A quick peek into the report

Table of Contents

1.1 Products Considered

Scope of the Report

3.1 Global Digital Biomarkers Market: Research Methodology

3.1.1 Primary Data Sources

3.1.2 Secondary Data Sources

4.1 Definition

4.2 Current State of Digital Biomarkers

4.3 Digital Biomarkers Ecosystem

4.3.1 Digital Platforms

4.3.1.1 Wearables Devices

4.3.1.2 Implantable Components/Sensors

4.3.1.3 Ingestible Sensors

4.3.1.4 Ocular Devices

4.3.1.5 Accelerometers

4.3.1.6 Smart Home Systems/IOTs

4.3.1.7 AR/VR Platforms

4.3.1.8 Desktop/Web Apps

4.4 Data Measurements

4.4.1 Physiological Parameters

4.4.2 Behavioral Parameters

4.5 Types of Biomarkers

4.5.1 Wellness

4.5.2 Disease

4.5.3 Drugs

4.6 Industry

4.6.1 Pharmaceutical

4.6.2 Biotechnology/Life Sciences

4.6.3 Medical Devices

4.6.4 App Vendors

4.6.5 Clinical Trials (Clinical Research Organizations)

4.6.6 Technology Vendors

4.7 Digital Biomarkers: Technology Landscape

4.7.1 Artificial Intelligence and Machine Learning

4.7.2 Augmented Reality and Virtual Reality

4.7.3 Blockchain

4.7.4 Edge Computing

4.7.5 Cloud Computing

4.8 Successful Case Studies: Key Therapeutic Areas

4.8.1 Cardiovascular Disease

4.8.2 Parkinson’s Disease

4.8.3 Alzheimer’s Disease

4.8.4 Huntington's disease

5.1 Growth Promoting Factors

5.1.1 Explosion of Wearable Devices and Increasing Smartphone Penetration

5.1.2 Increasing Cost of Drug Development

5.1.3 Failure of Drugs for Neurodegenerative Disorder

5.1.4 Regulatory Flexibility Toward Digital Health Solutions

5.2 Market Challenges

5.2.1 Need for Standardized and Interoperable Solutions

5.2.2 Difference or Inaccuracy in Data Measurements

5.2.3 Lack of Integration and Interoperability Between Medical Records and User Generated Data

5.2.4 Lack of Use Cases Pertaining to the Return on Investment (ROI) Analysis

5.3 Market Opportunities

5.3.1 Digital Biomarkers: The Future of Precision Medicine

5.3.2 Investment in Voice-Based Digital Biomarkers

5.3.3 Investment in Wearable Technology

5.3.3.1 Early Detection of Neurological Disorders

5.3.3.2 For General Health Management

5.3.3.3 Metabolic, Cardiovascular, and Gastrointestinal Health

5.3.3.4 Maternal, Pre- and Neo-Natal Care

5.3.3.5 Pulmonary Health and Environmental Exposures

6.1 Key Strategies and Developments

6.1.1 Synergistic Interactions

6.1.2 Product Launches and Enhancements

6.1.3 Business Expansion and Funding Activities

6.1.4 Acquisitions, Approvals, and Others

7.1 Data Collection (Sensors and Tools that Collect Data)

7.1.1 Wearables Devices

7.1.1.1 Evolution of Wearable Devices in Clinical Trials

7.1.1.2 Wearable Devices in Clinical Trials

7.1.1.3 Actigraphy Devices

7.1.1.3.1 Generational Change from Polysomnography to Actigraphy

7.1.1.3.2 ActiGraph

7.1.1.4 Market Estimation and Forecast, 2018-2025

7.1.1.5 Opportunity in Digital Biomarker

7.1.1.6 New Developments

7.2 Implantable/Ingestible Biosensors

7.2.1 Market Estimation and Forecast, 2018-2025

7.2.2 Opportunity in Digital Biomarker

7.3 Mobile/Tablet Apps

7.3.1 Market Estimation and Forecast, 2018-2025

7.3.2 Opportunity in Digital Biomarker

7.3.3 New Developments

7.3.4 Competitive Landscape

7.4 Data Integration

7.4.1 Market Estimation and Forecast, 2018-2025

7.4.2 Competitive Landscape

7.5 Global Digital biomarkers Market (by Application)

7.5.1 Gastrointestinal Diseases

7.5.1.1 Inflammatory Bowel’s Disease

7.5.2 Sleep and Movement

7.5.3 Cardiovascular

7.5.4 Mood and Behavior (Psychiatric Disorders)

7.5.5 Chronic Pain

7.5.6 Neurodegenerative Disorders

7.5.6.1 Parkinson’s Disease

7.5.6.2 Multiple Sclerosis

7.5.6.3 Alzheimer’s Disease

7.5.7 Diabetes

7.5.8 Respiratory Conditions

7.5.9 Others

8.1 Biopharmaceutical Companies

8.1.1 Role of Biopharma Companies in the Development of Digital Biomarkers

8.1.2 Major Therapeutic Areas for Biomarkers

8.1.2.1 Respiratory Diseases

8.1.2.2 Neurodegenerative Diseases

8.1.2.3 Cardiovascular Diseases

8.1.2.4 Diabetes

8.2 Payers

8.3 Providers

9.1 North America

9.1.1 U.S

9.1.1.1 Digital Health Scenario

9.1.1.2 Degree of Adoption of Wearables

9.1.1.3 Degree of Adoption of Mobile Health Applications

9.1.1.4 Local Players in the Digital Biomarker Market

9.1.1.5 Regulatory Scenario

9.1.2 Canada

9.1.2.1 Digital Health Scenario

9.1.2.2 Degree of Adoption of Wearables

9.1.2.3 Degree of Adoption of Mobile Health Applications Adoption

9.1.2.4 Local Digital Biomarker Market

9.1.2.5 Regulatory Scenario

9.1.2.6 Future of Digital Health in Canada

9.2 Europe

9.2.1 Netherlands

9.2.1.1 Digital Health Scenario

9.2.1.2 Level of Wearables Adoption

9.2.1.3 Degree of Adoption of Mobile Health Applications

9.2.1.4 Local Players in the Digital Biomarker Market

9.2.2 Germany

9.2.2.1 Digital Health Scenario

9.2.2.2 Degree of Adoption of Wearables

9.2.2.3 Reluctance to Fitness Trackers

9.2.2.4 Future of Digital Health in Germany

9.2.3 U.K.

9.2.3.1 Digital Health Scenario

9.2.3.2 Degree of Adoption of Wearables

9.2.3.3 Increasing Sales of Smartwatches

9.2.3.4 Abandonment of Wearables

9.2.3.5 Local Players in Wearables

9.2.4 France

9.2.4.1 Digital Health Scenario

9.2.4.2 Degree of Wearables Adoption

9.2.4.3 Local Players in Digital Biomarkers Market

9.2.5 Spain

9.2.5.1 Digital Health Scenario

9.2.5.2 Degree of Adoption of Wearables

9.2.6 Italy

9.2.6.1 Digital Health Scenario

9.2.6.2 Degree of Adoption of Wearables

9.2.6.3 Degree of Adoption of Mobile Health Applications

9.2.7 Russia

9.2.7.1 Digital Health Scenario

9.2.7.2 Degree of Adoption of Wearables

9.2.7.3 Degree of Adoption of Mobile Health Applications

9.2.8 Rest-of-Europe

9.2.8.1 Digital Health Scenario

9.2.8.2 Degree of Adoption of Wearables

9.2.8.3 Degree of Adoption of Mobile Health Applications

9.2.8.4 Local Player in Digital Biomarker Market

9.3 Asia-Pacific

9.3.1 China

9.3.1.1 Digital Health Scenario

9.3.1.2 Degree of Adoption of Wearables

9.3.1.3 Degree of Adoption of Mobile Health Applications

9.3.1.4 Local Players in Digital Biomarker Market

9.3.2 Japan

9.3.2.1 Digital Health Scenario

9.3.2.2 Degree of Wearables Adoption

9.3.2.3 Degree of Mobile Health Applications Adoption

9.3.2.4 Local Players in Digital Biomarker Market

9.3.3 South Korea

9.3.3.1 Digital Health Scenario

9.3.3.2 Degree of Adoption of Wearables

9.3.3.3 Degree of Adoption of Mobile Health Applications

9.3.4 India

9.3.4.1 Digital Health Scenario

9.3.4.2 Degree of Adoption of Wearables

9.3.4.3 Degree of adoption of Mobile Health Applications

9.3.4.4 Local Players in Digital Biomarker Market

9.3.5 Australia

9.3.5.1 Digital Health Scenario

9.3.5.2 Level of Wearables Adoption

9.3.5.3 Level of Mobile Health Applications Adoption

9.3.6 Singapore

9.3.6.1 Digital Health Scenario

9.3.6.2 Degree of Adoption of Wearables

9.3.6.3 Degree of Adoption of Mobile Health Applications

9.3.7 Rest-of-Asia-Pacific

9.3.7.1 Digital Health Scenario

9.3.7.2 Degree of adoption of Wearables and Mobile Health Application

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Digital Health Scenario

9.4.1.2 Degree of Adoption of Wearables

9.4.1.3 Degree of Adoption of Mobile Health Applications

9.4.2 Mexico

9.4.2.1 Digital Health Scenario

9.4.2.2 Degree of Adoption of Wearables

9.4.2.3 Degree of Adoption of Mobile Health Applications

9.5 Rest-of-the-World

9.5.1 Saudi Arabia

9.5.1.1 Digital Health Scenario

9.5.1.2 Degree of Adoption of Wearables

9.5.1.3 Degree of Adoption of Mobile Health Applications

9.5.2 U.A.E.

9.5.2.1 Digital Health Scenario

9.5.2.2 Degree of Adoption of Wearables and Mobile Health Applications

9.5.3 Israel

9.5.3.1 Digital Health Scenario

9.5.3.2 Degree of Adoption of Wearables

9.5.4 South Africa

9.5.4.1 Digital Health Scenario

9.5.4.2 Degree of Adoption of Wearables

9.5.4.3 Degree of Adoption of Mobile Health Applications

10.1 Overview

10.2 ActiGraph, LLC

10.2.1 Company Overview

10.2.2 Role of ActiGraph, LLC in the Global Digital Biomarkers Market

10.2.3 Recent Developments

10.2.4 SWOT Analysis: ActiGraph, LLC

10.3 Akili Interactive Labs

10.3.1 Company Overview

10.3.2 Role of Akili Interactive Labs in the Global Digital Biomarkers Market

10.3.3 Recent Developments

10.3.4 SWOT Analysis

10.4 AliveCor Inc.

10.4.1 Company Overview

10.4.2 Role of AliveCor, Inc. in the Global Digital Biomarkers Market

10.4.3 Recent Development

10.4.4 SWOT Analysis

10.5 Altoida AG

10.5.1 Company Overview

10.5.2 Role of Altoida AG in the Global Digital Biomarkers Market

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.6 Amgen Inc

10.6.1 Company Overview

10.6.2 Role of Amgen Inc. in the Global Digital Biomarkers Market.

10.6.3 Financials

10.6.4 Key Insights About Financial Health of the Company

10.6.5 Recent Developments

10.6.6 SWOT Analysis

10.7 Bayer AG

10.7.1 Company Overview

10.7.2 Role of Bayer AG in the Global Digital Biomarkers Market

10.7.3 Financials

10.7.4 Key Insights About Financial Health of the Company

10.7.5 Recent Developments

10.7.6 SWOT Analysis

10.8 Biogen Inc.

10.8.1 Company Overview

10.8.2 Role of Biogen Inc. in the Global Digital Biomarkers Market

10.8.3 Financials

10.8.4 Key Insights About Financial Health of the Company

10.8.5 Recent Developments

10.8.6 SWOT Analysis

10.9 Eli Lilly and Company

10.9.1 Company Overview

10.9.2 Role of Eli Lilly and Company in the Global Digital Biomarkers Market

10.9.3 Financials

10.9.4 Key Insights About Financial Health of the Company

10.9.5 Recent Developments

10.9.6 SWOT Analysis

10.10 Evidation Health, Inc.

10.10.1 Company Overview

10.10.2 Role of Evidation Health, Inc. in the Global Digital Biomarker Market

10.10.3 Recent Developments

10.10.4 SWOT Analysis

10.11 F. Hoffmann-La Roche Ltd

10.11.1 Company Overview

10.11.2 Role of F. Hoffmann-La Roche Ltd in the Global Digital Biomarkers Market

10.11.3 Financials

10.11.4 Key Insights About Financial Health of the Company

10.11.5 Recent Developments

10.11.6 SWOT Analysis

10.12 Fitbit, Inc.

10.12.1 Company Overview

10.12.2 Role of Fitbit Inc. in the Global Digital Biomarker Market

10.12.3 Financials

10.12.4 Key Insights About Financial Health of the Company

10.12.5 Recent Developments

10.12.6 SWOT Analysis

10.13 GlaxoSmithKline Plc

10.13.1 Company Overview

10.13.2 Role of GlaxoSmithKline Plc in the Global Digital Biomarkers Market

10.13.3 Financials

10.13.4 Key Insights About Financial Health of the Company

10.13.5 Recent Developments

10.13.6 SWOT Analysis

10.14 Human API

10.14.1 Company Overview

10.14.2 Role of Human API in the Global Digital Biomarkers Market

10.14.3 Recent Developments

10.14.4 SWOT Analysis

10.15 Happify Health

10.15.1 Company Overview

10.15.2 Role of Happify Health in the Global Digital Biomarker Market

10.15.3 Recent Developments

10.15.4 SWOT Analysis

10.16 IXICO Plc

10.16.1 Company Overview

10.16.2 Role of IXICO Plc in the Global Digital Biomarkers Market

10.16.3 Financials

10.16.4 Key Insights About Financial Health of the Company

10.16.5 Recent Developments

10.16.6 SWOT Analysis

10.17 Koninklijke Philips N.V.

10.17.1 Company Overview

10.17.2 Role of Koninklijke Philips N.V. in the Global Digital Biomarkers Market

10.17.3 Financials

10.17.4 Key Insights About Financial Health of the Company

10.17.5 Recent Developments

10.17.6 SWOT Analysis

10.18 Medopad Ltd

10.18.1 Company Overview

10.18.2 Role of Medopad Ltd in the Global Digital Biomarker Market

10.18.3 Recent Developments

10.18.4 SWOT Analysis

10.19 Mindstrong Health

10.19.1 Company Overview

10.19.2 Role of Mindstrong Health in the Global Digital Biomarker Market

10.19.3 Recent Developments

10.19.4 SWOT Analysis

10.20 Neurotrack Technologies, Inc.

10.20.1 Company Overview

10.20.2 Role of Neurotrack Technologies, Inc in the Global Digital Biomarker Market

10.20.3 Recent Developments

10.20.4 SWOT Analysis

10.21 Novartis International AG

10.21.1 Company Overview

10.21.2 Role of Novartis International AG in the Global Digital Biomarkers Market

10.21.3 Financials

10.21.4 Key Insights About Financial Health of the Company

10.21.5 Recent Developments

10.21.6 SWOT Analysis

10.22 Orikami

10.22.1 Company Overview

10.22.2 Role of Orikami in the Global Digital Biomarker Market

10.22.3 Recent Developments

10.22.4 SWOT Analysis

10.23 Pfizer Inc.

10.23.1 Company Overview

10.23.2 Role of Pfizer Inc in the Global Digital Biomarkers Market

10.23.3 Financials

10.23.4 Key Insights About Financial Health of the Company

10.23.5 Recent Developments

10.23.6 SWOT Analysis

10.24 Quanterix Corporation

10.24.1 Company Overview

10.24.2 Role of Quanterix Corporation in the Global Digital Biomarker Market

10.24.3 Financials

10.24.4 Key Insights About Financial Health of the Company

10.24.5 Recent Developments

10.24.6 SWOT Analysis

10.25 Sanofi S.A.

10.25.1 Company Overview

10.25.2 Role of Sanofi S.A. in the Global Digital Biomarker Market

10.25.3 Financials

10.25.4 Key Insights About Financial Health of the Company

10.25.5 Recent Developments

10.25.6 SWOT Analysis

10.26 The Takeda Pharmaceuticals Company Limited

10.26.1 Company Overview

10.26.2 Role of The Takeda Pharmaceuticals Company Limited in the Global Digital Biomarkers Market

10.26.3 Financials

10.26.4 Key Insights About Financial Health of the Company

10.26.5 Recent Developments

10.26.6 SWOT Analysis

10.27 Verily Life Sciences

10.27.1 Company Overview

10.27.2 Role of Verily Life Sciences in the Global Digital Biomarkers Market

10.27.3 Recent Developments

10.27.4 SWOT Analysis: Verily Life Sciences

Company Snapshots

10.28 Cambridge Cognition Plc

10.28.1 Company Overview

10.28.2 Role of Cambridge Cognition Plc. in the Global Digital Biomarkers Market

10.28.3 Recent Developments

10.29 MC10 Inc.

10.29.1 Company Overview

10.29.2 Role of MC10 Inc. in the Global Digital Biomarkers Market

10.29.3 Recent Developments

10.30 Medical Care Corporation

10.30.1 Company Overview

10.30.2 Role of Medical Care Corporation in the Global Digital Biomarkers Market

10.31 Shimmer

10.31.1 Company Overview

10.31.2 Role of Shimmer in the Global Digital Biomarkers Market

10.31.3 Recent Developments

10.32 Winterlight Labs Inc.

10.32.1 Company Overview

10.32.2 Role of Winterlight Labs, Inc. in the Global Digital Biomarkers Market

10.32.3 Recent Developments

Table 1: A Comparison Between Examples of Clinical Biomarkers and Digital Biomarkers

Table 2: Percentage of Different Wearable Technology Brands Being Used in Clinical Trials (As of December 2019, N=1600)

Table 3: Regional Perspective: From Consumer (Non-Clinical) Generated Data, $Million, 2018-2025

Table 4: Regional Perspective: Patient Centric Data During Clinical Trials, $Million, 2018-2025

Table 4.1: Different Categories of Mobile Health Applications

Table 5.1: Leading Wearable Devices and Their Features

Table 5.2: Major FDA Clearances in 2019

Table 6.1: Synergistic Activities Share (by Company), January 2016– September 2019

Table 6.2: Product Launches and Enhancements Share (by Company), January 2016 – September 2019

Table 6.3: Business Expansion and Funding Activities Share (by Company), January 2016 – September 2019

Table 6.4: Key Acquisitions in the global digital biomarkers Space (2019)

Table 7.4: Distribution of Clinical Trials Performed Using Wearable Connected Devices (Up to Dec 2019)

Table 7.5: ActiGraph Objective Measures

Table 7.6: Recent Key Developments in the Digital Biomarker Space in Terms of Wearable Devices

Table 7.7: Some of the recent developments in this segment

Table 7.9: Potential Digital Tools for the Measurement of Outcomes for Inflammatory Bowel’s Disease

Table 7.10: Overview of Clinical Trials Performed Using Mobile Application for the Monitoring/Management of IBD

Table 7.11: Commercially Available Mobile Apps Used for the Monitoring and Management of Inflammatory Bowel’s Disease

Table 7.14: Clinical Trials Using Mobile Application for the Assessment of Sleep-Related Disorders:

Table 7.15: Clinical Trials Using Wearable Devices for the Assessment of Sleep-Related Disorders

Table 7.16: Some of the key developments in the Field of Sleep Disorders Using Digital Health

Table 7.17: Overview of Clinical Trials Performed Using Mobile Application for the Monitoring/Management of Cardiovascular Diseases

Table 7.18: Overview of Clinical Trials Performed Using Wearable Devices for the Monitoring/Management of Cardiovascular Diseases

Table 7.19: Recent Developments Using Wearable Developments for the Assessment of Cardiovascular Diseases

Table 7.20: Clinical Trials Using Actigraphy devices for the Assessment of Mood Disorders

Table 7.22: Recent Developments in the Mood Related Disorders Space

Table 7.23: Number of Clinical Trials Using a Mobile Application, 2019

Table 7.24: Increased Use of Wearable Devices in Clinical Trials for Chronic Pain

Table 7.25: Recent Key Developments in the Field of Digital Tech Assisted Chronic Pain Management

Table 7.26: Top 5 Clinical Trials on Parkinson’s Disease Conducted Using Smartphone Apps

Table 7.27: Some of the Clinical Trials on Parkinson’s Disease Conducted Using Wearable Devices

Table 7.28: Top 5 Clinical Trials on Multiple Sclerosis Conducted Using Smartphone Apps

Table 7.29: Some of The Clinical Trials on Multiple Sclerosis Conducted Using Wearable Devices

Table 7.30: Top 5 Clinical Trials on Alzheimer’s Disease Conducted Using Smartphone Apps

Table 7.31: Some of the Clinical Trials on Alzheimer’s Disease Conducted Using Wearable Devices

Table 7.32: Recent Developments in the Neurodegenerative Disease Space Pertaining to Digital Biomarkers

Table 7.33: Clinical Trials Using Mobile Application for the Management of Diabetes:

Table 7.34: Clinical Trials Using Wearable Devices to Manage Diabetes

Table 7.35: Key Developments Involving Wearables/Mobile Application in the Management of Diabetes

Table 7.36: Leading Respiratory Conditions and Related Deaths

Table 7.37: Top 5 Clinical Trials on Respiratory Disease Conducted Using Mobile Apps

Table 7.38: Some of the Clinical Trials on Respiratory Disease Conducted Using Wearable Devices

Table 7.39: Recent Developments in the Respiratory Segment

Table 9.1: Different Types of Health Tracking People and Their Characteristics

Table 9.4: Rate of Usage of Wearables in Italy

Table 9.5: Different Classes of Mobile Application in Healthcare and their Rate of Usage (%)

Table 9.6: Different European Countries and the Level of Adoption of Consumer Wearables (in Percentage, 2019)

Table 9.7: Different Wearables and Their Adoption Rates in Australia

Table 9.8: Different Wearables and Their Expected Adoption Rates in Australia

Table 9.9: Different Wearables and Their Adoption Rates in Singapore

Table 9.10: Different Wearables and Their Expected Adoption Rates in Singapore

Table 9.11: Different Wearables and Their Adoption Rates in Mexico

Table 9.12: Different Wearables and Their Expected Adoption Rates in Singapore

Table 10.1: Clinical Trials Involving Devices from ActiGraph, LLC

Table 10.2: Akili Interactive Labs: Clinical Trials

Table 10.3: AliveCor, Inc.: Clinical Trials

Table 10.4: Altoida AG: Clinical Trials

Table 10.5: Bayer AG: Clinical Trial

Table 10.6: Biogen Inc.: Clinical Trial

Table 10.7: Eli Lilly and Company: Clinical Trials

Table 10.8: Evidation Health, Inc.: Clinical Trials

Table 10.9: F. Hoffmann-La Roche Ltd: Clinical Trials

Table 10.10: Fitbit, Inc.: Clinical Trials

Table 10.11: GlaxoSmithKline Plc: Clinical Trials

Table 10.12: Happify Health: Clinical Trials

Table 10.13: Koninklijke Philips N.V.

Table 10.14: Medopad Ltd: Clinical Trials

Table 10.15: Mindstrong Health: Clinical Trials

Table 10.16: Neurotrack Technologies, Inc.: Clinical Trials

Table 10.17: Novartis International AG: Clinical Trials

Table 10.18: Pfizer Inc: Clinical Trials

Table 10.19: Quanterix Corporation: Clinical Trials

Table 10.20: Verily Life Sciences: Projects

Table 10.21: Verily Life Sciences: Clinical Trials

Table 10.22: MC10 Inc: Clinical Trials

Table 10.23: Shimmer: Clinical Trials

Table 10.24: Winterlight Labs, Inc: Clinical Trials

Figure 1: Global Subscriber Base and Smartphone Penetration

Figure 2: Number of Clinical Trials Using Connected Wearable Devices by Year (Cumulative)

Figure 3: Percentage of Completed and Active Clinical Trials Using Wearables (As of December 2019, N=1600)

Figure 5: Global Digital Biomarkers Market (by Type), $Million, 2018-2025

Figure 6: Global Digital Biomarkers Market, Provider Type (Data Collection), $Million, 2018-2025

Figure 7: Global Digital Biomarkers Market, Data Collection System Type, $Million, 2018-2025

Figure 8: Global Digital Biomarkers Market, Data Integration System Providers, $Million, 2018-2025

Figure 9: Global Digital Biomarkers Market (Application/Therapeutic Area), $Million, 2018-2025

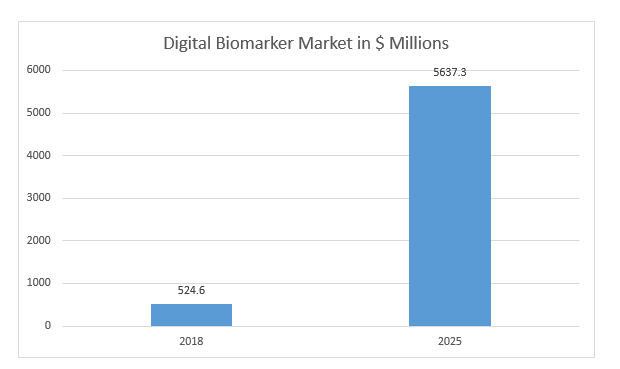

Figure 10: Share of Leading Therapeutic Areas in the Digital Biomarkers Market, 2018 and 2025 (Market Size: 2018 = $524.6 million, 2025 = $5.63 billion)

Figure 11: Global Digital Biomarkers Market (End Users), $Million, 2018-2025

Figure 12: Current Penetration of Different End User Groups in the Digital Biomarkers Market (2018)

Figure 2.1: Global Digital Biomarkers Market: Breakup of the Market

Figure 3.1: Global Digital Biomarkers Market Research Methodology

Figure 3.2: Primary Research

Figure 3.3: Secondary Research

Figure 3.4: Data Triangulation

Figure 3.5: Bottom-Up Approach (Segment-Wise Analysis)

Figure 3.6: Top-Down Approach (Segment-Wise Analysis)

Figure 3.7: Assumptions and Limitations

Figure 3.8: Considered Factors for Data Prediction and Modeling

Figure 3.9: Scope Definition for the Global Digital Biomarkers Market

Figure 4.1: Major Components of Digital Biomarkers Market

Figure 4.2: A Flowchart Depicting the Conversion of Healthcare Data to a Digital Biomarker

Figure 4.3: Different Populations of Data Producers of Digital Biomarkers

Figure 5.1: Number of Alzheimer's Disease Drug Under Development

Figure 6.1: Share of Key Developments and Strategies, January 2016–September 2019 (Total Developments = 106)

Figure 7.1: Global Digital Biomarker Data Collection Market ($million), 2018-2025

Figure 7.2: Wearable Devices and its Market Share (in Units) in Global Healthcare Sector

Figure 7.3: Clinical Trials Using Connected Wearable Devices by Year (Cumulative)

Table 7.1: Number of Clinical Trials Performed Using Different Brands of Wearables Catering to Diverse Therapeutic Areas (Cumulative, As of 2019)

Table 7.2: Distribution of Number of Clinical Trials Using Wearable Devices, by Country (Up to Dec 2019)

Table 7.3: A Comparative Analysis on the Commercially Available Actigraphy Devices

Figure 7.4: Distribution of Number of Clinical Trials Using Actigraphy Devices, by Region (Cumulative as of 2019)

Figure 7.5: Distribution of Number of Clinical Trials Using ActiGraph Devices, by Therapeutic Areas (Cumulative as of 2019)

Figure 7.6: Evolution of Four Generations of ActiGraph Activity Monitors

Figure 7.7: Global Wearable Devices Digital Biomarkers Market ($million), 2018-2025

Figure 7.8: Global Implantable Components/Biosensors Market, $Million, 2018-2025

Figure 7.9: Global Mobile/Tablet Apps Market, $Million, 2018-2025

Figure 7.10: Global Data Integration Systems Market, $Million, 2018-2025

Figure 7.11: Global Digital Biomarkers Market, Application Type: Gastrointestinal Diseases, $Million, 2018-2025

Figure 7.12: Global Digital Biomarkers Market, Application Type: Sleep Disorders, $Million, 2018-2025

Figure 7.13: Global Digital Biomarkers Market, Application Type: Cardiovascular, $Million, 2018-2025

Figure 7.14: Global Digital Biomarkers Market, Application Type: Mood and Behavior, $Million, 2018-2025

Figure 7.15: Global Digital Biomarkers Market, Application Type: Chronic Pain, $Million, 2018-2025

Figure 7.16: Global Digital Biomarkers Market, Application Type: Neurodegenerative Disorders, $Million, 2018-2025

Figure 7.17: Global Digital Biomarkers Market, Application Type: Respiratory Conditions, $Million, 2018-2025

Figure 7.18: Global Digital Biomarkers Market, Application Type: Respiratory Conditions, $Million, 2018-2025

Figure 7.19: Global Digital Biomarkers Market, Application Type: Other Therapeutic Areas, $Million, 2018-2025

Figure 8.1: Potential Use Cases of Digital Biomarkers (From an End User Perspective)

Figure 8.2: Global Digital Biomarkers Market, End User Type: Biopharma companies, $Million, 2018-2025

Figure 8.3: Global Digital Biomarkers Market, End User Type: Health Insurance Payers, $Million, 2018-2025

Figure 8.4: Global Digital Biomarkers Market, End User Type: Healthcare Providers, $Million, 2018-2025

Figure 9.1: North America Digital Biomarkers Market, Clinical Trials, $Million, 2018-2025

Figure 9.2: North America Digital Biomarkers Market, Non-Clinical, $Million, 2018-2025

Figure 9.3: Factors Influencing Digital Biomarkers Market in North America

Figure 9.4: U.S. Digital Biomarkers Market, $Million, 2018-2025

Figure 9.5: U.S. Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.6: Canada Digital Biomarkers Market, $Million, 2018-2025

Figure 9.7: Canada Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.8: Mobile Health Applications: Usage Areas (As of 2019)

Figure 9.9: Europe Digital Biomarkers Market, $Million, 2018-2025

Figure 9.10: Factors Influencing Digital Biomarkers Market in Europe

Figure 9.11: Netherlands Digital Biomarkers Market, $Million, 2018-2025

Figure 9.12: Netherlands Digital Biomarkers Market, by Settings, $Million, 2018-2025

Figure 9.13: Germany Digital Biomarkers Market, $Million, 2018-2025

Figure 9.14: Germany Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.15: U.K. Digital Biomarkers Market, $Million, 2018-2025

Figure 9.16: U.K. Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.17: France Digital Biomarkers Market, $Million, 2018-2025

Figure 9.18: France Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.19: Spain Digital Biomarkers Market, $Million, 2018-2025

Figure 9.20: Spain Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.21: Italy Digital Biomarkers Market, $Million, 2018-2025

Figure 9.22: Italy Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.23: Russia Digital Biomarkers Market, $Million, 2018-2025

Figure 9.24: Russia Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.25: Belgium Digital Biomarkers Market, $Million, 2018-2025

Figure 9.26: Sweden Digital Biomarkers Market, $Million, 2018-2025

Figure 9.27: Denmark Digital Biomarkers Market, $Million, 2018-2025

Figure 9.28: Norway Digital Biomarkers Market, $Million, 2018-2025

Figure 9.29: Asia-Pacific Digital Biomarkers Market, $Million, 2018-2025

Figure 9.30: Factors Influencing Digital Biomarkers Market in Asia-Pacific

Figure 9.31: China Digital Biomarkers Market, $Million, 2018-2025

Figure 9.32: China Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.33: Japan Digital Biomarkers Market, $Million, 2018-2025

Figure 9.34: Japan Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.35: South Korea Digital Biomarkers Market, $Million, 2018-2025

Figure 9.36: South Korea Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.37: India Digital Biomarkers Market, $Million, 2018-2025

Figure 9.38: India Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.39: Australia Digital Biomarkers Market, $Million, 2018-2025

Figure 9.40: Australia Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.41: Singapore Digital Biomarkers Market, $Million, 2018-2025

Figure 9.42: Latin America Digital Biomarkers Market, $Million, 2018-2025

Figure 9.43: Factors Influencing Digital Biomarkers Market in Latin America

Figure 9.44: Brazil Digital Biomarkers Market, $Million, 2018-2025

Figure 9.45: Brazil Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.46: Mexico Digital Biomarkers Market, $Million, 2018-2025

Figure 9.47: Mexico Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.48: Rest-of-the-World Digital Biomarkers Market, $Million, 2018-2025

Figure 9.49: Factors Influencing Digital Biomarkers Market in Rest-of-the-World

Figure 9.50: Saudi Arabia Digital Biomarkers Market, $Million, 2018-2025

Figure 9.51: Saudi Arabia Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.52: U.A.E. Digital Biomarkers Market, $Million, 2018-2025

Figure 9.53: U.A.E. Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.54: Israel Digital Biomarkers Market, $Million, 2018-2025

Figure 9.55: Israel Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 9.56: South Africa Digital Biomarkers Market, $Million, 2018-2025

Figure 9.57: South Africa Digital Biomarkers Market (by Setting), $Million, 2018-2025

Figure 10.1: Total Number of Companies Profiled

Figure 10.2: ActiGraph, LLC: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.3: ActiGraph, LLC.: SWOT Analysis

Figure 10.4: Akili Interactive Labs: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.5: Akili Interactive Labs: SWOT Analysis

Figure 10.6: AliveCor, Inc: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.7: AliveCor Inc.: SWOT Analysis

Figure 10.8: Altoida, AG: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.9: Altoida AG.: SWOT Analysis

Figure 10.10: Amgen Inc: Overall Financials, 2016-2018

Figure 10.11: Amgen Inc. Revenue (by Region), 2016-2018

Figure 10.12: Amgen Inc. R&D Expenditure, 2016-2018

Figure 10.13: Amgen Inc: SWOT Analysis

Figure 10.14: Bayer AG.: Overall Financials, 2016-2018

Figure 10.15: Bayer AG: Revenue (by Segment), 2016-2018

Figure 10.16: Bayer Inc: Revenue (by Region), 2016-2018

Figure 10.17: Bayer AG: R&D Expenditure, 2016-2018

Figure 10.18: Bayer AG: SWOT Analysis

Figure 10.19: Biogen Inc: Overall Financials, 2016-2018

Figure 10.20: Biogen Inc.: Revenue (by Region), 2016-2018

Figure 10.21: Biogen Inc.: R&D Expenditure, 2016-2018

Figure 10.22: Biogen Inc: SWOT Analysis

Figure 10.23: Eli Lilly and Company: Overall Financials, 2016-2018

Figure 10.24: Eli Lilly and Company: Revenue (by Segment), 2016-2018

Figure 10.25: Eli Lilly and Company: Revenue (by Region), 2016-2018

Figure 10.26: Eli Lilly and Company: R&D Expenditure, 2016-2018

Figure 10.27: Eli Lilly and Company: SWOT Analysis

Figure 10.28: Evidation Health, Inc.: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.29: Evidation Health, Inc: SWOT Analysis

Figure 10.30: F. Hoffmann-La Roche Ltd: Overall Financials, 2017-2019

Figure 10.31: F. Hoffmann-La Roche Ltd: Revenue (by Segment), 2017-2019

Figure 10.32: F. Hoffmann-La Roche Ltd: Revenue (by Region), 2017-2019

Figure 10.33: F. Hoffmann-La Roche Ltd: R&D Expenditure, 2017-2019

Figure 10.34: F. Hoffmann-La Roche Ltd: SWOT Analysis

Figure 10.35: Fitbit, Inc: Product Portfolio for Global Digital Biomarkers Market

Figure 10.36: Fitbit Inc.: Overall Financials, 2016-2018

Figure 10.37: Fitbit Inc.: Revenue (by Region), 2016-2018

Figure 10.38: Fitbit, Inc.: R&D Expenditure, 2016-2018

Figure 10.39: Fitbit Inc.: SWOT Analysis

Figure 10.40: GlaxoSmithKline Plc: Overall Financials, 2016-2018

Figure 10.41: GlaxoSmithKline Plc: Revenue (by Business Segments), 2016-2018

Figure 10.42: GlaxoSmithKline: Revenue (by Region), 2016-2018

Figure 10.43: GlaxoSmithKline Plc: R&D Expenditure, 2016-2018

Figure 10.44: GlaxoSmithKlin Plc SWOT Analysis

Figure 10.45: Human API: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.46: Human API: SWOT Analysis

Figure 10.47: Happify Health: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.48: Happify: SWOT Analysis

Figure 10.49: IXICO Plc: Product Portfolio for Global Digital Biomarkers Market

Figure 10.50: IXICO plc: Overall Financials, 2016-2018

Figure 10.51: IXICO plc: Revenue (by Region), 2016-2018

Figure 10.52: IXICO plc: R&D Expenditure, 2016-2018

Figure 10.53: IXICO plc: SWOT Analysis

Figure 10.54: Koninklijke Philips N.V.: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.55: Koninklijke Philips N.V.: Overall Financials ,2016-2018

Figure 10.56: Koninklijke Philips N.V.: Revenue (by Segment) ,2016-2018

Figure 10.57: Koninklijke Philips N.V.: Revenue (by Region), 2016-2018

Figure 10.58: Koninklijke Philips N.V.: R&D Expenditure, 2016-2018

Figure 10.59: Koninklije Philips N.V.: SWOT Analysis

Figure 10.60: Medopad Ltd: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.61: Medopad Ltd: SWOT Analysis

Figure 10.62: Mindstrong Health: Product Portfolio for the Global Digital Biomarkers Market

Figure 9.63: Mindstrong Health: SWOT Analysis

Figure 10.64: Neurotrack Technologies, Inc: Product Portfolio for Global Digital Biomarkers Market

Figure 10.65: Neurotrack Technologies, Inc: SWOT Analysis

Figure 10.66: Novartis International AG: Overall Financials, 2016-2018

Figure 10.67: Novartis AG: Revenue (by Segment), 2016-2018

Figure 10.68: Novartis AG: Revenue (by Region), 2016-2018

Figure 10.69: Novartis International AG, R&D Expenditure, 2016-2018

Figure 10.70: Novartis International AG: SWOT Analysis

Figure 10.71: Orikami: SWOT Analysis

Figure 10.72: Pfizer, Inc: Overall Financials, 2016-2018

Figure 10.73: Pfizer Inc: Revenue (by Segment), 2016-2018

Figure 10.74: Pfizer Inc: Revenue (by Region), 2016-2018

Figure 10.75: Pfizer Inc.: R&D Expenditure, 2016-2018

Figure 10.76: Pfizer Inc.: SWOT Analysis

Figure 10.77: Quanterix Corporation: Product Portfolio for Global Digital Biomarkers Market

Figure 10.78: Quanterix Corporation: Overall Financials, 2015-2017

Figure 10.79: Quanterix Corporation: Revenue (by Region), 2015-2017

Figure 10.80: Quanterix Corporation: R&D Expenditure, 2015-2017

Figure 10.81: Quanterix Corporation: SWOT Analysis

Figure 10.82: Sanofi S.A.: Overall Financials, 2016-2018

Figure 10.83: Sanofi: S.A. Revenue (by Business Segments), 2016-2018

Figure 10.84: Sanofi S.A.: Revenue (by Region), 2016-2018

Figure 10.85: Sanofi S.A.: R&D Expenditure 2016-2018

Figure 10.86: Sanofi S.A.: SWOT Analysis

Figure 10.87: The Takeda Pharmaceuticals Company Limited: Overall Financials, 2016-2018

Figure 10.88: The Takeda Pharmaceuticals Company Limited: Revenue (by Region), 2016-2018

Figure 10.89: The Takeda Pharmaceuticals Company Limited: R&D Expenditure, 2016-2018

Figure 10.90: The Takeda Pharmaceuticals Company Limited: SWOT Analysis

Figure 10.91: Verily Life Sciences: SWOT Analysis

Figure 10.92: Cambridge Cognition Plc: Product Portfolio for the Global Digital Biomarkers Market

Figure 10.93: MC10 Inc: Product Portfolio for Global Digital Biomarkers Market

Digital Biomarkers Market Report Coverage

|

Digital Biomarkers Market |

|||

|

Base Year |

2018 |

Market Size by 2018 |

$524.6 million |

|

Forecast Period |

2019-2025 |

Value Projection and Estimation by 2025 |

$5,637.3 million |

|

CAGR During Forecast Period |

40.39% |

Number of Tables |

17 |

|

Number of Pages |

433 |

Number of Figures |

170 |

|

Research Hours |

270 |

|

|

|

Market Segmentation |

• Application – Sleep and Movement, Cardiovascular, Mood and Behavior, Pain Management, Neurodegenerative Disorders, and Respiratory Conditions • End Users – Biopharmaceutical Companies, Payers, and Providers |

||

|

Regional Segmentation |

• North America – U.S., Canada • Europe –Netherlands, Germany, U.K., France, Spain, Italy, Russia • Asia-Pacific – China, Japan, South Korea, India, Australia, Singapore • Latin America- Brazil, Mexico • Rest-of-the-World – Saudi Arabia, U.A.E., Israel, South Africa |

||

|

Growth Drivers |

• Increasing Cost of Drug Development • Failure for Drugs for Neurodegenerative Disorder • Regulatory Flexibility Toward Digital Health Solutions • Explosion of Wearable Devices and Increasing Smartphone Penetration |

||

|

Market Challenges |

• Test and Validation • Addressing Biases • Validation Testing • Integration • Cost and Usability |

||

|

Market Opportunities |

• Personalized Medicine • Investment in Voice-Based Digital Biomarkers • Investment in Wearable Technology |

||

|

Key Companies Profiled |

ActiGraph LLC, Akili Interactive Labs, AliveCor Inc., Altoida Inc., Amgen Inc., Bayer AG, Biogen Inc., Eli Lilly and Company, Evidation Health Inc., Fitbit Inc., GlaxoSmithKline Plc., Human API, Happify Health, IXICO Plc., Neurotrack Technology Inc., Novartis, Pfizer Inc., F. Hoffmann-La Roche Ltd., Sanofi, Takeda Pharmaceuticals, Verily Life Science LLC. |

||

Key Questions Answered in this Report:

• What is the total addressable market (TAM) and the potential market opportunity for the global digital biomarkers market?

• What are the major market drivers and challenges of, and the opportunities in, the global digital biomarkers market?

• What is the market share of the leading segments and sub-segments of the global digital biomarkers market in 2019 and 2025?

• How did the global digital biomarkers market evolve?

• How is each segment of the global digital biomarkers market expected to grow during the forecast period and what is the expected revenue to be generated by each of the segments by the end of 2025?

• What are the consumer preferences in terms of adoption of wearable technology for the assessment of medical conditions?

What are the key development strategies implemented by the key players to stand out in this market?

• What is the preferred business model used for building digital biomarkers?

• Which area of application is expected to be the highest revenue generator in the global digital biomarkers market during the forecast period?

• Which end-user segment is expected to be the highest revenue generator in this industry during the forecast period?

• What is the potential of global digital biomarkers market in the emerging countries during the forecast period?

Market Overview

With the proliferation of digital tools such as smartphones and wearables globally, the rate at which health information is collected by these devices has significantly increased. The information collected also include digital biomarkers from patients.

The digital biomarker discovery is a great assistance for patients of chronic diseases. The chronic condition patients are neither able to have frequent consultations, nor can they recall their symptoms on a particular day. Thus, digital predictive biomarkers monitor the patient’s condition regularly and help in providing quality care.

Moreover, it is of immense benefit for a doctor to be able to measure and accurately track any subtle changes in the symptoms of a patient in order to prevent the progression of irreversible diseases such as Parkinson’s and Alzheimer’s. Hence, diagnostic biomarkers can be considered the future face of medicine and can help develop personalized treatments for patients.

In 2018, the global digital biomarkers market was estimated to be $524.6 million and is expected to reach $5,637.3 million by the end of 2025, growing at a double-digit CAGR of 40.39% during the forecast period. The growth is primarily due to the increasing number of synergistic associations among the industry stakeholders.

This tremendous growth rate of the digital biomarkers market is facilitated by several factors, such as rapidly increasing uptake of smartphones, wearables, and the advent of high-speed networks and connectivity solutions. Currently, there are approximately 2.0 billion smartphone users globally, which is expected to reach nearly 6 billion in the coming years.

The use of high-speed networks, such as 3G and 4G, too, is set to increase by 73% by the end of 2020. Also, from a health perspective, there is an increasing demand for solutions which could efficiently minimize healthcare costs and help in the management of chronically ill patients by diagnosing ailments with different types of biomarkers.

In addition, the advent of connected digital platforms for detecting novel biomarkers such as wearable devices, biosensors, and portable devices have significantly enabled the accurate measurements of various physiological (such as sleep, activity, heart rate) as well as biochemical parameters (such as electrolytes, metabolites, small molecules, and proteins). This, in turn, provides enormous opportunities to revolutionize the data capture and collection process during clinical trials.

Competitive Landscape

The global digital biomarkers market is dominated by a plethora of digital health companies that can be categorized as developers of tools and sensors that collect patient-level data and developers of systems that integrate the collected patient data. Companies are continuously collaborating with research and medical institutions to expand the digital biomarker space.

In the three years (January 2016-September 2019), the market witnessed approximately 106 notable key developments. These included 34 synergistic activities, 46 product launches and enhancements, 22 business expansion and funding activities, and four acquisition, among others. Most of the companies are significantly undertaking synergistic activities to not only expand their global footprint but also to leverage technologies and products offered by other companies in a bid to consolidate the marketplace. Therefore, synergistic activities constitute the dominant contributor’s strategies.

Some of the major companies operating in the market, including ActiGraph, LLC., Akili Interactive Labs, AliveCor, Inc., Fitbit, Inc., HumanAPI, Novartis, Pfizer Inc. F. Hoffmann-La Roche Ltd, Sanofi, Takeda Pharmaceuticals, and Verily Life Science LLC.

Global Digital Biomarkers Market

Focus on Key Trends, Growth Potential, Competitive Landscape, Components (Data Collection and Integration), End Users, Application (Sleep and Movement, Neuro, Respiratory and Cardiological Disorders) and Region – Analysis and Forecast, 2019-2025