector and Plasmid Manufacturing Market for Infectious Diseases, 2019-2030

Figure 9.7: Global Viral Vector and Plasmid Manufacturing Market for Infectious Diseases, 2019-2030

Figure 9.8: Global Viral Vector and Plasmid Manufacturing Market for Other Diseases, 2019-2030

Figure 10.1: Global Viral Vector and Plasmid Manufacturing Market Segmentation (by Application)

Figure 10.2: Global Viral Vector and Plasmid Manufacturing Market (by Application), 2019 and 2030

Figure 10.3: Global Viral Vector and Plasmid Manufacturing Market for Gene Therapy, 2019-2030

Figure 10.4: Global Viral Vector and Plasmid Manufacturing Market for Vaccinology, 2019-2030

Figure 10.5: Global Viral Vector and Plasmid Manufacturing Market for Cell Therapy, 2019-2030

Figure 10.6: Global Viral Vector and Plasmid Manufacturing Market for Cell Therapy, 2019-2030

Figure 11.1: Global Viral Vector and Plasmid Manufacturing Market (by Region), 2019 and 2030

Figure 11.2: North America: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.3: North America: Market Dynamics

Figure 11.4: North America: Viral Vector and Plasmid Manufacturing Market (by Country), 2019 and 2030

Figure 11.5: U.S.: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.6: Canada: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.7: Europe: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.8: Europe: Market Dynamics

Figure 11.9: Europe: Viral Vector and Plasmid Manufacturing Market (by Country), 2019 and 2030

Figure 11.10: Germany: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.11: U.K.: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.12: France: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.13: Italy: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.14: Switzerland: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.15: Belgium: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.16: Spain: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.17: Rest-of-Europe: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.18: Asia-Pacific: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.19: Asia-Pacific: Market Dynamics

Figure 11.20: Asia-Pacific: Viral Vector and Plasmid Manufacturing Market (by Country), 2019 and 2030

Figure 11.21: China: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.22: Australia: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.23: Japan: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.24: India: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.25: South Korea: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.26: Singapore: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.27: Rest-of-Asia-Pacific: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.28: Rest-of-the-World: Viral Vector and Plasmid Manufacturing Market, 2019-2030

Figure 11.29: Rest-of-the-World: Viral Vector and Plasmid Manufacturing Market (Latin America and Middle-East and Africa), 2019-2030

Figure 12.1: Shares of Key Company Profiles

Figure 12.2: Aldevron, LLC: Service / Product Portfolio for Global Viral Vector and Plasmid Manufacturing Market

Figure 12.3: Aldevron, LLC: SWOT Analysis

Figure 12.4: Boehringer Ingelheim: Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.5: Boehringer Ingelheim: SWOT Analysis

Figure 12.6: Catalent, Inc: Service / Product Portfolio for Global Viral Vector and Plasmid Manufacturing Market

Figure 12.7: Catalent, Inc: Overall Financials, 2017-2019

Figure 12.8: Catalent, Inc.: Net Revenue (by Business Segment), 2017-2019

Figure 12.9: Catalent, Inc.: Net Revenue (by Region), 2017-2019

Figure 12.10: Catalent, Inc.: R&D Expense, 2017-2019

Figure 12.11: Catalent, Inc.: SWOT Analysis

Figure 12.12: FUJIFILM Holdings Corporation: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.13: FUJIFILM Holdings Corporation: Overall Financials, 2017-2019

Figure 12.14: FUJIFILM Holdings Corporation: Net Revenue (by Business Segment), 2017-2019

Figure 12.15: FUJIFILM Holdings Corporation: Healthcare and Material Solutions Revenue (by Sub-Segment), 2017-2019

Figure 12.16: FUJIFILM Holdings Corporation: R&D Expense, 2017-2019

Figure 12.17: FUJIFILM Holdings Corporation: SWOT Analysis

Figure 12.18: GE Healthcare: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.19: GENERAL ELECTRIC Company: Overall Financials, 2017-2019

Figure 12.20: GENERAL ELECTERIC: Revenue (by Business Model), 2017-2019

Figure 12.21: GENERAL ELECTRIC: Revenue (by Region), 2017-2019

Figure 12.22: GENERAL ELECTRIC: R&D Expenditure, 2017-2019

Figure 12.23: GENERAL ELECTRIC: SWOT Analysis

Figure 12.24: GenScript: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.25: GenScript: Overall Financials, 2016-2018

Figure 12.26: GenScript: R&D Expense, 2016-2018

Figure 12.27: GenScript: SWOT Analysis

Figure 12.28: Lonza: Service / Product Portfolio for Global Viral Vector and Plasmid Manufacturing Market

Figure 12.29: Lonza: Overall Financials, 2017-2019

Figure 12.30: Lonza: Revenue (by Segment), 2017-2019

Figure 12.31: Lonza: Revenue (by Region), 2017-2019

Figure 12.32: Lonza: R&D Expenditure (2017-2019)

Figure 12.33: Lonza: SWOT Analysis

Figure 12.35: Merck KGaA: Overall Financials, 2017-2019

Figure 12.36: Merck KGaA: Revenue (by Product and Services), 2017-2019

Figure 12.37: Merck KGaA: Revenue (by Region), 2017-2019

Figure 12.38: Merck KGaA: R&D Expenditure, 2017-2019

Figure 12.40: MolMed S.p.A.: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.41: MolMed S.p.A.: Overall Financials, 2016-2018

Figure 12.42: MolMed S.p.A.: SWOT Analysis

Figure 12.43: Novasep Holding SAS: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.44: Novasep Holding SAS: SWOT Analysis

Figure 12.45: Oxford Biomedica plc: Service / Product Portfolio for Global Viral Vector and Plasmid Manufacturing Market

Figure 12.46: Oxford Biomedica plc: Overall Financials, 2016-2018

Figure 12.47: Oxford Biomedica plc: Revenue (by Segment), 2016-2018

Figure 12.48: Oxford Biomedica plc: R&D Expenditure (2016-2018)

Figure 12.49: Oxford Biomedica plc: SWOT Analysis

Figure 12.50: Sartorius AG: Service/Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.51: Sartorius AG: Overall Financials, 2017-2019

Figure 12.52: Sartorius AG: Revenue (by Business Segment), 2017-2019

Figure 12.53: Sartorius AG: Revenue (by Region), 2017-2019

Figure 12.54: Sartorius AG: R&D Expenditure (2017-2019)

Figure 12.55: Sartorius AG: SWOT Analysis

Figure 12.56: Takara Bio Inc.: Service/Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.57: Takara Bio Inc.: Overall Financials, 2017-2019

Figure 12.58: Takara Bio Inc.: Revenue (by Business Segment), 2017-2019

Figure 12.59: Takara Bio Inc.: Revenue (by Region), 2017-2019

Figure 12.60: Takara Bio Inc.: R&D Expenditure (2017-2019)

Figure 12.61: Takara Bio Inc.: SWOT Analysis

Figure 12.62: Thermo Fisher Scientific, Inc.: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.63: Thermo Fisher Scientific, Inc.: Overall Financials, 2017-2019

Figure 12.64: Thermo Fisher Scientific, Inc.: Revenue (by Business Segment), 2017-2019

Figure 12.65: Thermo Fisher Scientific, Inc.: Revenue (by Region), 2017-2019

Figure 12.66: Thermo Fisher Scientific, Inc.: R&D Expenditure (2017-2019)

Figure 12.67: Thermo Fisher Scientific, Inc.: SWOT Analysis

Figure 12.68: WuXi AppTec: Service / Product Portfolio for the Global Viral Vector and Plasmid Manufacturing Market

Figure 12.69: WuXi AppTec: Overall Financials, 2016-2018

Figure 12.70: WuXi AppTec: Net Revenue (by Business Segment), 2016-2018

Figure 12.71: WuXi AppTec: Net Revenue (by Region), 2016-2018

Figure 12.72: WuXi AppTec: R&D Expense, 2016-2018

Figure 12.73: WuXi AppTec: SWOT Analysis

Key Questions Answered

Key Questions Answered

- What is a vector and what is its importance in the medical industry? What are the major characteristics and types of vectors? What are the areas of application of vectors?

- What are the major advancements in viral vector and plasmid manufacturing? What are the key trends of the global viral vector and plasmid manufacturing market? How is the market evolving and what is its future scope?

- What are the major drivers, challenges, and opportunities of the global viral vector and plasmid manufacturing market?

- What are the key developmental strategies implemented by the key players of the global viral vector and plasmid manufacturing market to sustain the competition of the market? What is the percentage share of each of the key players in different key developmental strategies?

- What is the regulatory scenario of the global viral vector and plasmid manufacturing market? What are the initiatives implemented by different governmental bodies and guidelines put forward to regulate the commercialization of viral vector and plasmid manufacturing products?

- What are major milestones in patenting activity in the global viral vector and plasmid manufacturing market?

- What was the market size of the global viral vector and plasmid manufacturing market in 2019 and what is the market size anticipated to be in 2030? What is the expected growth rate of the global viral vector and plasmid manufacturing market during the period between 2020 and 2030?

- What is the global market size for manufacturing plasmids and different types of viral vectors available in the global viral vector and plasmid manufacturing market in 2019? What are the key trends of the market with respect to different vectors and which vector type is expected to dominate the market in 2030?

- What are the different disease areas where plasmids and viral vectors are employed in the global viral vector and plasmid manufacturing market? Which disease type dominated the market in 2019 and is expected to dominate in 2030?

- What are the different applications associated with viral vector and plasmid manufacturing? What was the contribution of each of the application areas in the global viral vector and plasmid manufacturing market in 2019 and what is it expected in 2030?

- Which region is expected to contribute the highest sales in the global viral vector and plasmid manufacturing market during the period between 2019 and 2030? Which region and country carries the potential for the significant expansion of key companies for different viral vector and plasmid manufacturing? What are the leading countries of different regions that contribute significantly toward the growth of the viral vector and plasmid manufacturing market?

- What are the key players of the global viral vector and plasmid manufacturing market and what is their role in the market? What is the market share of the key players in 2019?

Market Overview

Market Overview - Global Viral Vector and Plasmid Manufacturing Market

The global viral vector and plasmid manufacturing market represents the market scenario of the viral vector and plasmid products and services across the world, taking into account key companies and their offerings in the market.

The advent of advanced therapies including gene therapy and cell therapy, which employ the use of vectors has created a huge buzz in the field of medicine in the past few decades. Therapies that require genetic modification, including the introduction of therapeutic DNA/gene into a patient's body or cell, demonstrated tremendous potential for the treatment of several critical diseases, including cancer, Alzheimer's disease, Parkinson's disease, and rheumatoid arthritis, among others.

A vector act as a gene delivery vehicle used for the introduction of a transgene into the targeted cell, where it can be replicated and/or expressed. The vector itself is a DNA molecule, consisting of an insert (transgene) and a larger sequence that serves as the pillar of the vector. The main role of the vector in transferring genetic information to another cell involves isolation, multiplication, or expression of the insert in the target cell.

Viral and non-viral vectors have emerged as well-organized delivery tools offering promising therapeutic approaches for previously intractable human diseases, including cancer, genetic, immunologic, neurodegenerative, ocular, as well as cardiovascular diseases, among others.

According to the market intelligence by BIS Research, global viral vector and plasmid manufacturing market was estimated at $1.16 billion in 2019 and is expected to grow at a significant double digit CAGR during the forecast period from 2020 to 2030.

|

Market Dynamics |

|||

|

Growth Drivers |

• Rising Prevalence of Cancer, Genetic Disorders, and Infectious Diseases • Rapid Uptake of Viral and Plasmid Vectors for the Development of Innovative Therapies • Increasing Number of Clinical Studies for the Development of Gene Therapy • Favorable Funding Scenario for Vector-Based Therapies |

||

|

Market Challenges |

• Unaffordable Cost of Gene Therapies • High Manufacturing Costs of Viral Vectors and Plasmids • Complications Associated with Large-Scale Production of Vectors |

||

|

Market Opportunities |

• Rising Demand for Synthetic Genes • Emergence of Next-Generation Vectors |

||

Growth Factors

- Rising prevalence of cancer, genetic disorders, and infectious diseases: Rising prevalence of cancer, genetic diseases, and infectious diseases is generating high demand for vector-based gene therapies, cell therapies, and vaccines, and therefore acting as one of the key driving factors for the growth of the global viral vector and plasmid manufacturing market. The most common types of cancers include breast cancer, lung cancer, prostate cancer, colon, and rectum cancer. Among these, lung cancer accounts for most of the cancer deaths, followed by breast cancer and colorectal cancer, according to the World Health Organization.

- Rapid uptake of viral and plasmid vectors for the development of innovative therapies: Viral and non-viral vectors are increasingly being used for the development of novel therapies. These vectors are helpful in achieving in-vivo delivery of gene to a targeted cell or tissue. Viral vectors such as adeno-associated virus, lentivirus, and retrovirus are some of the commonly used vectors utilized in several clinical and preclinical trials evaluating gene and cell therapy products as well as vaccines.

- Increasing number of clinical studies for the development of gene therapy: Currently, the global gene therapy market is witnessing an increasing number of clinical trials, offering a lucrative opportunity for the growth of viral vector and plasmid manufacturing market.

- Favorable funding scenario for vector-based therapies: Preclinical and clinical trials, analyzing the effectiveness of any therapy, require adequate funding because of the high cost involved in manufacturing and development of the new therapy. Huge availability of grants and funds for conducting research and development activities related to vector-based cell and gene therapies is actively promoting the growth of the viral vector and plasmid manufacturing market.

Report Description

|

Market Report Coverage - Global Viral Vector and Plasmid Manufacturing Market |

|||

|

Base Year |

2018 |

Market Size by 2018 |

$1,158.44 Million |

|

Forecast Period |

2020-2030 |

Value Estimation by 2030 |

$ 5,862.22 Million |

|

CAGR During Forecast Period |

16.28% |

Number of Tables |

14 |

|

Number of Pages |

275 |

Number of Figures |

157 |

|

Market Segmentation |

• Vector Type – Plasmid DNA and Viral Vector • Viral Vector Type – Adenovirus, Adeno-Associated Virus, Retrovirus, Lentivirus, Vaccinia Virus, and Other Viral Vectors • Disease Type – Cancer, Genetic Disease, Infectious Disease, Cardiovascular Disease, and Other Diseases • Application – Gene Therapy, Cell Therapy, Vaccinology, and Other Applications |

||

|

Regional Segmentation |

• North America – U.S., Canada • Europe – Germany, U.K., France, Italy, Switzerland, Belgium Spain, and Rest-of-Europe • Asia-Pacific – China, Australia, Japan, India, South Korea, Singapore, and Rest-of-Asia-Pacific • Rest-of-the-World – Latin America and Middle-East and Africa |

||

|

Key Companies Profiled |

FUJIFILM Holdings Corporation, GENERAL ELECTRIC, Lonza, Merck KGaA, MolMed S.p.A., Novasep Holding, Oxford Biomedica plc, Catalent, Inc., Thermo Fisher Scientific, Inc., GenScript, Boehringer Ingelheim, Wuxi AppTec Co., Ltd., Sartorius AG, Takara Bio Inc., and Aldevron, L.L.C. |

||

Market Segmentation

Market Outlook by Vector Type

The vector type market segment is further categorized into plasmid DNA and viral vector. Both viral vector and plasmids have gained widespread success, owing to the promising results displayed by them in preclinical and clinical studies of cell and gene therapies as well as vector-based vaccine products.

Among these two classes of vectors, viral vectors account for majority of the market share that is mainly attributable to the availability of a large variety of viral vector options in the market and the effectiveness displayed by each of them in the treatment of various diseases. The market is largely dominated by viral vectors that contributed to maximum of the total market share in 2019.

By Disease Type

The disease type segment is further categorized into cancer, genetic disease, infectious disease, cardiovascular disease, and other diseases. The global viral vector and plasmid manufacturing market, by disease, is largely dominated by the cancer segment that contributed to maximum of the total market share in 2019. The cancer segment is expected to register a double digit CAGR during the forecast period between 2020 and 2030. This is mainly attributed to the progress made in vector-based CAR-T cell therapies and increasing investments in the field of oncology for the development of advanced therapies.

However, among the different disease types, the infectious disease segment is expected to account for the highest CAGR during the forecast period between 2020 and 2030, owing to the increasing investments in the infectious disease sector, globally, for the development of advanced therapies to protect against infectious disease pandemics and outbreaks.

By Region

North America dominated the global viral vector and plasmid manufacturing market in 2019. The presence of a large number of well-equipped vector manufacturing facilities with advanced infrastructure and the strong investments in the biomanufacturing sector are significantly promoting the growth of the viral vector and plasmid manufacturing market in North America.

The North America viral vector and plasmid manufacturing is largely dominated by the U.S., owing to the rapid adoption rate of vector-based gene and cell therapy products, which has led to an increased demand for viral vectors and plasmids.

However, among all the regions, Asia-Pacific is expected to witness the highest CAGR during the forecast period between 2020 and 2030. This is mainly attributed to the strong potential of emerging nations of Asia-Pacific including Japan, India, Australia, South Korea, and Singapore, among others.

Global Viral Vector and Plasmid Manufacturing Market

Focus on Vector Type, Application, Disease, 5 Region’s Data, 15 Countries’ Data, Patent Landscape and Competitive Insights - Analysis and Forecast, 2020-2030